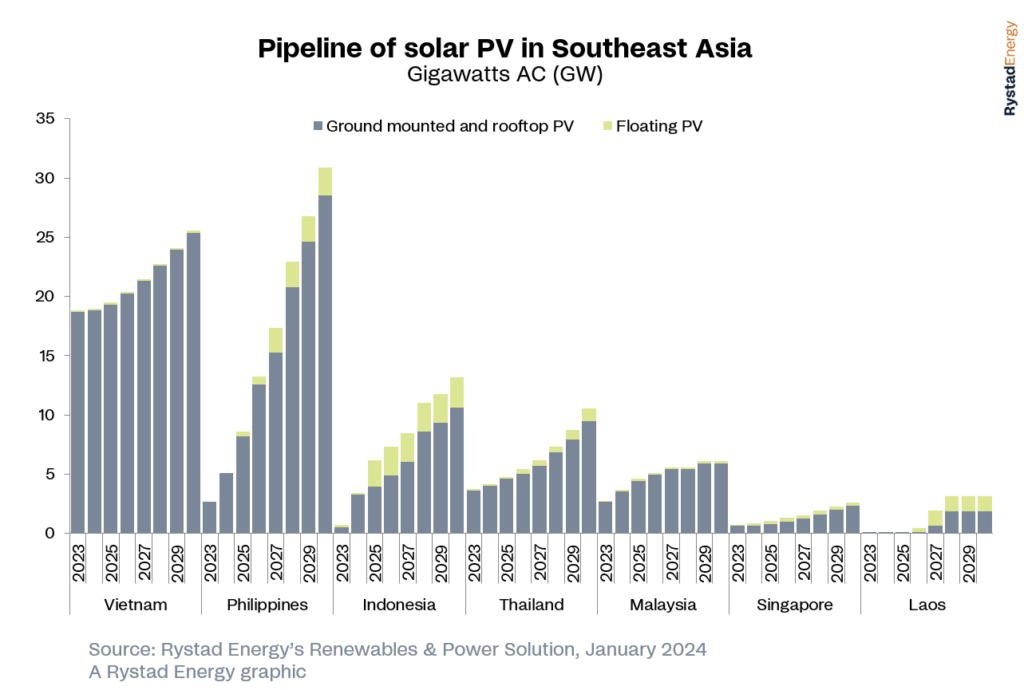

Southeast Asia is expected to add 300MW of floating solar PV (FPV) capacity in early 2024, according to a report from research firm Rystad Energy.

Indonesia, the Philippines and Thailand are expected to lead the region in the coming years in the FPV market, which currently has nearly 500MW of installed capacity in Southeast Asia.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Southeast Asia’s potential in FPV capacity is expected to increase in the long run and play a key role in the expansion of solar PV, with the region at the forefront of global deployment by 2031, along with China and India.

Due to land scarcity, which is predominantly used for agricultural purposes, solar developers face the challenge of securing land for their projects. In Thailand, companies are signing power purchase agreements for FPVs in a similar move to rooftop solar leasing, with businesses or individuals leasing their rooftop space to solar companies.

Home to many large inland lakes, the Philippines has many suitable FPV capacity to be developed, including the Laguna Lake, which has plans for 3GW of capacity, of which Philippines-based developer ACEN – expected to become the largest FPV developer in the region – is working on a 1GW FPV plant in Laguna Lake.

Two other solar developers – Filipino solar company SunAsia and Singapore-headquartered Blueleaf Energy – are working on a 1GW-scale FPV project in Laguna Lake, along with other projects across the Philippines.

Indonesia’s use of hydropower also makes it a good candidate to add FPV capacity to its reservoirs, as is the case with the 2.2GWp FPV project located on the Duriangkang reservoir in Batam, from Singapore-based developer Sunseap.

Jun Yee Chew, head of Asia renewables and power research at Rystad Energy, said: “Their [FPVs] modular design allows for integration with existing hydropower dams and unlocks tremendous opportunities for hydropower-rich nations like Laos, Thailand and Indonesia. Additionally, with land rights a major deterrent facing solar developers in Southeast Asia, as much of the land is used for agriculture, FPVs provide a solution for the coexistence of solar farms and agriculture.”

China is currently dominating the FPV landscape globally with nine of the ten largest projects in operation located there. The remaining one is the Cirata FPV project in West Java, Indonesia, which was commissioned in November 2023 with an operational capacity of 145MW. Prior to the project reaching commercial operation, UAE-state-owned renewables developer Masdar and state-owned Indonesia electricity company PLN Nusantara Power signed an agreement to treble the project’s capacity to up to 500MW.

Back in November, PV Tech Premium looked at the potential of building FPV capacity across Southeast Asia with a look at Indonesia, the Philippines and Thailand, with each country boasting a potential for FPV capacity in excess of 28GW each.

With the ever-increasing potential of FPV, both inland and offshore, Chinese solar manufacturer JinkoSolar has been working on a module specifically for this market and has already secured 1GW of module supply for offshore projects.