Taiwan-based PV cell and module manufacturer Motech Industries continued a fourth consecutive quarterly loss, yet losses declined on increased solar cell shipments in the second quarter of 2017.

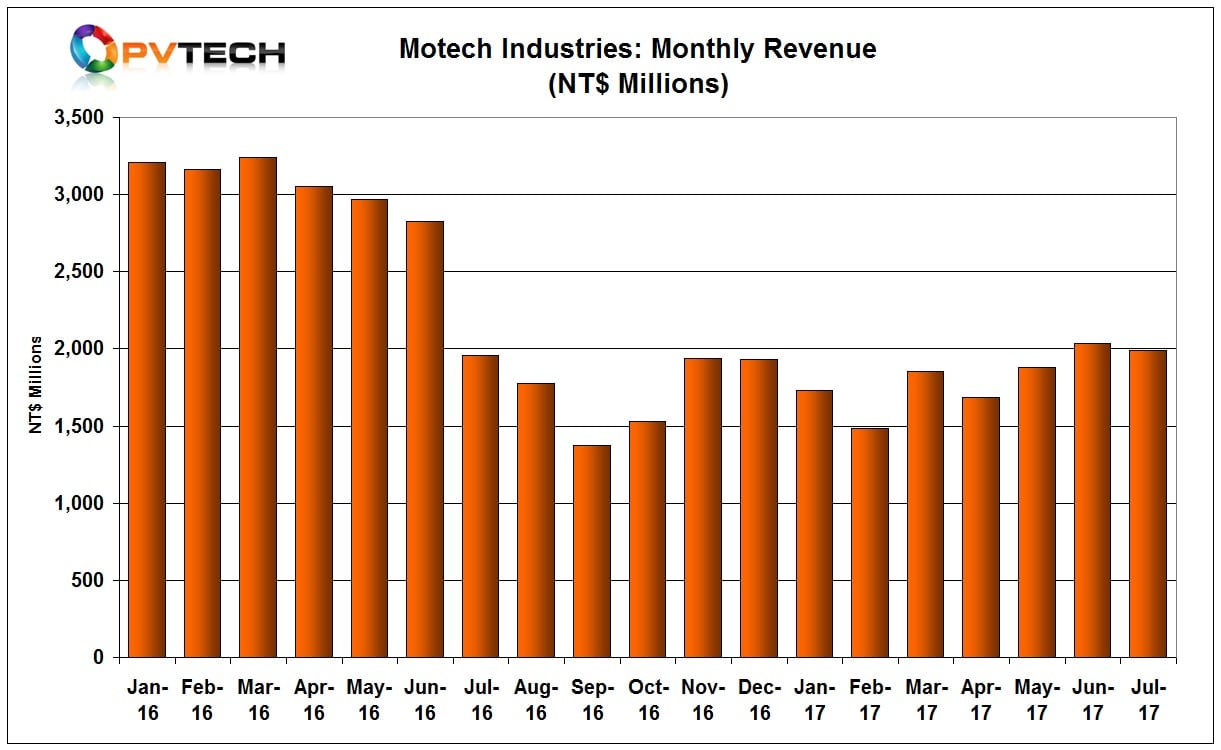

Motech reported second quarter revenue of NT$5,598 million (US$184.6 million), compared to NT$5,069 million (US$167.1 million) in the previous quarter, around a 10% increase.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Sales in July dipped slightly from the previous month. Motech had sales of NT$1,987 million, compared to NT$2,032 million in June.

Gross profit in the quarter was negative NT$267 million (US$8.8 million), compared to a negative gross profit of NT$593 million (US$19.5 million) in the first quarter of 2017. Gross margin was negative 4.8%, down from negative 11.8% in the previous quarter. The company reported a negative net profit margin of 12.4%, down from a negative net profit margin of 20.1% in the first quarter of 2017.

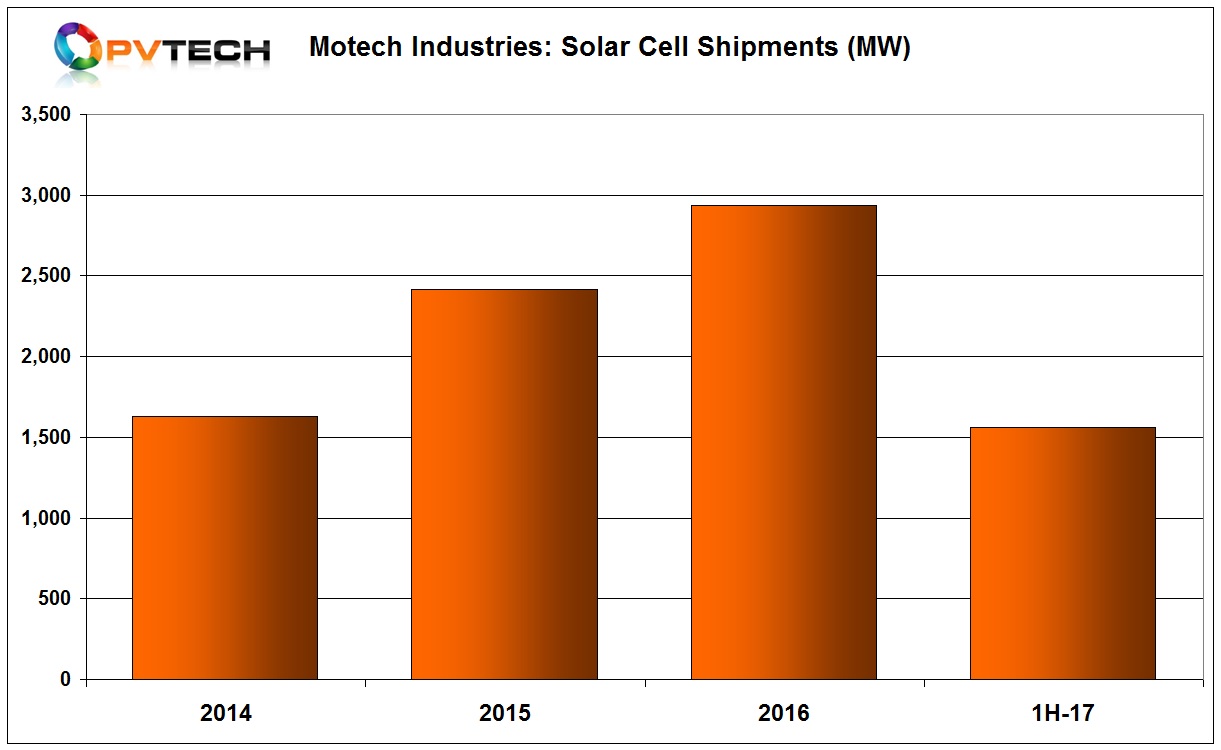

Solar cell shipments in the quarter were 837MW, up from 727MW in the first quarter of 2017, a 15% quarter-on-quarter increase.

Motech reported first half 2017 revenue of 10,667 million, compared to 18,464 million in the prior year period, a 42% decline.

The company reported first half year 2017 solar cell shipments were 1,564MW, compared to 2,414MW in the prior year period, over a 34% decline, year-on-year.

Manufacturing update

Motech is continuing to incrementally increase manufacturing capacity, reaching a total nameplate capacity of 3.6GW at the end of June, 2017, a 200MW increase from the end of the first quarter of 2017. Total capacity at the end of 2016 was 3.2GW.

The company has primarily added 600MW of solar cell capacity in Taiwan since the end of 2016, while adding around 170MW at its facility in Nanke, China. Motech also recently announced the establishment of a new solar cell facility by its subsidiary Motech Suzhou Renewable Energy Co in the Xuzhou Economic and Technological Development zone, Jiangsu Province, China.

Motech said that it was continuing to focus of cost reductions, while expanding its customer base in China and the US. Higher cell conversion efficiencies were also a priority as well as developing its downstream PV system business in the emerging Taiwanese market.

Tough times continue

As PV Tech has highlighted in the first half of 2017, Taiwanese manufacturers have not recovered sales to levels remotely close to those set in prior year period. This is because there has been an increasing number of China-based cell producer ramping P-type monocrystalline and P-type multicrystalline cell production, while migrating to PERC (Passivated Emitter Rear Cell) technology, further restricting demand from Taiwanese suppliers, which are known for high-efficiency cells.

Limited capacity expansions and relative scale to a growing number of Chinese producers has also led to production cost reductions that have squeezed margins for Taiwanese producers.

Compounding the problem has been declining ASP’s and limited availability of mono wafers, offering higher margins than multi wafers.