The SNEC 2025 PV&ES Expo, held at the National Exhibition and Convention Centre in Shanghai, China, closes its doors after gathering more than 3,600 companies and PV industry professionals from nearly 100 countries. This year’s event also set a new record with 400,000㎡ of exhibition space.

However, the reality outside the exhibition hall tells a starkly different story—polysilicon prices have plunged to a low of RMB 34,500/ton (US$4,803/ton); more than half of listed PV companies have reported losses for five consecutive quarters, and the entire industry urgently seeks direction at a crossroads between “scale expansion” and “value creation”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As the world’s largest PV exhibition, the expo also serves as the ideal platform to observe how companies adapt amid an industry downturn. While TOPCon modules on display achieve efficiencies exceeding 26%, perovskite tandem cells enter pilot production, and back contact (BC) technology evolves into lightweight dual-protection modules, companies behind the scenes are contemplating how to shift from “price wars” to “long-term survival”.

Jinko Solar Chairman Li Xiande noted that: “For the past 180 days, the industry has been preoccupied with how to ‘survive,’ but this period has taught me that we should focus on ‘revival’, to discover our own pace.”

GCL-SI Chairman Zhu Gongshan added: “The ‘ice age’ will eventually end, and the true survivors will be those with ‘scenario-defining’ and ‘ecosystem-integrating’ capabilities.”

N-type TOPCon diverges, 650W sets the benchmark

Based on PV Tech‘s on-site observations, this year’s module products have fully shifted to n-type modules, with the competition among n-type technologies showing a markedly divergent trend: TOPCon, HJT, and BC each making their own distinct factions. Additionally, n-type modules combined with perovskite technology are “breaking through” in high power and high efficiency. This year, every company’s high-output modules have been driven by this advancement.

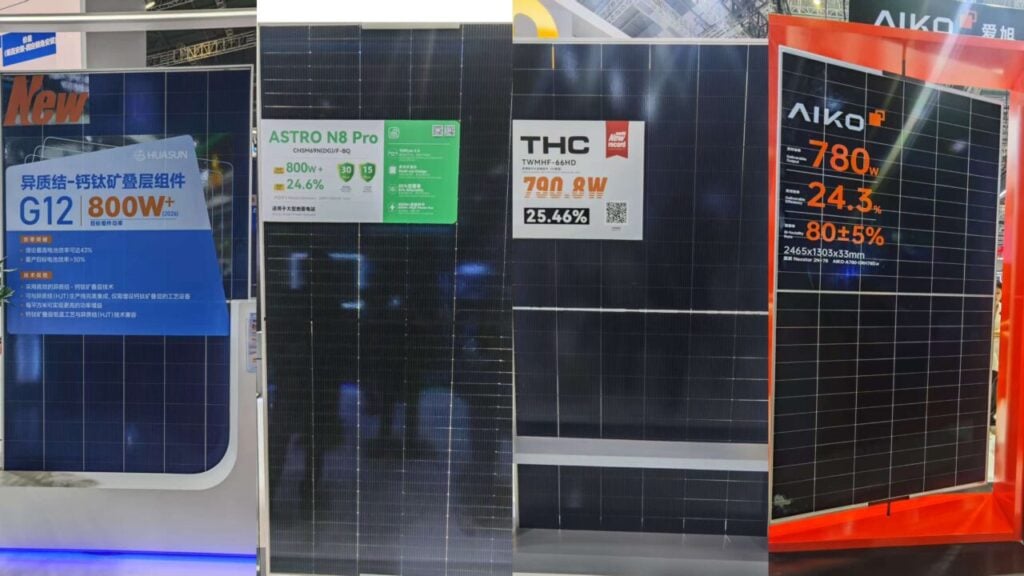

Among them are solar manufacturers’ Huasun Solar’s HJT-perovskite tandem G12 module, which reaches 800W power efficiency; Astronergy’s ASTRO N8 Pro module also surpasses 800W; Tongwei’s THC module follows at 790.8W; and Aiko Solar’s back-contact module hits 780W.

As the leading technology, TOPCon has become the flagship product for most companies. Many exhibitors displayed TOPCon-perovskite tandem modules, further driving module power to new heights.

Qian Jing, Vice President of Jinko Solar, noted that TOPCon modules will soon be segmented, with 650W modules setting the benchmark. Manufacturers capable of mass-producing 650W TOPCon modules will dictate premium prices, competing with BC technologies in distributed generation markets, while sub-650W products will remain mainstream commodities. “The faster a company commercialises these high-value products, the quicker it will return to profitability,” she added.

The BC wave

When it comes to BC technology, the prevailing mindset seems to be ”mass-production can wait – catching the wave is what matters now.” This year’s trade show has witnessed a noticeable surge in flashy BC product debuts, with manufacturers eager to showcase their latest offerings.

Among the sea of BC contenders, Aiko Solar and LONGi stand out as the most compelling players in this space, with their technological advancements generating real buzz.

Aiko Solar unveiled its fully upgraded ABC module portfolio, covering residential, C&I, ground-mounted and floating PV applications. Each product line was optimised for specific scenarios, building on the foundation of its high-efficiency ABC technology. The showstopper was its third-generation “Full-Screen” ABC module.

Aiko displayed 54-cell, 72-cell, and 78-cell products of its Full-Screen modules, demonstrating how the technology adapts to diverse applications and bringing its cutting-edge technology benefits to a wider customer base. The 78-cell module delivers 800W–810W output with a conversion efficiency of up to 25%.

Chen Gang, Chairman of Aiko Solar, stated: “Our two-step innovation combining ABC technology and low-cost mass production has made significant contributions to global PV development. We’ve laid a solid foundation for a healthy ABC ecosystem through patents and high-quality manufacturing. In Q1, we achieved positive operating cash flow and aimed at full-year operational improvement, leading the industry through this cycle.”

This year, LONGi Green has launched its Hi-MO X10 lightweight dual-protection module, designed for low-load commercial and industrial rooftops, with its core based on BC technology. According to reports, this module is 30% lighter than conventional products, addressing the pain point that 20% of existing rooftops remain undeveloped due to insufficient load-bearing capacity.

Is the era of perovskite tandem cells arriving?

Beyond mainstream N-type products, PV Tech also observed some differentiated offerings in the market, such as thin-film flexible modules, BIPV products, balcony PV systems, and PV+ solutions. These products are gradually carving out a niche, though they currently operate in a highly competitive space. It remains difficult to predict which of these will emerge as frontrunners in the future.

Gao Jifan, Chairman of Trina Solar, remarked: “Many companies are still debating whether TOPCon, BC, or HJT are superior; this debate is meaningless.” He believes that with the advent of perovskite tandem cells, the industry will truly enter a new historical phase. This year, Trina Solar plans to establish a perovskite pilot production line, which targets an efficiency improvement of at least 4% over conventional crystalline-silicon (C-Si) modules. Earlier this week, the company unveiled it had achieved a 30.6% perovskite-silicon tandem module efficiency. An efficiency that was certified by the Fraunhofer Institute for Solar Energy Systems (ISE) in Germany on a large-area, 1185 cm² tandem module.

GCL-SI Chairman Zhu Gongshan shares a similar view. He noted that perovskite tandem modules deliver 50% higher theoretical efficiency, 20% lower cost, and over 50% reduced carbon footprint versus conventional modules. Conservatively estimated, when factoring in energy yield, cost savings, and green premiums, 1GW of such modules can generate at least RMB2 billion in additional revenue over their lifecycle.

At GCL Tech’s booth, the company showcased several products, including a 2 m² perovskite single-junction module with a conversion efficiency of 19.04%, and a 1.71 m² perovskite tandem module achieving an efficiency of 26.36%.

Notably, these large-format modules have achieved cost-efficient mass production, with manufacturing costs approximately half that of conventional C-Si modules.

“Perovskite has now entered an era of ‘high efficiency, large size, and stability,'” a representative at GCL Tech’s booth told PV Tech. The company’s subsidiary, Kunshan GCL Optoelectronics, is the world’s only manufacturer to have obtained commercial certification for practical applications. Moreover, GCL Tech has begun construction on the world’s first GW-scale production base for large-format perovskite tandem modules.

Jinko Solar also revealed that its N-type TOPCon-perovskite tandem cell has achieved a record-breaking conversion efficiency of 34.22% and exceeding 2.01V, certified by third-party Voc. Furthermore, the company’s tandem cells have demonstrated remarkable reliability, showing <5% efficiency degradation in multiple tests, establishing new industry-leading benchmarks.