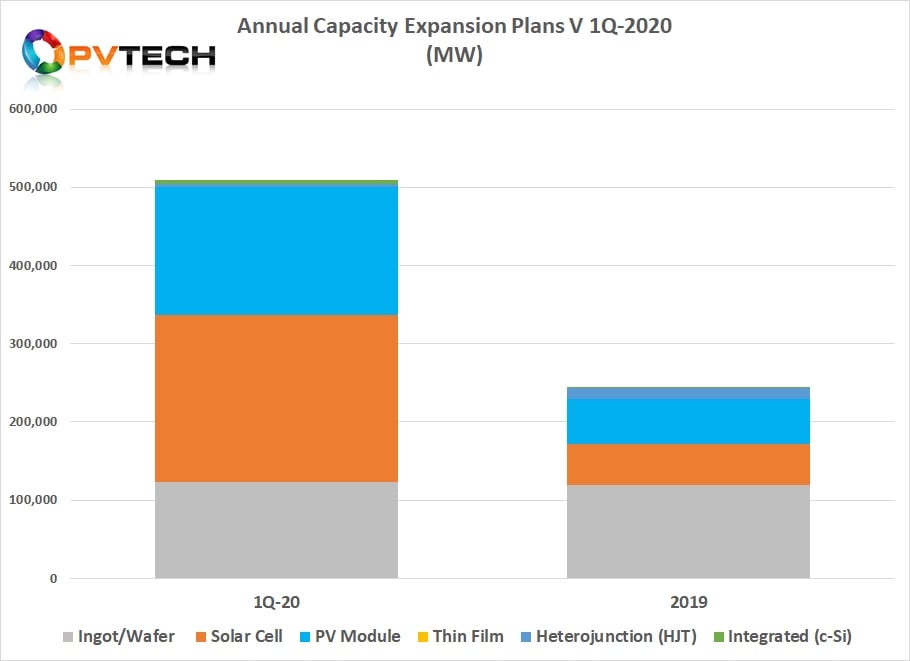

The solar industry announced unprecedented levels of capacity expansion plans in the first quarter of the year – some 500GW – easily surpassing any total annual plans in the history of the industry, preliminary data compiled by PV Tech shows.

PV Tech’s preliminary analysis of upstream manufacturing capacity expansion announcements in the first quarter of 2020, across ingot/wafer, solar cell and module assembly segments combined, exceeded a staggering 500GW.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

To put this in perspective, PV Tech’s preliminary analysis of capacity expansion plans announced in 2019 reached a combined total of over 228GW, less than half the combined figures announced in Q1 2020.

The vast majority of announcements in Q1 2020 were driven by China-based PV manufacturers. In 2019, China accounted for around 94% of capacity expansion announcements, according to PV Tech’s analysis.

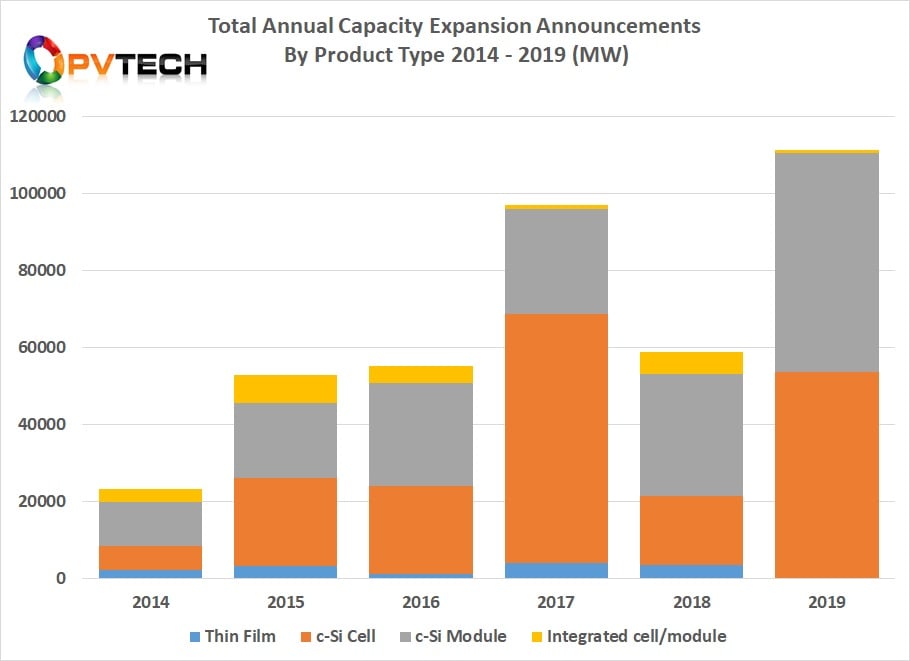

It should also be noted that the combined total of over 228GW announced in 2019 was a new annual record for the PV industry surpassing the previous record set in 2017.

Ingot/wafer expansions

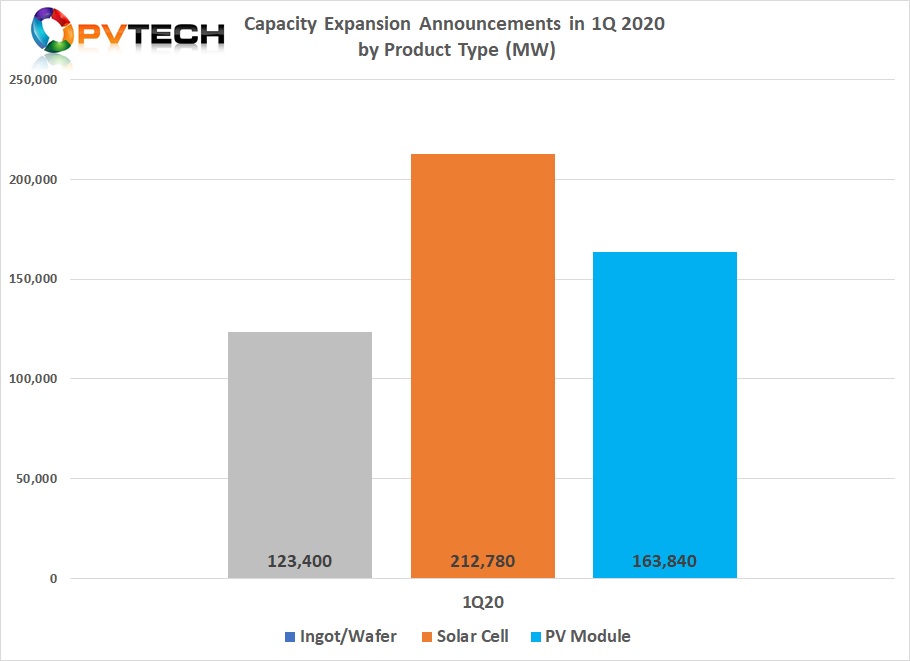

Capacity expansion announcements in Q1 2020 related to the combined ingot and wafer segment exceeded 123GW compared to approximately 118GW of expansion plans announced in all of 2019, according to preliminary PV Tech data.

Solar cell expansions

Solar cell (c-Si) capacity expansion announcements in Q1 topped 212GW. This is compared with PV Tech’s preliminary full-year 2019 figures of total planned expansions exceeding 53GW.

PV module assembly expansions

With regards to total module assembly capacity expansion announcements in just Q1 2020, preliminary figures have almost reached 164GW. In comparison, total module assembly capacity expansion plans in 2019, almost reached 57GW.

January 2020

The most active month in the first quarter of 2020 for capacity expansion announcements was January, leading up to Chinese New Year celebrations.

A preliminary total of 22 companies announced expansion plans in the month, which was dominated by over 102GW of solar cell expansion announcements. This was in turn followed by module assembly plans totalling almost 85GW. Preliminary ingot/wafer expansions exceeded 52GW in January.

Key announcements kicked off in early January when JA Solar announced plans to expand mono solar cell and module assembly capacity by 10GW, each.

Major merchant cell producer, Aiko Solar announced expected capacity ramps over a three-year period totalling 12.8GW in 2020 alone and totalling almost 36GW through 2022.

February 2020

Not surprisingly, the extended Chinese New Year, travel restrictions and escalating impact of COVID-19 led to only eight companies announcing further capacity expansion plans in February.

The month was again dominated by solar cell expansion plans that totalled almost 40GW, with only 9GW of module assembly expansion plans and zero plans to add ingot/wafer capacity, according to PV Tech’s preliminary analysis.

Highlights included further expansions plans announced by major merchant solar cell producer, Tongwei Group, which was a new 30GW manufacturing hub.

JA Solar’s second wave of plans totalling 8.6GW is also of note, including cell technology upgrades that would boost nameplate capacity in 2020.

March 2020

Despite COVID-19 challenges escalating through early to mid-March, well over 70GW of new ingot/wafer capacity expansion plans were announced in China, followed by just over 70GW of solar cell and 70GW on module assembly plans.

But despite the very strong figures, only five companies contributed to the preliminary total in March, which was dominated by GCL System Integration Technology (GCL-SI) and LONGi Group.

In late March, GCL-SI announced a new 60GW megacomplex to house the complete manufacturing supply chain to feed 60GW of annual PV module production in a multi-phased, multi-year plan.

LONGi also announced another wave of future expansions that included a 10GW mono-ingot project, 7.5GW mono solar cell project, a 5GW module assembly project and an advanced integrated cell and module project totalling 680MW.

Key trends

A trend noticeable in in the last three years has been the scale of company announcements, notably in China. Typically, the 500MW expansion or new plant announcements have given way (in 2018 and 2019) to nameplate capacity plans of 5,000MW and above. Indeed, 10,000MW expansion plans have been noted in PV Tech’s 2019, preliminary analysis.

However, many plans announced that are in the 5,000MW to 10,000MW range tend to include multiple phases that can span several years. This was also notable with a significant number of plans announced in Q! 2020, which would span at least three years or more.

Typically, solar cell and module assembly plans in up to the 2,000MW range are starting to ramp production within 12 months or earlier. The multi-phase, multi-year projects initial ramps are typically at the same scale and timeframe, although indications from some companies has been the ability to complete 10GW expansions in 12 months but utilisation rates are not necessarily high.

With manufacturing equipment costs significantly lower than five years ago, having module assembly plants with lower utilisation rates has little impact on production costs when companies are already at significant scale. This also applies to solar cell production plants but to a lesser degree.

The large-scale announcements are being fuelled by near-term end-market growth projections, coupled to a major technological race to higher conversion efficiencies and lower production costs that will also displace more than 100GW of legacy manufacturing from multicrystalline ingot/wafer capacity to p-type and n-type monocrystalline with large-area wafers, through to next-generation cell technology post the mainstream PERC (Passivated Emitter Rear Cell) area to technologies such as heterojunction technology (HJT).

A more detailed breakout and in-depth analysis of these record capacity expansion announcements in Q1 2020, coupled to an analysis of the potential overcapacity implications across the upstream manufacturing sector, is to follow shortly on PV Tech.

Technical notes

Preliminary data

The capacity expansion plans data for 2019 and 1Q 2020 remains ‘preliminary’ due to a number of public listed companies are still due to report full-year 2019 financial results through to the end of April 2020. Often companies will have added capacity in a financial year that was outside specific announcements or expansions only feature or can be analyzed in annual reports. Therefore there is a level of backdating required as well as time taken in obtaining confirmations of expansion plans when very little or no data existed.

Effective capacity

Historically, capacity expansion announcements are no guarantee that such plans go ahead. Should plans be executed the capacity becomes ‘effective capacity’. This can typically take between 12 to 18 months from plans being announced and converted to effective capacity. Since 2014, PV Tech’s analysis has shown that the conversion rate of plans/announcements becoming effective capacity can be a little as 50%.

Many factors are at play, including low conversion rates for start-ups or new industry entrants to next-gen technology adopters. Certain countries and regions have also proved to have a history of perennially low conversion rates, some as high as 90%. The inability to raise necessary funds, changes in market dynamics and lack of inward investment incentives are also factors contributing to low conversion rates, after expansion announcements are often made.