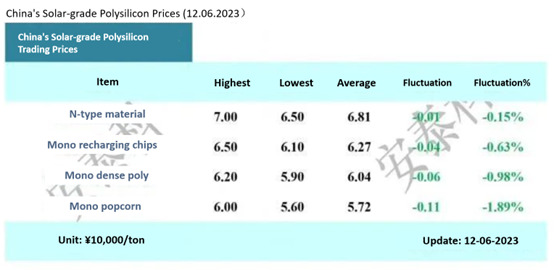

On 6 December, the Silicon Industry Branch of the China Nonferrous Metals Industry Association released the latest transaction prices for solar-grade polysilicon.

The transaction price for n-type material ranged from RMB65,000-70,000/US ton, averaging at RMB68,100/US ton, a decrease of 0.15% week-on-week.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The mono recharging chips traded between RMB61,000-65,000/US ton, with an average price of RMB62,700/US ton, marking a 0.63% reduction from the previous week. Mono dense polysilicon material was priced between RMB59,000-62,000/US ton, averaging RMB60,400/US ton, reflecting a 0.98% drop week-on-week.

Additionally, mono popcorn polysilicon material was priced between RMB56,000-60,000/US ton, with an average of RMB57,200/US ton, experiencing a more substantial decline of 1.89% from the previous week.

There has been a downward shift across process for n-type material transactions, compared with the previous week, with minimal changes in the average price. However, lower-quality silicon materials experienced a more significant reduction in prices.

Industry experts observe that with the swift industry transition from p-type to n-type silicon, there has been a notable surge in the production of n-type silicon wafers. Concurrently, the demand for p-type wafers is being increasingly curtailed, resulting in a reduction of their market presence. This shift has led to a relatively heightened demand for n-type silicon materials, and while inventories are dwindling, offering some price stability, the general price trend remains downward.

PV Tech has already reported a similar downward trend in the prices of solar modules in the Chinese market. Recent centralised procurement bids by state-owned entities such as the Three Gorges Group have seen the bid prices for n-type modules consistently drop below the RMB1/W threshold.

In light of these market trends, analysts anticipate sustained price declines. The swift reduction in prices across the photovoltaic industry’s various sectors is likely to hasten technological evolution and drive significant restructuring within the industry.