Diversified renewables firm Shunfeng International Clean Energy (SFCE) has secured the sale of 11 PV power plants in China to reduce mounting debts.

Agreements by China National Nuclear Power Co have been made with SFCE to purchase 11 PV power plants in China for RMB 641 million (US$91.2 million). However, SFCE said that the sales transaction on the PV assets would mean a loss of around RMB 705 million (US$100.2 million).

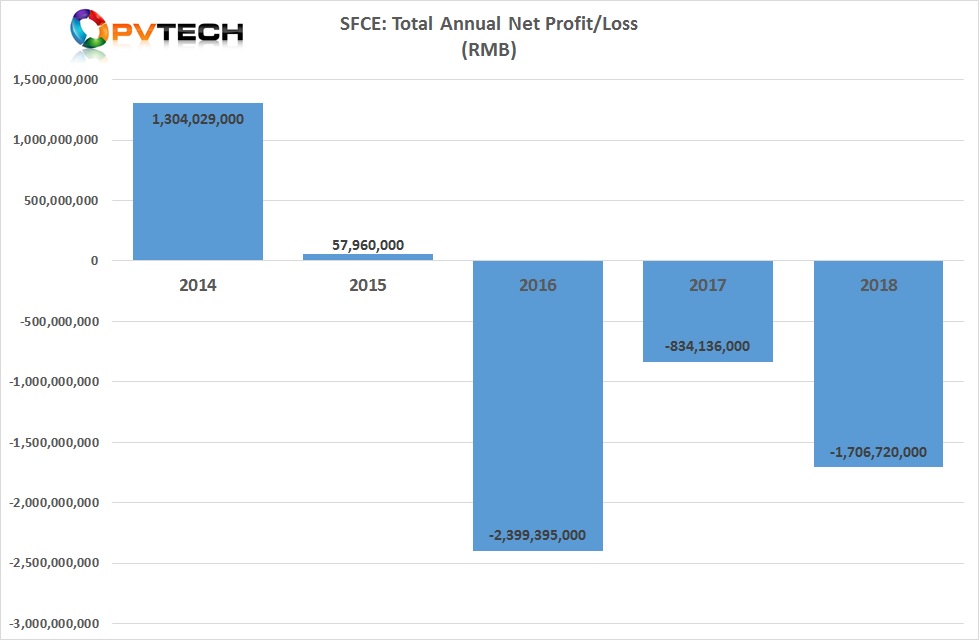

SFCE had a negative net cash position of RMB 13,014.9 million (US$1.85 billion) at the end of the first half of 2019.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The company had bank and other borrowings of RMB 11,468.9 million, convertible bonds of RMB 1,146.3 million, bonds payable of RMB 822.1 million and lease liabilities of RMB 158.7 million.

The company had also stopped building new PV power plants to conserve cash.

A key factor in SFCE’s mounting debt have been long delays in receiving FiT payments for electricity generation from the Chinese State Grid. SFCE has outstanding FiT receivables of approximately RMB 3,069 million (US$436 million) going back almost two years.