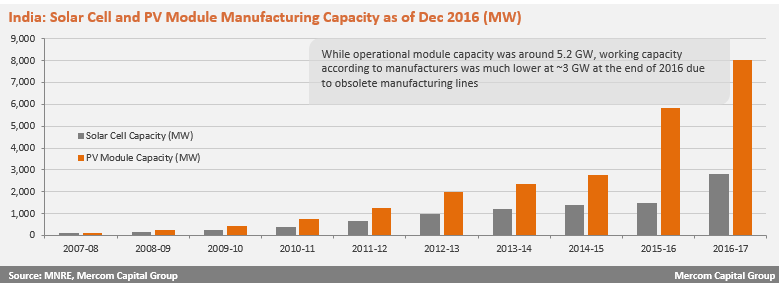

India’s solar manufacturers have said that roughly 2.25GW of module manufacturing capacity that was previously deemed functional is either obsolete or too old to be counted as operational, according to consultancy firm Mercom Capital Group.

As of December 2016, Mercom had put the installed figures at 2,815MW of cells and 8,008MW of modules. Of this, 1,448MW of cell and 5,246MW of module capacity were deemed operational.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Since then manufacturers have told Mercom that the true operational module manufacturing capacity stands at roughly 3GW – around 2.25GW less than previously projected. This is due to some manufacturers reporting defunct manufacturing lines as operational.

India’s manufacturers have been struggling for some time, especially since the plunge in prices for products coming out of China midway through last year. Mercom reports that Indian modules, that aren’t part of local content rules, typically cost about 10% more than Chinese modules. Furthermore, projects with the latest record low tariffs at Rewa in Madhya Pradesh of INR2.97/kWh (with escalation) will only be viable with cheaper Chinese modules.

Various manufacturers told Mercom that lack of scale is hindering the sector as well as inadequate government support, an underdeveloped supply chain and challenges over access to affordable financing. They also cited almost negligible investment in R&D compared to countries such as China. Manufacturers were also looking for some form of government subsidy or incentive to scale up production, but the recently announced budget did not provide any.

Although a Ministry of New and Renewable Energy (MNRE) official told Mercom that the government is trying to promote domestic manufacturing with a 20-25% capital subsidy and various incentives via the ‘Make in India’ programme, most industry memebrs have been sceptical of the programme’s benefits over the last two years.

However, the adverse effects on solar developers of the Goods and Services Tax (GST) Bill – due to come into force later this year – should actually help domestic manufacturers by raising the prices for imports.

Mercom chief executive Raj Prabhu said: “Cheaper infrastructure and R&D investment are other areas that the government can focus on. American and European manufacturers have tried and failed to upend the domination of Chinese manufacturers, and it remains to be seen how far the Indian government is willing to go to support local manufacturers.”