After a 2021 which saw price volatility dominate the solar industry’s new, the sector started anew last week. How has the downstream started the year with regards manufacturing and pricing?

In terms of module pricing, third-party analyst PVInfoLink has partially adjusted its price display terms for the forthcoming year, cancelling the spot price forecasts for 365-375W and 440-450W modules shipped overseas.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

To identify the range of low, average high prices for modules, the average is based upon top tier manufacturers with centralized and bid-opening projects, while high prices are based on distributed projects. Low price forecasts mainly reflect the prices of second-tier manufacturers and below.

Module prices largely remained stable in the first week of 2022, with end user demand standing stable and utilisation rates increasing slightly. Pricing forecasts supplied by PVInfoLink, EnergyTrend and Solarbe indicate a range of RMB1.8 – 1.88/W (US$0.282 – 0.295c/W) for 210mm modules and RMB1.84 – 1.87/W (US$0.288 – 0.293c/W) for 182mm modules.

| Quotation agency | Product | Average price (RMB/W) |

|---|---|---|

| PVInfoLink | 182mm monofacial mono PERC module | 1.88 |

| PVInfoLink | 210mm monofacial mono PERC module | 1.88 |

| EnergyTrend | 182mm monofacial mono PERC module | 1.85 |

| EnergyTrend | 210mm monofacial mono PERC module | 1.87 |

| Solarbe | 182mm mono bifacial module | 1.84 |

| Solarbe | 210mm mono bifacial module | 1.80 |

In recent bidding for PV modules within China, the highest quoted price of RMB2.07/W (US$0.325/W) was made by Jiangsu Sunportpower Photovoltaic Technology, while the lowest quoted price – RMB1.835/W (US$0.288c/W) – was made by Changzhou EGing Photovoltaic Technology.

Judging by those opening bids, there is a clear differentiation between the prices quoted for utility-scale and distributed or rooftop solar modules.

There, too, is a broad range of EPC prices being quoted in China, with prices quoted at between RMB3.5/W (US$0.549c/W) and RMB5.77/W (US$0.905c/W).

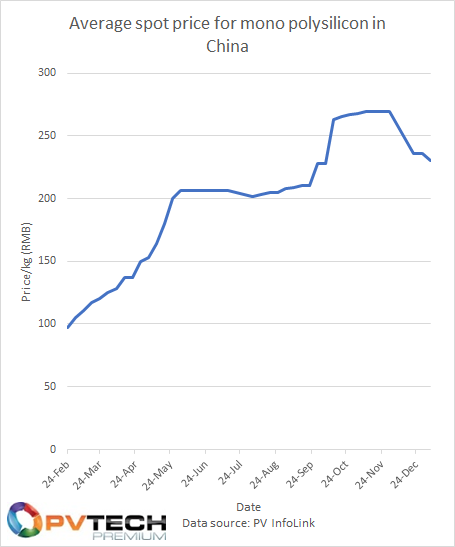

Meanwhile, polysilicon prices have continued their downward trend, falling last week to levels not seen since last October. Last week’s average price dipped to RMB230/kg (US$36/kg), inclusive of China’s sales tax of 20%. The raw material price, therefore, stood at around RMB191, equivalent to US$29.99/kg.