In 2022, a flurry of green hydrogen projects were announced in the Middle East and North Africa (MENA) region, coinciding with the COP27 climate conference in Egypt. Many of these projects in Egypt – powered by solar PV either alone or co-located with wind – are expected to be at the gigawatt-scale, such as Australian mining company Fortescue Metals Group‘s 9.2GW or independent power producer Globeleq’s 9GW green hydrogen hub. Yet, many of these projects are not expected to be operational for many years to come.

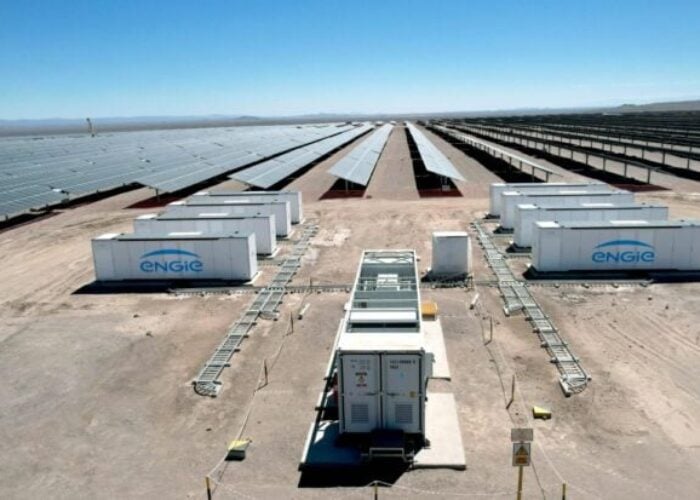

In addition to the many gigawatt-scale projects announced in the MENA region, Latin America is another market that has shown potential for green hydrogen and green ammonia solar-powered projects. Among the countries in the region, Peru and Chile are the most promising says Dylan Rudney, CEO at solar developer Verano Energy.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“These two markets are clearly going to be the best ammonia export markets, specifically northern Chile and southern Peru.”

Verano Energy’s jump into green ammonia was made easier by the fact it was already an active player in the region’s PV market – primarily in Chile, Colombia and Peru. Verano’s market knowledge made solar the obvious technology to choose to power the 5.6GW green ammonia project in Arequipa, south of Peru, which was recently submitted for environmental impact assessment.

The reason Peru was selected was that Colombia could not compete on a levelised cost of electricity (LCOE) basis with the other two and, while Chile might have better irradiation (as covered in this PV Tech Premium piece), its permitting process is much slower than Perú, says Rudney.

“If we want to be early to market, Peru is the best country for a competitive early-to-market project, which we do. We developed this project on the largest piece of private land that we believe exists in southern Peru, which is faster than doing a state land process,” adds Rudney. The company expects the project to be fully permitted by early next year.

The difference between Chile and Peru is quite significant, explains Rudney. In Chile, Verano Energy has a project on state-owned land but doesn’t expect a final investment decision before 2030. “It’s about three times the amount of time to permit a project,” he says.

Rudney believes Peru has huge renewable potential, be it PV or the use of PV to power other resources such as green ammonia.

Peru: a market under the radar

“Peru, in general, is often a country that’s under the radar. The amount of foreign investment they’ve gotten over the last several years from the mining and agricultural industry is material. It’s a good market, they have relatively strong institutions,” adds Rudney.

Of course, this is based on the condition that green ammonia and green hydrogen’s potential fully materialises in the coming years. “If this eventually becomes a commodity market with real infrastructure set up, this will be one of many projects in the region,” says Rudney, adding that today there is already demand and this was one of the reasons why Verano Energy expects to be an early entrant in the green ammonia market.

“We’re in a mining area where there’s a huge amount of imports and exports already. Environmentally, [it is] not a sensitive area, for the large part. It’s very unpopulated and extremely dry, with very little vegetation and fauna,” says Rudney, explaining why the south of Peru and northern Chile are much better locations compared to southern Chile, which has also seen interest in green hydrogen powered by wind. Southern Chile lacks the necessary infrastructure for it, with no roads and ports able to facilitate the construction of green hydrogen and green ammonia projects and the export of ammonia, he says.

Moreover, in terms of pure green hydrogen projects, Rudney sees Brazil as a local market in the region where there is an existing demand for hydrogen, which is significant enough to develop projects in Brazil.

The nearly 6GW of solar capacity expected to power the green ammonia plant, which once fully operational will have an annual capacity of 1.65 million tons of ammonia production, represents almost a third of the total installed electricity generation in Peru.

As of the end of 2022, all Peru’s generation sources combined amounted to 15.8GW, according to data from the Peruvian Ministry of Energy and Mines, solar’s share was a mere 2%, with 286MW of installed capacity. Most of that is located in the southern region of Moquega, which borders Arequipa.

Rudney does not expect projects like Verano Energy’s to cannibalise standalone solar PV or solar co-located with storage, as these are different markets. The green ammonia project is 100% export-driven, while local demand for energy will always be present, which solar PV will be able to provide.

“There’s always a demand for local energy contracts, which we also see in Peru. So the short answer is no [there’s no risk of cannibalisation]. I think that they can both happily coexist. There may be some ability of large hydrogen plants to sell a small amount of energy to the grid,” says Rudney.

Green ammonia projects in Peru, powered by solar PV, could play a key role in the accelerated growth of solar PV in the country, which has yet to reach a gigawatt of installed capacity.