As much as 191GW of new solar PV is expected to be installed this year – up by a third on last year’s deployment figure – despite polysilicon and module prices remaining high into 2022, BloombergNEF has said.

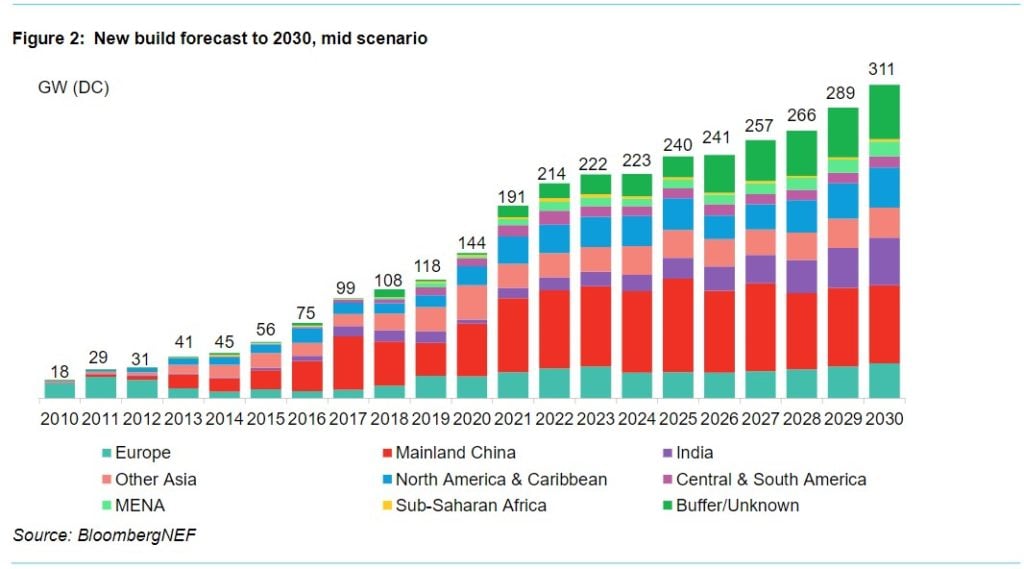

Statistics included within the research group’s Q3 Global PV Market Outlook report provides a central estimate for 2021 deployment of 191GW, up 32.6% on last year’s installation figure of 144GW. BNEF then expects annual solar deployment to increase to 214GW and 222GW in 2022 and 2023 respectively, figures which are broadly in line with the optimistic deployment scenario included within its Q1 update.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Polysilicon supply meanwhile is forecast to increase 29% in 2022 and a further 57% in 2023. Although it anticipated high polysilicon prices for the rest of this year, BNEF maintained its estimated price range of US$15-20/kg for polysilicon in 2022, which it said “should allow module prices to fall again to about US$0.20/W by the end of 2022”.

New builds forecast upgraded

The increase in its deployment forecast from Q2 is largely down to some countries surpassing short term expectations, with China in particular installing more solar than anticipated. Mainland China is expected to be by far the biggest installer of solar in 2021, with the US a distant second.

Some European countries are also deploying more solar than expected, outperforming both analyst expectations and national solar targets. Poland, for example, has a target of 7.3GW of solar PV by 2030 but had already installed a total of 5.2GW by the end of June this year, with an expected increase of 2GW/3GW per year. BNEF estimated it will have 27.7GW of solar by 2030, far higher than its own national targets expect.

Meanwhile, “there is also a substantial buffer for markets lacking in visibility (such as many African countries) and for countries that are likely to exceed their current targets, perhaps significantly,” the report said.

BNEF expects the solar industry to continue to grow, but stressed such growth will be constrained in the long term by factors such as land, grid connection and penetration into the electricity mix. And its worldwide forecasts for 2030 based on targets and estimates, a first for the report, said the level of solar deployment anticipated by 2030 (311GW/year) is “far below what is needed to be on track for global net zero by 2050”.

Polysilicon and module prices

While BNEF predicts polysilicon prices to remain high for the rest of 2021, it expects them to fall in 2022, resulting in a US$0.02-0.04/W cost reduction for integrated module makers. Polysilicon manufacturers have enjoyed strong profits in the first half of the year because of high market prices, with some delaying planned maintenance and increasing production in order to exploit higher average selling prices (ASPs). Furthermore, several new entrants have announced new production capacity expansions totalling 500,000 metric tons this year, attracted to the market by the high profits. But, considering the lead in time for polysilicon production, this supply is unlikely to contribute to the market in the next two years.

As a result, BNEF maintained its estimated module price at US$0.24/W for the rest of 2021, although some manufacturers, such as JinkoSolar, have said they expect prices to be at US$0.28-0.29/W for the remainder of the year.

“We have observed orders from Tier-1 players of about 1.80RMB/W (US$0.28/W). The range is somewhere between RMB1.82 to RMB1.86, so that should be our flagship price for the rest of 2021,” said Jinko CMO Gener Miao in a call with analysts following yesterday’s Q2 2021 results disclosure.

Speaking to PV Tech last quarter, analysts PV InfoLink expected polysilicon prices to be flat at around US$26.5/kg moving into the new year, underscoring a range of possibilities when it comes to the price of modules in 2021.

The expected increases in polysilicon supply are enough to support crystalline silicon module production of 270GW in 2022 and 430GW in 2023, assuming an average consumption of 2.8g/W, according to BNEF. This is far below expected demand – 181GW for 2022 – suggesting that polysilicon ASPs could come down significantly in the coming years.

Importantly for the US solar market, new factories under construction by existing polysilicon makers in China are being located outside of Xinjiang and could be potentially insulated from US import bans.

The cover story of PV Tech Power vol. 27 explored Europe’s growing solar market, the full story of which can be read here, while PV Tech Power vol. 28 examined the causes behind the increase in module prices and what it has meant for the industry.

PV Tech publisher Solar Media travels to Poland in November to host the maiden Large Scale Solar Central & Eastern Europe (LSS CEE) conference. Held in Warsaw, the event will bring together investors, developers and EPCs from the European solar community. More details on the event, including how to attend, can be found here.