Global module capacities are on track to reach 866GW by the end of 2023, more than doubling the existing capacity at the end of 2022.

As of the end of the second quarter, 540GW of module capacity was already online, with expansions concentrated in China. However, the US is expected to more than treble its module capacity from 6GW in 2022 to 23GW by the end of 2023, while further US announcements are expected.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In its ‘Q2 2023 PV Supplier Market Intelligence Program (SMIP) Report’, published today (6 September), the advisory firm Clean Energy Associates (CEA) expects module capacity to surpass the 1TW threshold in 2024, with almost the entirety of it coming from China with 930GW, followed by Southeast Asia with 68GW and the Americas closing the podium with 33GW of annual capacity at the end of 2024.

Due to shorter construction time, module expansion announcements are usually completed within the next two years.

Between Q1 2023 and Q2 2023, suppliers have expanded their cell and module capacity by 16%.

With the transition towards n-type technologies, almost all cell capacity expansions will be directed towards next-gen technology with most suppliers going with tunnel oxide passivated contact (TOPCon) over heterojunction, IBC or PERC conversion.

This transition will lead cell capacity expansion to accelerate even faster than modules, going from 375GW in 2022 to 843GW at the end of 2023, before surpassing module capacity in 2024 with 1.1TW.

Zero busbar technology gaining traction

The report notes that the SmartWire patent expiry – in August 2023 – on zero busbar (0BB) presents an opportunity to reduce cell shading and silver used in modules and has gained traction among suppliers analysed by CEA. The patent, which was acquired by solar manufacturer Meyer Burger in 2012, was used in its heterojunction modules.

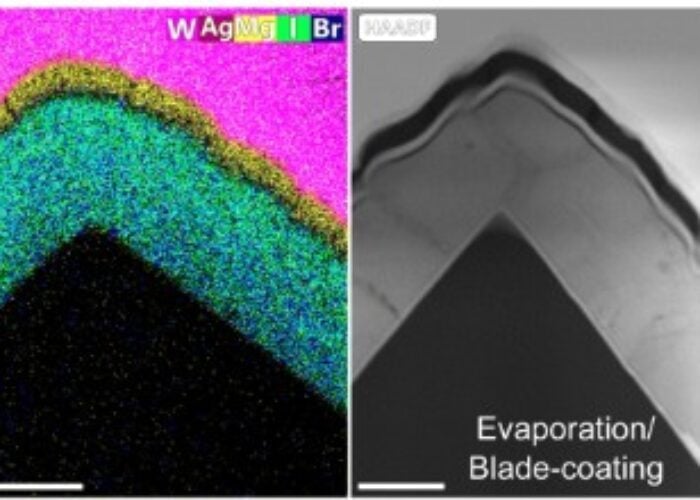

A 0BB cell lacks printed busbars in metallisation and involves a single screen-printing step for metallic finger deposition, which allows for customised patterns. Other advantages outlined by CEA are the reduction in silver consumption, thinner ribbon and no busbar shading, low temperature process and half the screen-printing tools required.

Heterojunction technology benefits the most from the 0BB due to its high silver usage and existing low temperature processes.

Several companies are developing a 0BB application method, including module manufacturer Risen – through a glue dispensing scheme – and module equipment maker Maxwell Technologies – through a soldering-dispensing scheme.

| PV Tech publisher Solar Media will be organising its first PV CellTech USA Conference in the San Francisco Bay Area, US from 03-04 October 2023. The conference will be dedicated to the US manufacturing sector. The event will gather the key stakeholders from PV manufacturing, equipment/materials, policy-making and strategy, capital equipment investment and all interested downstream channels and third-party entities. More information, including how to attend, can be read here. |