The PV industry has recently witnessed the launch of a new wave of high-efficiency, high-power modules incorporating state-of-the-art technology. As China and other countries around the world embrace grid parity, modules with higher conversion efficiency and output are becoming increasingly favoured by the market.

Amid the accelerated push for higher efficiency and mounting cost pressure, major companies are competing with each other to produce larger modules connected by more cells.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Starting from 157.75mm, wafer sizes have gradually increased to 158.75mm, 161mm, 166mm, 182mm and 210mm. Zhonghuan Semiconductor carried it even further by launching a 217mm x 217mm wafer. On the cell side, the quantity has changed from 60 to 72, now followed by 78.

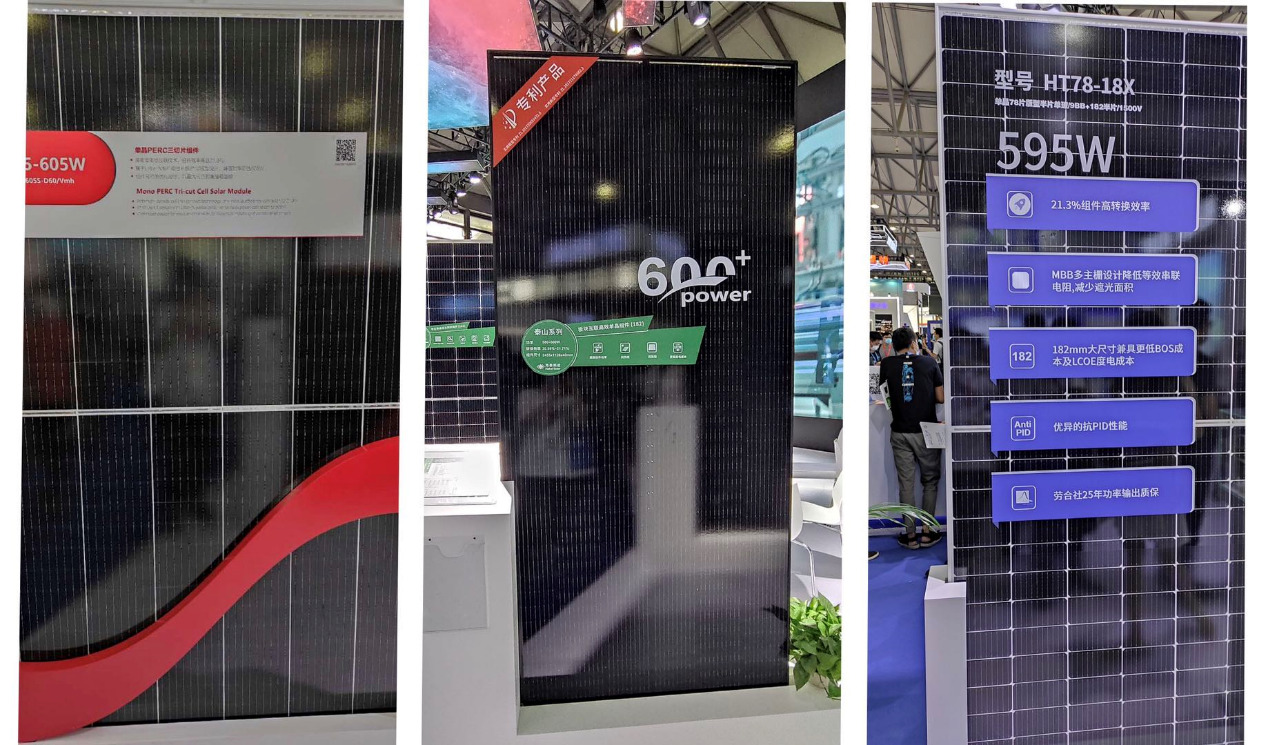

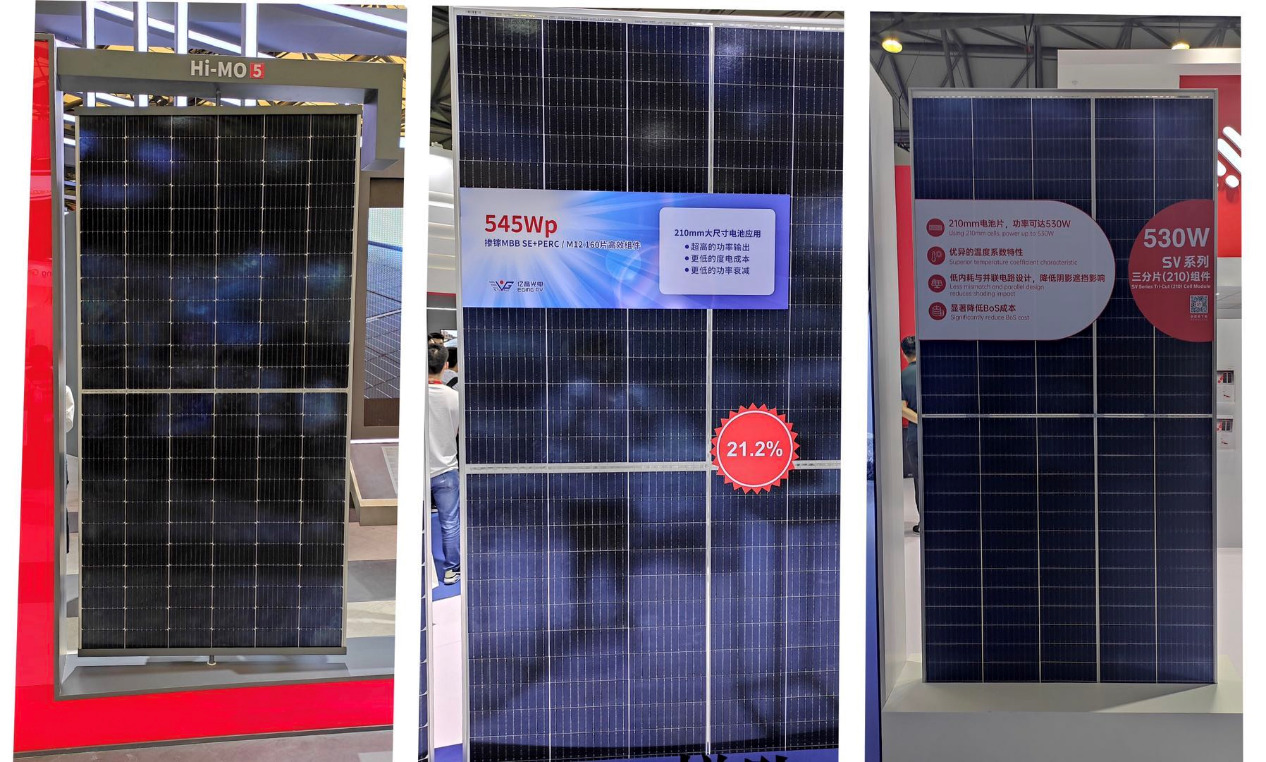

PV Tech visited a number of mainstream module companies at this year's SNEC exhibition in Shanghai to take a closer look at their products, all of which pointed to the fact that the industry has entered the 5.0 era of high-power modules (500W).

500W+ modules have already become mainstays of companies like Jinko Solar, Trina Solar, JA Solar, Risen Energy, LONGi Solar, Canadian Solar and GCL-SI, but 660W and even 800W modules were unveiled at the show.

One of the companies making such a statement was JA Solar, which exhibited its 800W ultra-high power module (810W), the highest power of all at the show. Meanwhile, perhaps more surprisingly, the second-highest power module (780W) came from Tongwei.

Trina Solar exhibited its 660W ultra-high power module just three weeks after the release of its previous 600W module. According to Trina, the 660W module, with optimised product design, was built upon the 600W version. At the same time Jinko Solar showcased its new generation, high-efficiency 610W Tiger Pro. The conversion efficiency of this eye-catching, tiling ribbon mono module can reach 22.3%.

Other manufacturers have also placed technology at the heart of development to jointly drive module power beyond 500W. The recent progress of the supply chain has been marked, given that it was only last year that the industry exceeded 400W and, less than one year later, it has jumped beyond 500W, exceeding 600W in some instances.

Talesun Solar, Jinergy and others also introduced new featured products at SNEC. The following table details all of the products exhibited at SNEC this year.

| Company | Product | Technology | Module Output (W) | Conversion Efficiency (%) | Wafer Size (mm) |

|---|---|---|---|---|---|

| JinkoSolar | Tiger Pro N-type 78-cell bifacial module | Tiling ribbon, MBB | 610 | 22.31 | 182 |

| JA Solar | JumboBlue | 1/3 cut, 11MBB, PERC | 800 | 20.50 | 210 |

| Tongwei | PERC, mono shingled module G12 | Shingled module+G12, Large wafer | 760-780 | 21.90 | 210 |

| Trina Solar | Vertex | MBB, non-destructive cutting, high-density encapsulation | 660 | 21.20 | 210 |

| LONGi Solar | Hi-MO 5 super-high module | Gallium doped wafer+half-cut+9BB | 540 | 21.1 | 182 |

| Canadian Solar | HiKu6 | Mono PERC | 590 | 21.30 | 182 |

| Risen | TITAN 600W+ | PERC, half-cut, 12BB | 615 | 21.2 | 210 |

| GCL-SI | GCL-M12/50GDF | 1/3 cut, non-destructive cutting+ high-density encapsulation | 505 | 20.8 | 210 |

| Suntech | Ultra | PERC, MBB, 1/3 cut | 605 | 21.30 | 210 |

| Yingli Green | Bifacial Panda | 1/3 cut, 9BB | 550 | 21.6 | 210 |

| Seraphim | SII all-black half-cut | Half-cut, MBB, PERC | 530 | 20.30 | 210 |

| LDK Solar | Mono 210, large size | 1/3 cut, PERC+SE, MBB | 500 | 22.40 | 210 |

| Jinergy | Super-high, mono PERC | Half-cut, MBB, HJT | 510 | / | 166 |

| SPIC | 156 cell, half-cut, white backsheet | IBC 6BB half-cut | 505 | 21.6 | 158.75 |

| ZNshine Solar | 150 cell, 10MBB, mono PERC | 10MBB, anti-PID degradation | 520 | 21.79 | 210 |

| DZS Solar | G12-66P bifacial | Shingled module+G12 large wafer | 635 | 22.1 | 210 |

| Jolywood | Niwa® Super615W high-efficiency bifacial | Topcon, 11BB | 615 | 22.10 | 210 |

| EGing | Gallium doped MBB SE+PERC high-efficiency module | Gallium doped MBB, SE+PERC, 1/3 cut | 545 | 21.20 | 210 |

| HT-SAAE | 78 cell, half-cut, mono, single glass module | Half cut, 9BB | 595 | 21.3 | 182 |

| Talesun | BISTAR PRO | Half-cut+10BB | 590 | 21.0 | 182 |

| HT Solar Group | Mount Tai 6.0 | Interconnection, PERC, MBB, high-density encapsulation | 600 | 21.71 | 182 |

| CECEP | 182-cell large size wafer | MBB, half-cut, PERC, non-destructive cutting | 540 | 21 | 182 |

It can be seen that the front-side cell efficiency of modules (over 600W) manufactured by mainstream module players is basically above 22.5%, peaking at 23.6%. Module efficiency is between 21.2% and 22.3%.

Compared to 2019, modules exhibited at SNEC 2020 continue to integrate as many technologies as possible. Almost every 500W+ high-power module includes a combination of several technologies. Taking PERC as an example, products that make use of three or four types of technologies, such as ‘PERC+bifacial+half-cut’ and ‘PERC+bifacial+glass-glass+half-cut’ have become the norm. In addition to PERC modules, the number of N-type high-efficiency modules on display has also increased significantly.

TopCon, IBC and HJT modules have also entered the stage. With wafers going larger, manufacturers have resorted to a combination of technologies including half-cut, multi-busbar, paving, seamless weld, tiling ribbon, bifacial, glass-glass and transparent backsheet to achieve high-power, high-efficiency and reliability.

A new dawn for BIPV?

What is interesting is that many PV module companies such as LONGi Solar, JinkoSolar, Yingli Green and Talesun, launched BIPV products at this year's show. JinkoSolar introduced China's first coloured BIPV curtain wall made up of five colouring schemes, namely black, blue, purple, red and green. The product’s appearance was different to that of a conventional module. By offering products of aesthetic value, JinkoSolar is planning to open up a new green building market with diversified designs.

The first pre-fabricated BIPV product, which just rolled off LONGi Group’s production line on 13 July, also made its debut at SNEC 2020, officially announcing the company’s entry into the integrated BIPV market.

According to LONGi, the “LONGi Roof” is its latest product, targeting the distributed C&I market. Starting R&D back in 2019, LONGi has designed the product to meet the needs of C&I roof systems and, after just over one year, the production line and the project have finally been commissioned. Produced by LONGi Energy, a subsidiary of the LONGi Group, the series is an important part of the company’s complete industry chain.

According to data from China’s National Bureau of Statistics and the Chinese Academy of Building Research, the country’s existing building area at present is about 80 billion square metres; at the same time, nearly 100 million square metres of roof area exposed to sunlight are added to the market every year. BIPV will evolve into a trillion-dollar market once applied on a massive scale.

Facing a market of such vast potential, it is hardly surprising that the industry’s top players should be vying with each other to secure their portion of the pie. A concept conceived as early as ten years ago, BIPV is nothing new, however, and has so far failed to make significant progress. It will be interesting to see if, now driven by the industry’s major players, it will set the scene in the future.