Updated: Leading ‘Silicon Module Super League’ (SMSL) member JinkoSolar has guided 2017 PV module shipments to be in the range of 8.5GW and 9.0GW, a potentially astonishing sequential growth rate after reporting 6.65GW of module shipments in 2016, an increase of 47.5% from 4.5GW in 2015.

JinkoSolar reported total revenues for 2016 of RMB21.40 billion (US$3.08 billion), an increase of 38.5% from RMB15.45 billion for the full year 2015. Total revenues including electricity revenue from discontinued operations were RMB22.35 billion (US$3.22 billion), an increase of 39.0% from RMB16.08 billion for the full year 2015.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Kangping Chen, JinkoSolar's Chief Executive Officer commented, “I am pleased to announce a strong quarter to finish out the year with module shipments hitting 1,733 MW and 6,656 MW in the fourth quarter and full year 2016, respectively. I am proud to say that this puts us firmly in the position as the largest module supplier globally. Total revenues during the quarter hit US$737.6 million and US$3.08 billion for the whole year. While market sentiment is gloomy overall, we remain optimistic about the global demand in 2017.”

“We successfully complete the spin-off process of Jinko Power's project business which generated US$145.2 million in investment gain for JinkoSolar and strengthened our balance sheet by cutting debt to US$892 million from US$2.1 billion. In January 2017, we further cut our debt by repurchasing almost all of our convertible notes due in 2019 at holders' put option. These initiatives have increased our corporate flexibility and reinforced our financial position which will allow us to take advantage of more opportunities in 2017.”

China demand remains strong

Chen noted in an earnings call to discuss fourth quarter and full-year results that the company expected end market demand in China to remain a 30GW plus market and demand after FiT reductions mid-year would not result in a demand collapse, due to demand generated by programs such as the ‘Top Runner’ scheme. Second-half year demand in China is expected to be around 8GW.

Management also noted that the Top Runner program could be responsible for 5GW to 6GW in 2017.

Manufacturing expansion update

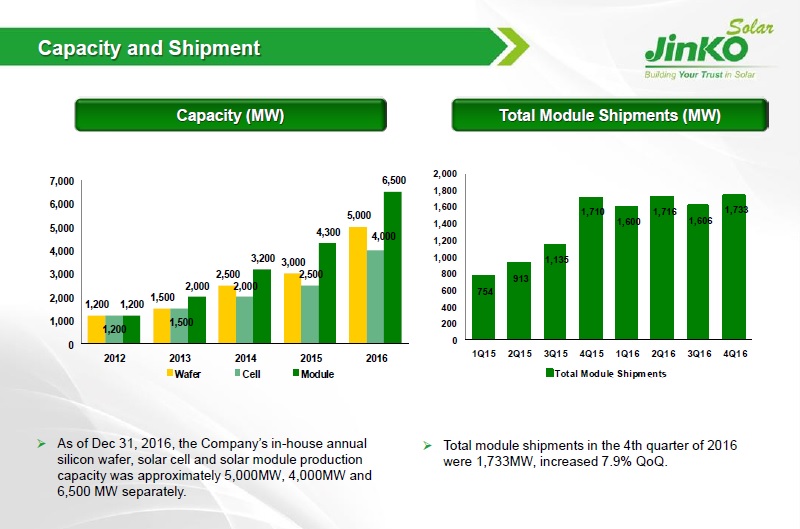

With continued strong growth momentum expected in 2017, JinkoSolar said that it would be expanding in-house ingot/wafer, solar cell and module assembly capacity this year.

“We remain focused on high-efficiency technologies and stringent quality controls. Demand for our PERC products continues to be strong and as a result, we have been adjusting our production capacity to accommodate this market trend since the first half of 2016,” added Chen.

Management noted in the earnings call that it expected to expand in-house ingot/wafer production from 5GW at the end of 2016 to 7GW by the end of 2017. The 2GW wafer expansion would be dedicated to monocrystalline, providing 3GW of monocrystalline capacity.

The company is still limiting in-house solar cell capacity expansions, adding only 500MW in 2017 to take nameplate capacity from 4GW at the end of 2016 to 4.5GW by the end of 2017.

However, the company noted that it was further migrating cell capacity to PERC (Passivated Emitter Rear Contact) technology, having reached 1.4GW of in-house PERC capacity in 2016. The company plans to have reached 2GW of PERC capacity by the end of 2017. JinkoSolar was also migrating to 'black silicon' wafer texturing to boost conversion efficiencies in 2017.

Management noted that it expected capital expenditures for 2017 to be in the range of US$400 million to US$500 million, focused on the mono wafer and PERC capacity expansions and upgrades.

Financial results

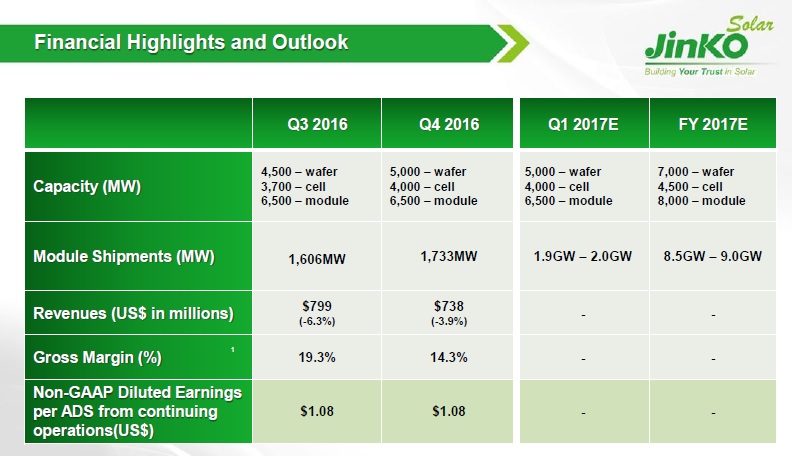

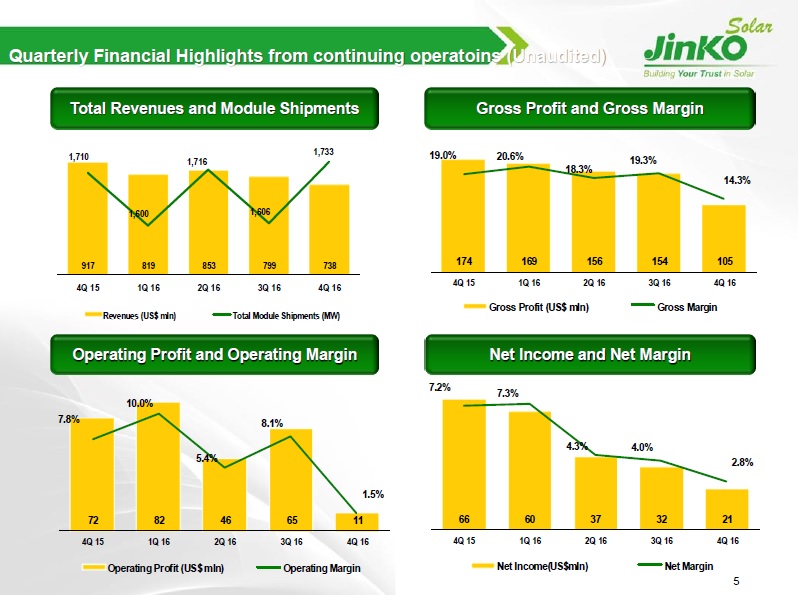

JinkoSolar reported fourth quarter total solar module shipments were 1,733MW, an increase of 7.9% from 1,606MW in the third quarter of 2016.

Total revenues were RMB5.12 billion (US$737.6 million), a decrease of 3.9% from the third quarter of 2016.

Total revenues including electricity revenue from discontinued operations were RMB5.23 billion (US$753.0 million), a decrease of 8.3% from the third quarter of 2016.

JinkoSolar reported fourth quarter gross margin of 14.3%, compared with 19.2% in the third quarter of 2016. Income from operations was RMB77.9 million (US$11.2 million), compared with RMB433.3 million in the third quarter of 2016.

Gross profit in the fourth quarter of 2016 was RMB730.0 million (US$105.1 million), compared with RMB1,026.1 million in the third quarter of 2016.

Guidance

JinkoSolar said it expected total solar module shipments to be in the range of 1.9GW to 2.0GW in the first quarter of 2017, up from 1.6GW in the first quarter of 2016. As already highlighted, JinkoSolar estimates total solar module shipments in 2017 are expected to be in the range of 8.5GW and 9.0GW.

Management noted in the earnings call that it expected overall strong demand to continue in 2017, citing China, US and India as key markets. With strong demand, JinkoSolar expected relatively stable module ASP’s in the first quarter of 2017 with price levels seen in the fourth quarter of 2016.

However, management did not expect a repeat in a 25% plummet in ASP’s as seen in the second half of 2016. The company said that strong demand was more balanced and that an ASP decline of 10% to 15% was the most expected in the second half of 2017.