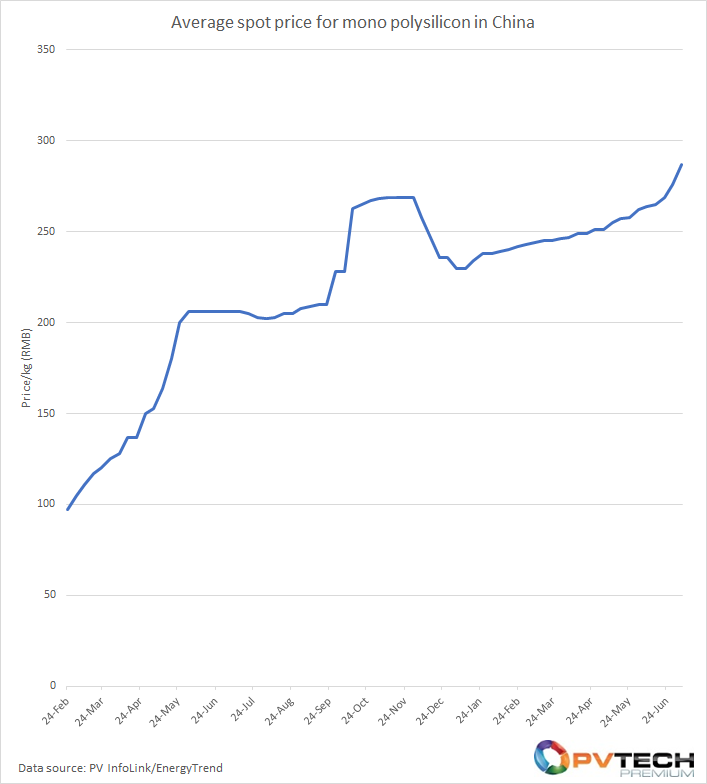

Solar polysilicon prices jumped by a further 4% this week, fuelling industry assessments that prices will soon jump above the RMB300/kg (US$44.74/kg) barrier.

This week’s average polysilicon strike price, using data provided by industry analysts PVInfoLink and Energy Trend, stands at RMB287/kg (US$42.81/kg). This price includes China’s 13% sales tax, indicating a material price of around US$37.88/kg.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

While polysilicon prices have remained stubbornly high and have grown modestly throughout the first half of the year, prices have grown considerably in the past two months. Since 4 May 2022, prices have grown by some 14%.

This has led industry analysts to expect that polysilicon prices will soon jump above the RMB300/kg barrier.

In a note issued earlier this week, Frank Haugwitz of advisory Asia Europe Clean Energy (Solar) Advisory (AECEA) stressed that with some instances of pricing already peaking in the early RMB290s/kg, polysilicon prices will soon exceed the RMB300 threshold.

Recent surges in prices have been driven by polysilicon producer maintenance schedules, with AECEA noting that maintenance works are scheduled for five sites in the coming weeks, resulting in a reduced output from the industry’s polysilicon production base.