Aiming to make its local solar manufacturers competitive on the global stage, the Indian government has proposed direct financial support of INR110 billion (US$1.7 billion) and a 12GW allocation of public sector tenders mandated to include locally sourced PV equipment.

The Ministry of New and Renewable Energy (MNRE) issued a number of policy support proposals on Friday and is now seeking comments from stakeholders by 31 December this year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Last week, both sides involved in the anti-dumping case against imports of cells and modules from China, Taiwan and Malaysia aired their cases at an oral hearing in Delhi, which has been followed by the government releasing this range of alternative support measures.

Intentions to encourage production of polysilicon, wafers and ingots from scratch, rather than just cells and modules, featured prominently in the proposals.

Indeed, in today’s guest blog on PV Tech, the head of the Indian Solar Manufacturers Association (ISMA) claimed that increased module production would naturally result in a boost to in-country development of batteries, glass, wafers and other products.

MNRE divulged that as of 31 July this year, installed capacity of cells and modules in India stood at 3.1GW and 8.8GW respectively. More importantly, it noted that actual capacity utilisation of this stands at just 1.5GW for cells and 2-3GW for modules and it blamed this on “stiff competition from imports”.

However, actual installed capacity is under some contention, with analysts noting earlier in the year that much of it had either become obsolete or too old. MNRE also said that very few Indian players have migrated to Passivated Emitter Rear Cell (PERC) technology yet, despite this trend in global manufacturing at large. The ministry also highlighted that current cell manufacturing capabilities are well below the 20GW per annum required for india’s downstream targets.

Present support

The industry already benefits from the Modified Special Incentive Package Scheme (M-SIPS), which is a capital subsidy for electronics manufacturers, but analysts have previously noted significant delays in dispersing these sops.

The original Domestic Content Requirement (DCR) policy came to end and on 14 December after a WTO ruling against it, having achieved 1,436MW of commissioned capacity, with another 1GW under construction. Now the only legal DCR tenders are those for government and public sector entities (CPSUs).

Proposed support

In light of this, the Indian government has now proposed direct financial support of INR110 billion (US$1.7 billion) along with significant concessions of the following structure:

- Having successfully carried out 1GW under the CPSU scheme, the plan is to raise this allocation to a whopping 12GW, a plan that many local manufacturers have been calling for them to carry out capacity expansions with confidence brought by an “assured DCR component”. Analysts in the past have noted potential trouble with this policy in the form of Discoms not wanting to buy power at slightly higher prices.

- A ‘quality order’ for cells and modules has been brought in. In light of this, the DCR will be reviewed annually to mandate a certain percentage of cells in the programme to be of higher quality, with this percentage and level of quality to increase each year.

- A similar policy will ensure a gradual increase of focus further upstream. In this case, part of the DCR allocation would again be earmarked for certain components in the earlier stages of production. This would also be increased over time to encourage “backward integration” and achieve production in India across the entire chain of PV manufacturing.

Other stages of this backward integration plan included aims to make the rooftop DCR component entirely made up of domestically-sourced cells by 2022. Meanwhile, 20% of DCR modules should have come from domestic wafers by 2019/20 under a tendering programme. A similar 20% policy will come in for polysilicon, but a year later in 2020/21. MNRE said this category would be independent from the quality orders categories mentioned above.

- Aiming for an additional 10GW of manufacturing capacity over a five-year period, a 30% subsidy would be offered for setting up or upgrading local manufacturing. This will be given to the following production stages, subject to the upper limits indicated below (Cr refers to INR10 million):

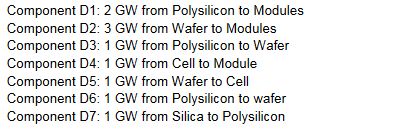

The new 10GW will be made up of the following segments:

- The Indian Renewable Energy Development Agency (IREDA) would offer an interest subvention of 3% to manufacturing capacity being set up without capital subsidy.

- A selection of PSUs will be chosen to set up integrated manufacturing all the way from polysilicon to modules of 1GW capacity each, with financial support from government.

- Capital goods required for setting up solar manufacturing facilities would be exempt from customs duty.

- MNRE noted the very high costs of power when carrying out such manufacturing and is proposing to offset such costs by allowing the manufacturing unit to set up a PV plant (or floating solar plants at designated reservoirs) of twice the required energy capacity and receive financial rewards for feeding excess electricity to the grid. However, using this model would block the unit from receiving other capital subsidies or interest subventions mentioned above.

- Finally, a subsidy scheme to support technology upgrades and R&D was put forward, although this policy requires separate guidelines.

The proposed policies in full can be found here.