‘Solar Module Super League’ (SMSL) member Trina Solar is planning its first major solar cell manufacturing expansion in recent years, driven by its migration to large-area PV modules using the 210mm wafer size as it ramps production of its high-performance mainstream ‘Vertex’ Series modules in 2021 onwards.

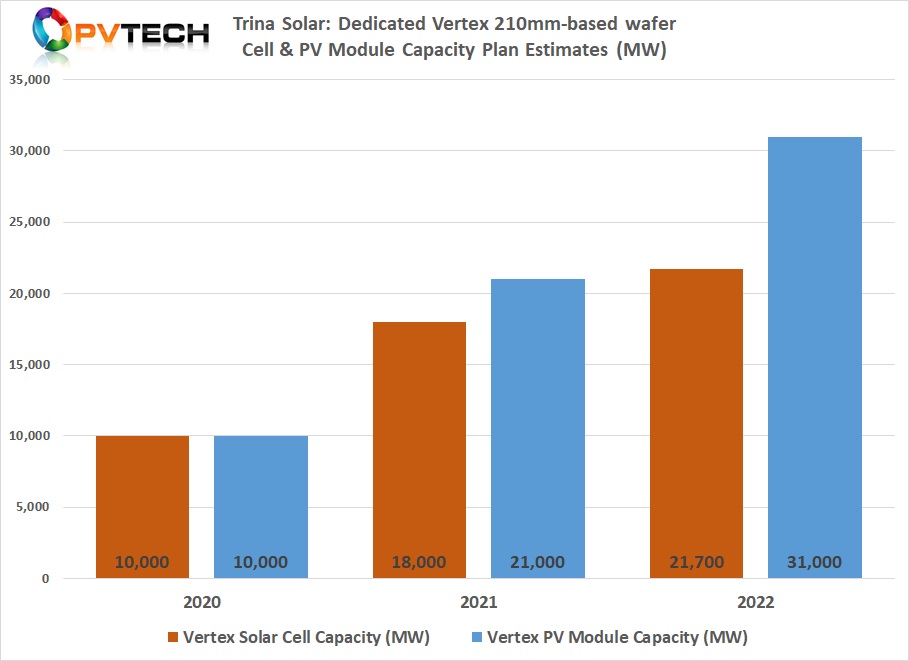

The SMSL member had recently highlighted that its new Vertex series module manufacturing capacity ramp would start in the fourth quarter of 2020 with a planned nameplate capacity of 10GW, ramping to 21GW in 2021 and top 31GW in 2022.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

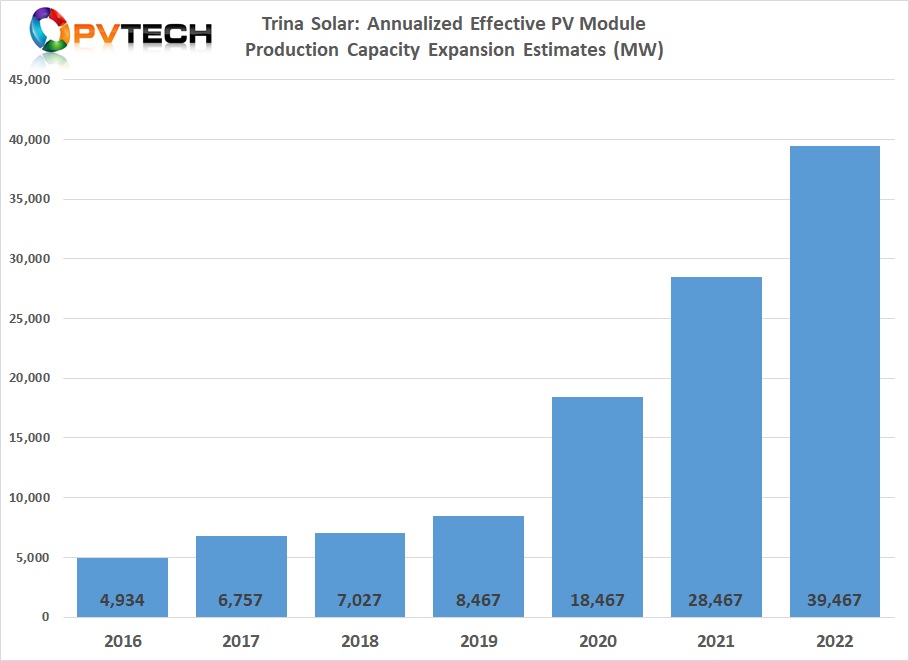

The last official figures, revealed before Trina Solar de-listed from the NYSE, had PV module capacity to reach 6GW by the end of 2016. With Trina Solar’s Chinese IPO earlier this year, the company reported PV module capacity figures of almost 8.5GW in 2019.

Based upon the 2019 IPO data, coupled to the latest module assembly expansion plans that are dedicated to the Vertex capacity ramp, Trina Solar is currently estimated to reach a total module assembly nameplate capacity of almost 39.5GW by the end of 2022.

However, Trina Solar has recently updated its plans for in-house mono-PERC (Passivated Emitter Rear Cell) solar cell capacity expansions related to the 210mm wafer size. This predominantly means cell production lines capable of processing the largest-area wafers in the market, requiring a major round of capital expenditure, compared to the companies previous ‘asset-lite’ manufacturing model.

The company said that it would add 7.6GW in annual new 210mm capable cell line capacity at its production plant in Yancheng, China, while upgrading a further 2.4GW of cell capacity at the site to process 210mm wafers, an initial 10GW of nameplate capacity dedicated to Vertex module needs.

With solar cell and module capacity in Malaysia, Thailand and Vietnam, Trina Solar said it would expand solar cell capacity by a further 2.5GW at facilities outside China.

Although not disclosing further site-specific cell expansion plans and upgrades, Trina Solar expects further increases in cell production capacity take place, equating to a total of 26GW of in-house cell capacity by the end of 2021. Approximately 70% of this total will be 210mm (Vertex) cell capacity.

This would also equate to around 18GW of Vertex-based cell capacity by the end of 2021, combined with around 21GW of Vertex module assembly capacity.

Historically, Trina Solar has followed an asset-lite manufacturing footprint, which included limited in-house ingot/wafer production, while relying on merchant cell producers for 1GW to 3GW-plus of external cell sourcing, due to higher in-house module assembly.

Although the cell expansions are significant, having had around 6GW of in-house cell capacity at the end of 2016, Trina Solar has still not abandoned the asset-lite model. PV module shipments in 2019 were around 10GW.