Tesla’s residential solar growth has continued into Q1 2021, but CEO Elon Musk has confessed to encountering major issues in roof assessments, which have stymied installs of its Solar Roof product.

Late yesterday Tesla reported its Q1 2021 results, confirming that during the three months ending 31 March 2021 the company had installed 92MW of solar, its strongest quarter in two-and-a-half years. That figure is a 162% increase on the 35MW it installed in Q1 2020 and a near 7% increase sequentially.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

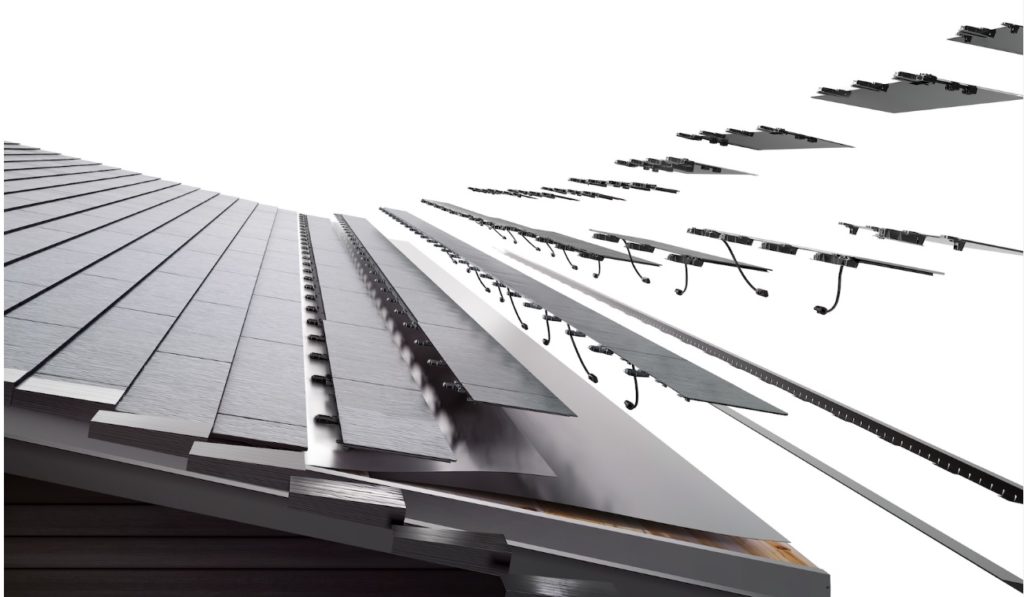

The company noted that demand for its Solar Roof product, launched to much fanfare in late 2016, was up nine-fold year-on-year, demand which Musk described as strong and “significantly in excess” of the company’s ability to meet. The product has been a long time in the making, having encountered numerous delays in ramping.

But Musk also stressed that the company had identified that it had made some “significant mistakes” in the assessments of installation difficulty in certain roofs, adding that the “complexity of roofs varies dramatically”.

“Some roofs are literally two times or three times easier than other roofs. So, you just can’t have a one size fits all situation.

“If a roof has a lot of protuberances or if the… core structure of the roof is rotted out or is not strong enough to hold the Solar Roof, then the cost can be double, sometimes three times what our initial quotes were,” Musk told analysts.

There had been numerous reports linking Tesla with a significant increase in price hikes for its Solar Roof product, some quotes – as Musk noted in the call – had been double or treble the initial quote. This had prompted concern by consumers, however Musk did qualify yesterday that customers can choose to have their deposit refunded in this situation.

Further reports had suggested Tesla was beginning to compensate customers who had experienced major increases in quoted prices for Solar Roof installs with free Powerwall batteries, aligning with the company’s new initiative to only sell solar alongside its Powerwall as a single, integrated product. Musk tweeted about this change in policy last week, however little insight was provided at the time.

Tesla disclosed yesterday that the reasoning behind this move was partly owing to a significant, multi-quarter backlog of Powerwall orders, with demand continuing to far outstrip production rates. Musk further attributed this to “insane difficulties” in its supply chain.

But the move also plays into a wider shift from the company to plug into wider energy transition trends around turning home solar-storage installations, both individual and aggregated, into miniature power stations in their own right. More on this strategy will be discussed later this week on PV Tech Premium.

Tesla also noted during its results disclosure that the move to only sell solar and energy storage as an integrated product could yet prove to be temporary, depending on product availability moving forward.

Meanwhile, Tesla noted that energy storage installations stood at 445MWh in Q1 2021, up around 70% on the 260MWh installed in Q1 2020, but down around 70% on the 1.5GWh installed in Q4 2020.

This performance, alongside solar installs, contributed towards revenues from its energy segment of US$494 million for the quarter, an increase of 68% on the division’s revenue performance in Q1 2020. Cost of revenues attributed to the segment stood at US$595 million, leading to the division reporting a negative gross margin (around -$101 million) for the second quarter running.

Zachary Kirkhorn, chief financial officer – or ‘Master of Coin’ as Tesla has recently designated that role – said the negative margin was attributable to continued high ramp costs associated with the Solar Roof product as well as winter seasonality affecting the lease BPA business.