Renewables will stand alone as the only generation class to experience growth in 2020 as the COVID-19 pandemic delivers the most seismic shock to the power sector since the Great Depression.

That is the key takeaway from the International Energy Agency’s (IEA) 2020 Global Energy Review, a report meant to explore the full impact of the pandemic on energy demand and generation as nations worldwide enact lockdown measures.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

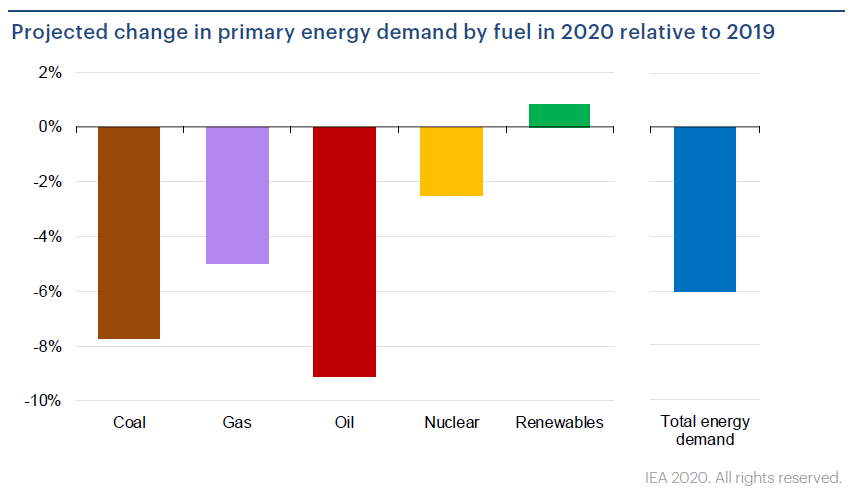

The report, published this morning, forecasts that global energy demand will fall by some 6% this year, a decline roughly seven-times that of the drop experienced during the 2008 financial crisis and the most severe drop since the second world war.

The effects have already been felt, with global energy demand having declined by 3.8% in Q1 2020, IEA analysis claims.

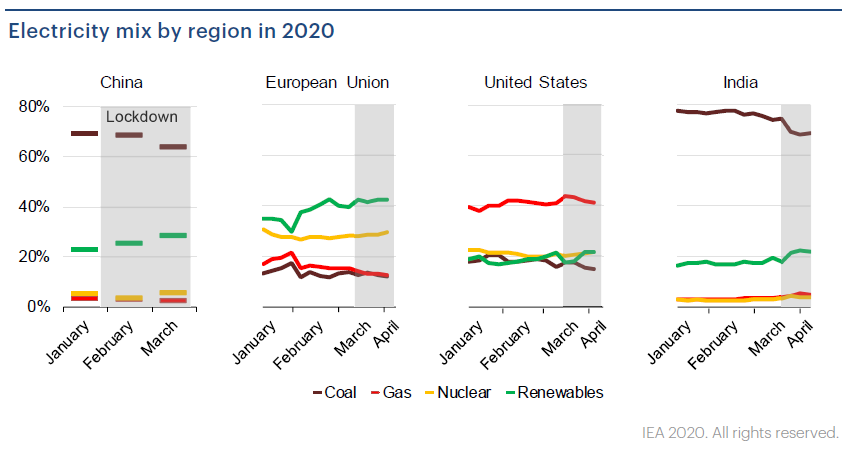

Advanced economies have been the hardest hit. The IEA expects energy demand in the US to fall by 9% this year and the European Union to experience an 11% collapse, driven predominantly by the effects of lockdown measures on industry. Renewables' role in the power mix of those respective markets has already grown, however.

The severity and length of lockdowns is instrumental to the collapse in demand, the IEA says. Analysis has found that full lockdown periods, like those experienced in many European markets, can trigger falls in energy demand of up to 20%. Meanwhile, energy demand also continues to fall by around 1.5% for each month lockdowns are in effect.

The forecasts, based on 100 days of preliminary data as the world has grappled with COVID-19, mean that the power sector will experience a 5% drop in demand this year, the largest fall in demand for electricity since the Great Depression in the early 1930s.

But that collapse would stand to be beneficial for renewable power, with the IEA expecting renewables to be the only asset class to experience growth this year, courtesy of new capacity coming onstream, lower OpEx and the benefit of priority dispatch in key markets.

Renewables could feasibly deliver 40% of global power in 2020, cementing the lead over incumbent fossil fuels the asset class had seized last year. Should those figures ring true, renewables would hold a six-percentage point lead over coal. Even gas, championed as a bridging fuel by many established economies, looks set to experience a decline in demand, with the IEA expecting gas demand to fall by 5% this year.

As a result, solar and wind in particular look set to shrug off any purported supply chain issues and add around 5% to renewables power generation in 2020.

Fatih Birol, executive director at the IEA, described the pandemic as posing an “historic shock to the entire energy world”.

“Amid today’s unparalleled health and economic crises, the plunge in demand for nearly all major fuels is staggering, especially for coal, oil and gas. Only renewables are holding up during the previously unheard-of slump in electricity use

“It is still too early to determine the longer-term impacts, but the energy industry that emerges from this crisis will be significantly different from the one that came before.”

More to follow…

PV Tech has set up a dedicated tracker to map out how the COVID-19 pandemic is disrupting solar supply chains worldwide. You can read the latest updates here.

If you have a COVID-19 statement to share or a story on how the pandemic is disrupting a solar business anywhere in the world, do get in touch at [email protected] or [email protected].