More than half of utility-scale solar projects planned for next year could be at risk of delay or cancellation as a result of surging materials and logistics cost, new analysis has claimed.

Analysis conducted by research firm Rystad Energy has found that of 90GW of utility-scale PV projects planned to complete next year, as much as 50GW – equivalent to 56% – could be under threat as a result of supply chain volatility.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

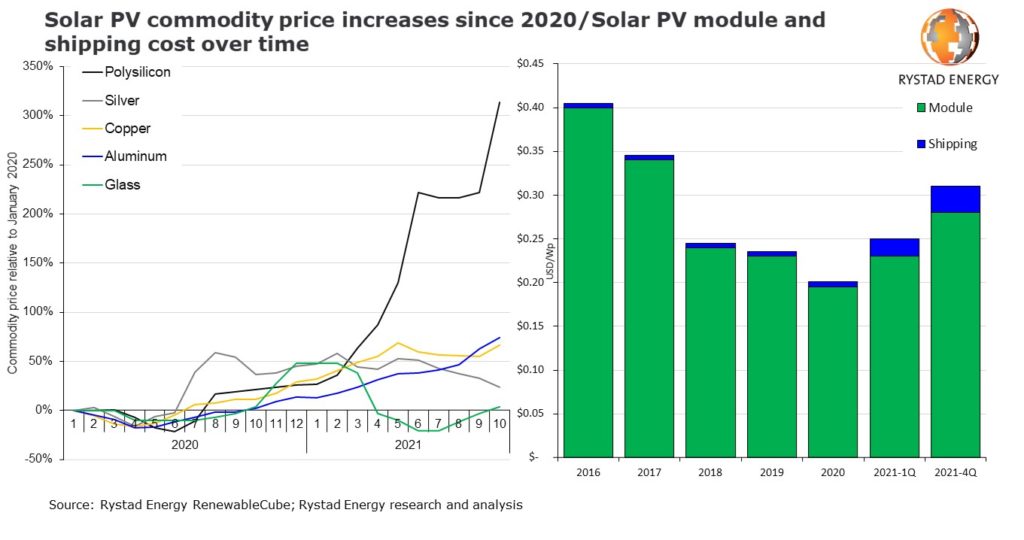

While manufacturing costs have seen the cost of PV modules soar from around US$0.20c/Wp at the end of last to as high as US$0.28c/Wp today, shipping and logistics costs – sent spiralling as a result of the pandemic – have also created supply chain bottlenecks and sent solar project Capex costs upwards.

Rystad noted that before the pandemic, shipping had a negligible impact on overall production costs, equivalent to around US$0.005/Wp. With the cost of shipping having soared – the cost of shipping a container from China to the US is now said to be up to US$15,000 – production costs related to shipping reached US$0.03/Wp this month.

With costs of polysilicon and other core materials such as silver, copper aluminium and glass also rising dramatically since the start of last year, solar PV has contended with nearly unprecedented headwinds. A sensitivity analysis performed by Rystad found that the levelised cost of electricity (LCOE) of new solar projects planned for next year had risen by between 10 – 15%, a hurdle sizeable enough to render a majority of planned projects at risk.

“The utility solar industry is facing one of its toughest challenges just days ahead of COP26,” David Dixon, senior renewables analyst at Rystad Energy, said.

“The current bottlenecks are not expected to be relieved within the next 12 months, meaning developers and offtakers will have to decide whether to reduce their margins, delay projects or increase offtake prices to get projects to financial close.”

PV Tech Premium’s regular PV Price Watch feature updates readers on cost factors across the solar value chain each week. To subscribe to PV Tech Premium, click here.