There was almost 1TW of renewable energy capacity and an estimated 427GW of storage active in US interconnection queues at the end of 2021 according to a Lawrence Berkeley National Laboratory (LBNL) analysis, which also showed that queues were growing year-on-year.

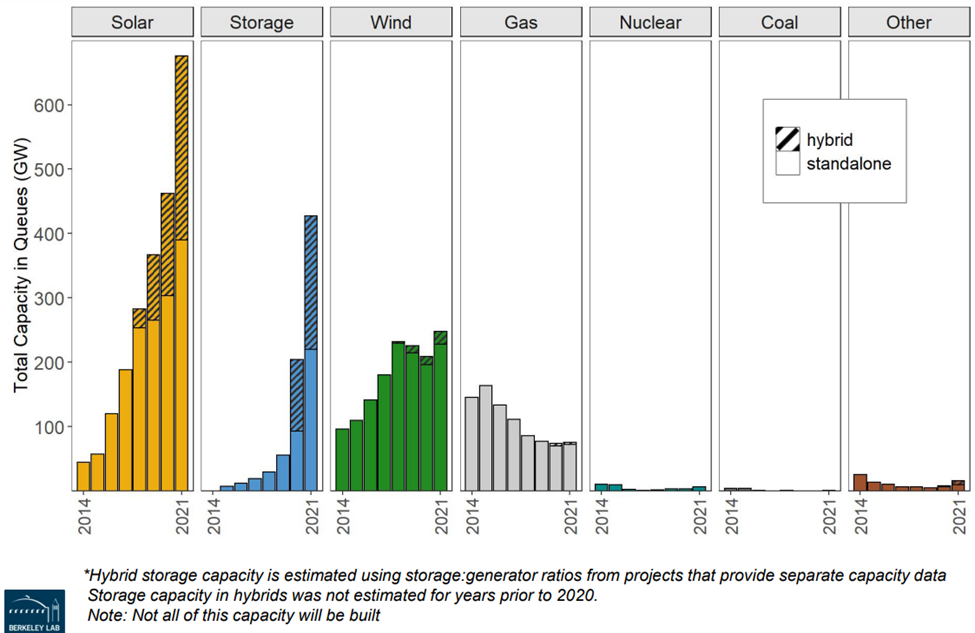

In total, over 930GW of zero-carbon generating capacity is currently seeking transmission access. Solar accounts for a record 676GW of this generation – beating the previous record of 462GW at the end of 2020 – and wind power makes up 247GW. Fossil fuels looking to connect are on the decline, however, with 75GW of natural gas and less than 1GW of coal currently proposed.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Solar and battery storage are by far the fastest growing resources in the queues – together accounting for 85% of new capacity entries in 2021 – but have some of the lowest completion rates, LBNL said. Clean energy organisations have long been calling for system reform to help more solar and storage get connected.

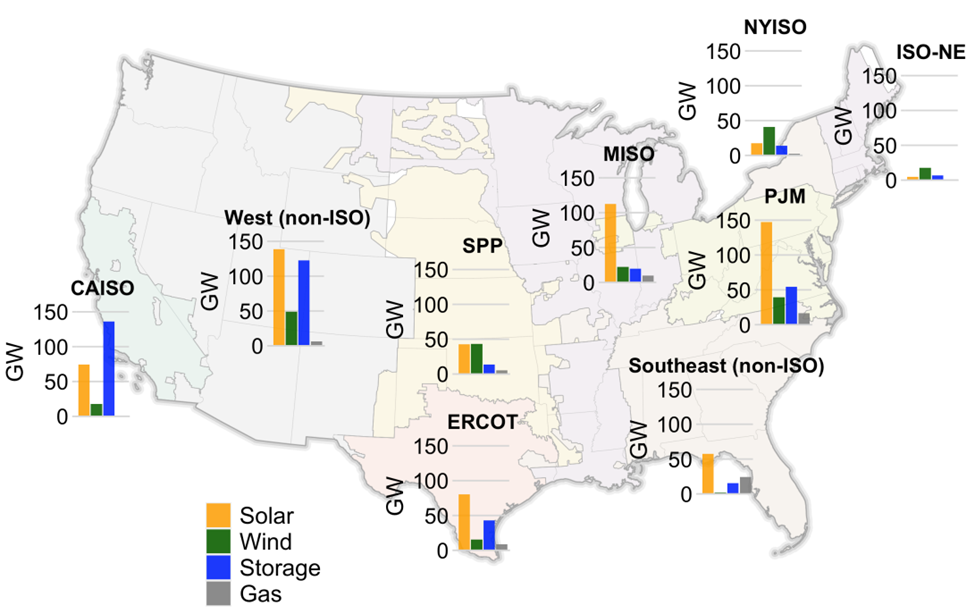

Meanwhile, hybrid projects comprise a large and growing share of proposed capacity, particularly in CAISO and the non-ISO West, LBNL said, adding that 286GW of solar hybrids (primarily solar-plus-battery storage) and 19GW of wind hybrids are currently active in the queues.

“Nearly half of the battery storage capacity in the queues is paired with some form of generation (mostly solar),” LBNL said.

Much of this proposed capacity will ultimately not be built, however, with only 23% of projects seeking connection from 2000 to 2016 having subsequently been built based on a LBNL analysis of a subset of queues. Only ISO-NE and ERCOT exceeded 30% completion rates, with CAISO performing the worst at 13%.

LBNL found that interconnection wait times are also on the rise. In the regions with available data, the typical duration from connection request to commercial operation increased from around 2.1 years for projects built in 2000-2010 to roughly 3.7 years for those built in 2011-2021.

In February, a coalition of three clean energy trade associations called on the US Federal Energy Regulatory Commission (FERC) to make interconnection reform a top priority to reduce the backlog of projects waiting to connect to the country’s grid.

“Interconnection backlogs are one of the biggest impediments to our ability to quickly and efficiently decarbonise our electricity grid in the near term,” Sean Gallagher, vice president of state and regulatory affairs at SEIA said in February.

Furthermore, ‘completion percentages’ of projects looking to connect appear to be declining and are even lower for wind and solar than other resources, LBNL said.

LBNL analysed interconnection queue data from all seven ISOs/RTOs in concert with 35 non-ISO utilities, representing over 85% of the total US electricity load.

In the US, electric transmission system operators (ISOs, RTOs or utilities) require projects seeking to connect to the grid to undergo a series of impact studies before they can be built.

Most projects that apply for interconnection are ultimately withdrawn and those that are built are taking longer on average to complete the required studies and become operational, LBNL said.

Earlier this week, the North American Electric Reliability Corporation (NERC) wrote for PV Tech Premium about the key considerations – and difficult balance – of managing grid connection from a transmission operators point of view.