Revenue growth is a key metric for five public listed PV inverter manufacturers in 2019, led by skyrocketing SolarEdge.

The five public listed companies under review are SolarEdge, SMA Solar, Sungrow, Enphase and Ginlong, whihc all made strong revenue gains in 2019 that is in stark contrast to several years of volatile swings.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

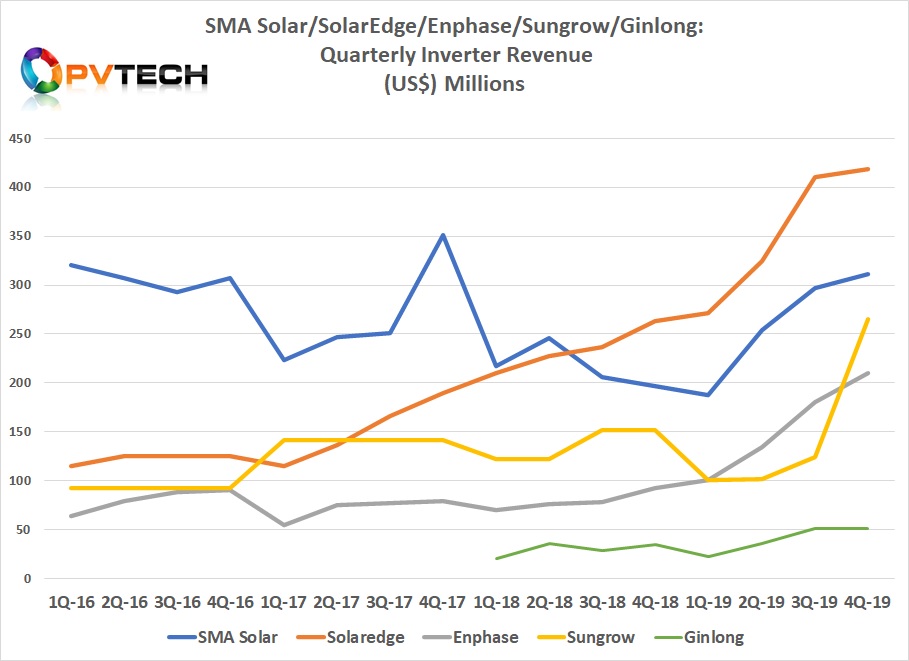

As the chart below shows, the growth of SolarEdge has been remarkable. Flatlining revenue in 2016 was transformed in 2017 and grew consistently through to the end of 2018. However, in the first nine months of 2019, SolarEdge’s revenue growth ramped at a significantly higher rate, only to plateau in the fourth quarter. The company also surpassed two major rivals (SMA Solar and Sungrow) since 2017.

Once the leading PV inverter manufacturer, SMA Solar’s quarterly revenue figures have shown wild swings with an underlining downward trend through the end of 2018.

However, SMA Solar bounced back strongly in 2019, matching SolarEdge’s revenue growth profile with a near similar profile in the fourth quarter.

It had been the third quarter of 2018 when SMA Solar’s revenue fell below that of SolarEdge’s for the first time. Although the revenue gap continued to expand through the first quarter of 2019, SMA Solar has clawed back some of SolarEdge’s gains during 2019.

Sungrow does not breakout quarterly PV inverter revenue figures but does breakout PV inverters sales as a percentage of annual revenue in annual reports, which enables a rough quarterly calculation to make the rival comparison.

In recent years, fourth quarter PV inverter revenue has been the peak in a calendar year but had reached a plateau overall. However, PV Tech’s calculations in 2019 indicate much weaker PV inverter revenue in the first half of the year, followed by increased sales in the third quarter and a massive spike in revenue in the fourth quarter of 2019. As a result, Sungrow surpassed Enphase in the fourth quarter of 2019.

Having long been the laggard in the group, Enphase showed a strong recovery in revenue from the second quarter of 2018. Revenue has grown fast in 2019, posting new record quarter-on-quarter.

Although revenue growth continued in the fourth quarter of 2019, the pace slowed slightly.

Newcomer to this rival analysis is Ginlong, which had its first year as a public company in 2019. A boost to capital after its IPO, Ginlong was able to expand both its product range and sales markets in 2019, compared to the previous year. Ginlong had strong revenue growth in the first half of the year. However, sales have briefly peaked in the second half of the year but has since announced plans to double its manufacturing capacity to 20GW per annum, due to demand and continued market expansion plans.

PV inverter shipments

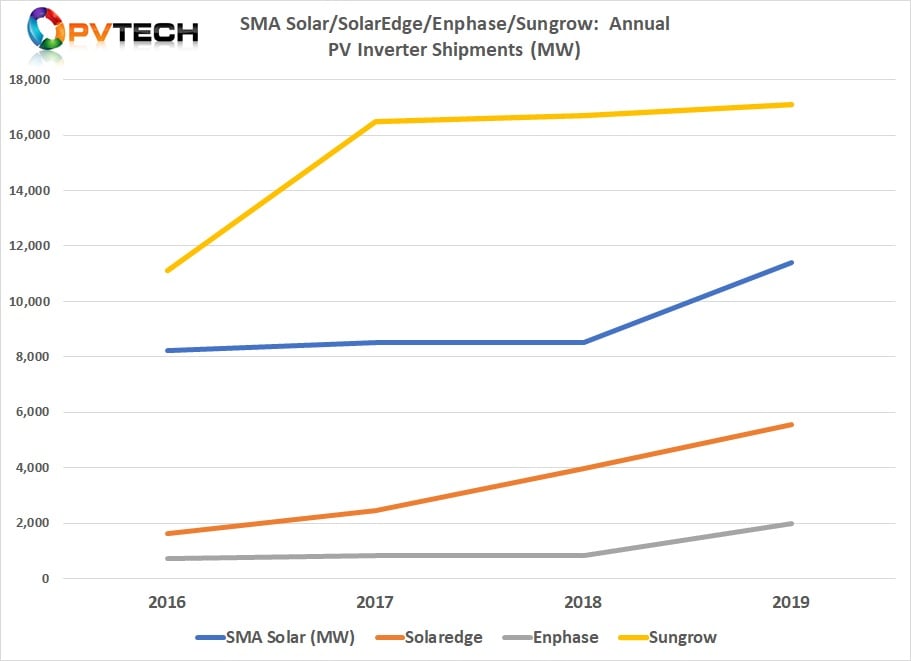

Unlike the PV module sector, PV inverter megawatts shipped is highly dependent on companies' product range. Both SMA Solar and Sungrow supply central inverters to the utility-scale markets in certain countries and so typically have high MW shipments in contrast to dedicated microinverter supplier Enphase that mainly supplies residential rooftop markets in certain key regions such as the US and Europe.

In the chart below, we have only analysed annual inverter shipments by megawatts for four out of the five companies as Ginlong has not reported MW shipments in its first annual report.

Not surprisingly, Sungrow and SMA Solar have significantly higher shipment figures than SolarEdge and Enphase. Although Sungrow is a key leader in the group on shipments, its annual growth rates have been minimal in recent years and had the weakest growth compared to its rivals in 2019.

Once again, SMA Solar has shown a strong rebound in shipments in 2019, hitting a new record high of 11.4GW, after two years of flat shipments of around 8.5GW in 2017 and 2018.

Shipments for both SolarEdge and Enphase are on parallel growth ramps in 2019.

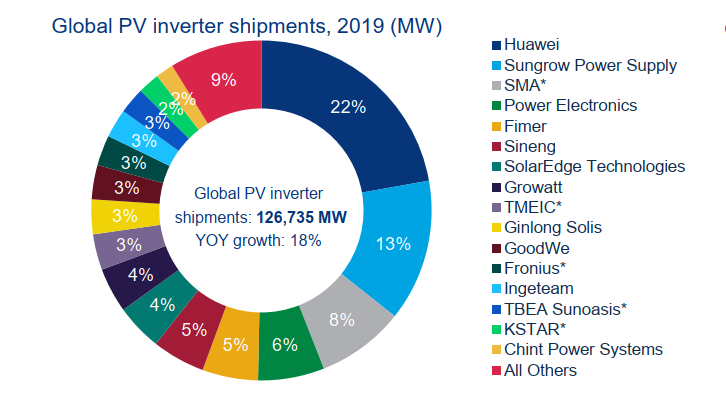

In contrast, market research firm Wood Mackenzie recently published shipment market share data for 2019 of a number of key inverter suppliers, many of which are not publicly listed or companies that are listed but rarely provide actual breakout figures for such as category.

As shown in the chart below, Huawei is still regarded as the company with a leading market share, almost double that of second ranked Sungrow and almost triple SMA Solar’s market share by megawatt shipments.