Since last year, module prices have risen by up to 25% as the cost of raw materials and transportation have soared, dampening downstream demand and disrupting the entire solar supply chain. The main driver of this has been an increase in the price of polysilicon, almost tripling in cost since its low in 2020. While analysts believe the cost of polysilicon, and in turn modules, will come down, there is uncertainty as to when, with most predicting higher prices continuing long into next year.

Polysilicon shortages the cause of module price increases

The price of basic mono PERC, monofacial modules at the factory gate in China has risen from below US$0.19/w last summer to US$0.24/w today, according to Jenny Chase, head of solar analysis at BloombergNEF (BNEF). This increase is largely due to fierce demand for polysilicon coupled with curtailed availability. As a result, wafer makers sought to lock in supply, signing long term contracts that put further upward pressure on prices. Compounding this was glass shortages and increases in the cost of silver at the end of 2020, although these pressures have since abated. Analysts expect last year’s supply shortages to end as some of the largest manufacturers bring significant capacity expansions online.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

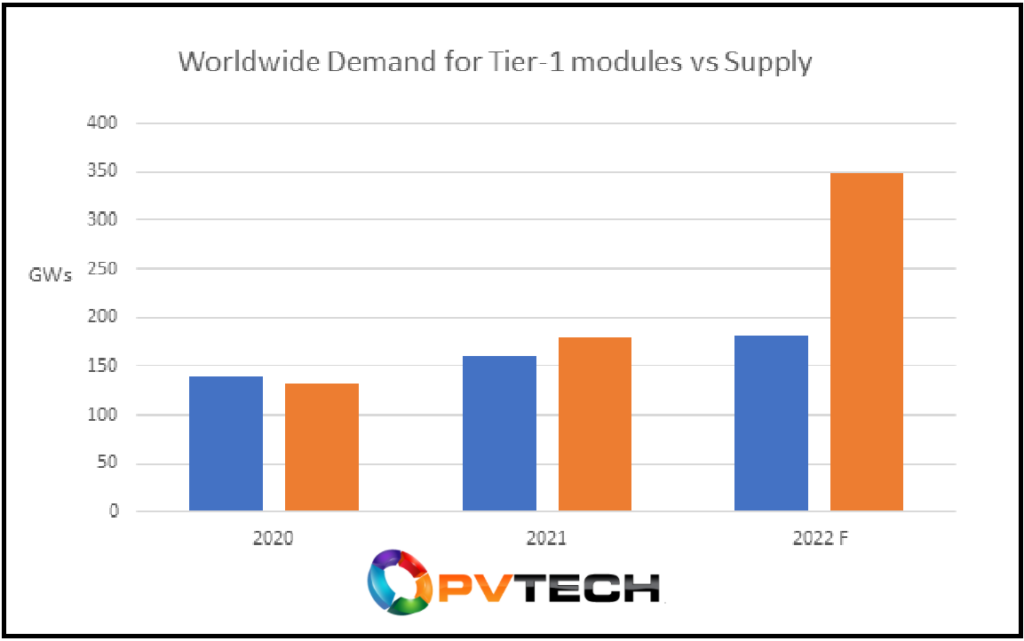

Polysilicon has gone from a low of around US$6/kg last year to in excess of US$28/kg today, says Chase, which has in turn forced the price of modules up by around 25%. PV InfoLink data supplied to PV Tech puts the puts the price in a slightly tighter range, showing how polysilicon rose from a low of US$8.7/kg in 2020 to US$22.2/kg earlier this year, but has since risen further. Worldwide demand for polysilicon in 2020 was 140GW, while supply only reached 133GW by the end of the year, according to Corrine Lin, chief analyst at PVInfoLink. Lin argues that planned capacity expansions by polysilicon manufacturers were not brought online soon enough to meet demand.

While Lin puts most of the price pressure down to lagging capacity, Chase says the exact cause of polysilicon supply tightness is uncertain. There was broadly enough supply to meet demand over the year, she says, but bottlenecks occurred. “I think the increasing cost of polysilicon was probably exacerbated in the first half of the year by wafer makers really needing to secure supply, meaning they signed long term contracts for large amounts of inputs at spot price rates” says Chase, which drove up prices more.

When will prices fall again?

Worldwide demand for modules from Tier 1 manufacturers is expected to be 160GW this year, with a supply channel of 180GW by the end of the year, according to PV InfoLink. The forecast for next year is even more favourable, with total supply hitting 349GW, with 181GW of demand, suggesting prices could drop substantially next year as supply outstrips expected demand.

BNEF expects 183GW of module demand this year, with a higher-end forecast of 204GW. Chase estimates that there is enough polysilicon to meet this demand, with an expected 207GW of supply. Its February 1Q 2021 Global PV Market Outlook Report forecasted an 18% growth in polysilicon in 2021 compared with 2020, assuming all factories run as planned. About 60% of this capacity is from existing factories which have experienced bottlenecking, with the remainder coming from new and reopened factories.

Both PV InfoLink and BNEF have pointed to significant expansions to polysilicon production by the largest manufacturers as the reason for expected module price decline. PV InfoLink data shows how Tongwei, Daqo, East Hope, Asia Silicon and TBEA plan to add 245,000 metric tonnes (MT) of polysilicon from Q4 2021 to Q2 2022, equating to 84GW. BNEF data expects 265,000MT of production throughout 2022 – but also includes potential contributions from OCI in Seoul (5,000MT) and Xinte (100,000MT), although the latter isn’t expected until 2023.

Analysts advise that the price of polysilicon, and in turn modules, will come down, either towards the end of the year or in H1 2022. But only last week (1 September) did solar manufacturer Tongwei increase the prices of its cells for the second time in a month, with polysilicon pricing also edging upwards of late. And while the price of mono PERC 158.75mm cells remained unchanged from previous pricing at RMB1.12/W (US$0.17c/W), prices for 166mm and 210mm cells – rapidly emerging as the industry’s new standard – increased by RMB0.03 and RMB0.02 respectively.

Lin says that PV InfoLink recently revised their polysilicon price forecasts, which were initially predicting price rises in Q3 and Q4 due to strong European and US demand, and now expect prices to be flat at around US$26.5/kg moving into the new year. In 2022, it expects the price of polysilicon to drop significantly to US$13.4/kg, down 40%. Major polysilicon producer Daqo New Energy however expects prices to remain elevated throughout 2022, falling to around US$23/kg in H1 2022 and US$20/kg in H2 2022.

In turn, modules are expected to plateau at around US$0.246/w in Q4 2021, not coming down to lower levels until at least Q1 or Q2 2022. Nonetheless, both Chase and Lin were certain that prices would come down, it is just a matter of precisely when.