Dutch-German solar testing firm Sinovoltaics will expand its operations in the US market as a result of the solar and battery energy storage manufacturing “boom” stimulated by the Inflation Reduction Act (IRA).

The company has a presence across Europe and Asia and offers both manned and AI quality assurance services to the PV and energy storage manufacturing industries.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

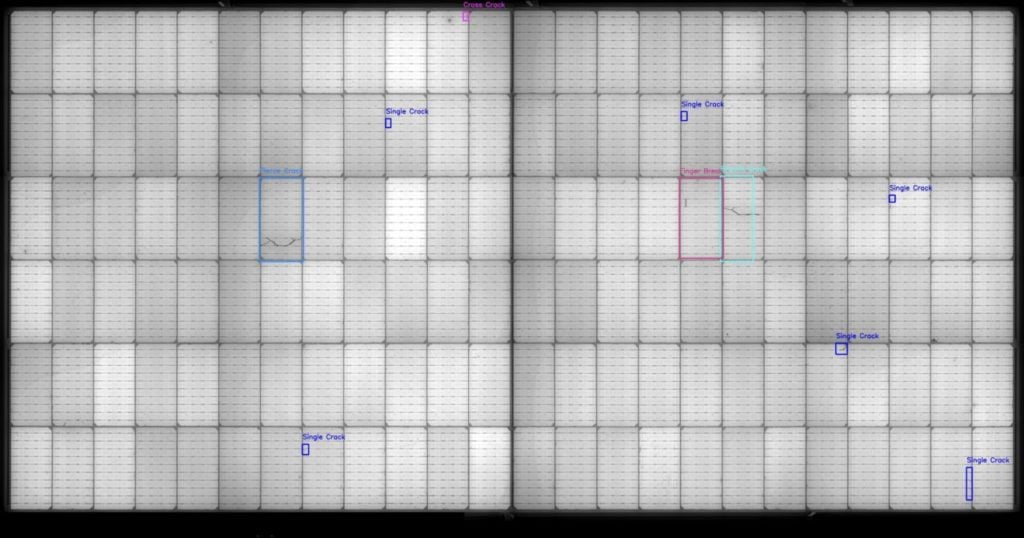

Sinovoltaics said that since 2020 its AI-driven SELMA (Sinovoltaics Electroluminescence Mass Analysis) tool has been used by “all” the Tier-1 solar manufacturers in Asia. The company claims that SELMA tests 100% of the modules that a buyer purchases and can assure “Zero Risk” of microcracks and other cell defects.

The technology is underwritten by a quality guarantee from German insurance company Munich Re, which Sinovoltaics says is an industry first.

Indeed, the majority of testing processes rely on taking a sample from a batch of modules and using EL testing to gauge the proliferation of any defects. This is largely due to the time and price constraints of testing every single module, especially as the price of the products continues to fall.

Sinovoltaics claims that it tested 4 million modules in 2023 and that Tier-1 facilities showed a replacement rate of around 1-3% on average.

“100 percent module inspections is the only way to ensure high performance solar projects,” said Dricus de Rooij, co-founder and CEO of Sinovoltaics. “Our goal is to help solar manufacturers to deliver—and for solar developers to receive—the highest quality solar modules. That’s why Sinovoltaics inspects 100 percent of PV modules and does not rely on sampling methods. Every module is inspected by SELMA and replaced, if necessary, before their clients’ orders leave the factory.”

Falling prices and more capacity

The company said that it will bring its AI-driven electroluminescence testing programme to the US in response to both the market opportunity provided to solar manufacturers by the IRA’s tax incentives and the declining price of Asian-made modules across the globe. The confluence of these situations is “compelling global manufacturers to become more efficient and reduce costs, raising investor concerns about maintaining quality standards”, Sinovoltaics said in a press release.

This is not the first time in recent months that the declining price of silicon modules has raised questions over general production quality. In a blog for this site last November, PV Tech head of research Finlay Colville predicted that the decline in price beyond the current cost of production could lead large manufacturers to attempt cost-saving measures to remain in the black, subsequently raising questions about quality control.

In tandem with this, US renewables firm Clean Energy Associates (CEA) published a report in October which found a “massive increase” in solar module defects and cracks, particularly those produced in the US. This, it said, was due to both the supply chain difficulties that led manufacturers to seek alternative and less reliable suppliers and the groundswell of new PV capacity in the country.

In response to questions from PV Tech, the CEA said of the new capacity boom: “ Our experience from performing quality assurance and production oversight over many GWs of projects has repeatedly shown that new factories take months to ramp up and iron our quality issues, and new manufacturers take even longer to improve.”

The next edition of our downstream journal, PV Tech Power, will feature a deep dive into PV module testing, defects and quality assurance as its cover feature.