Tongwei has become the latest upstream solar manufacturer to increase prices as the cost of raw materials continues to spiral.

Late last week Tongwei increased the prices for its entire cell range, while also capitalising on high polysilicon prices by securing a major supply deals with Shuangliang Silicon Material and Meike Silicon Material worth an estimated US$18 billion.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

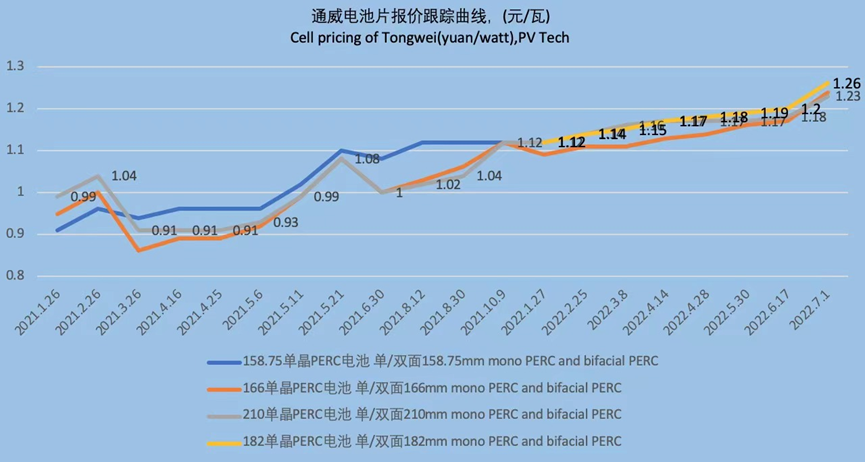

Tongwei’s cell prices have jumped by between 5 – 7 RMB cents per watt, or around 6%, indicating the scale of stress within the PV industry’s supply chain at present.

A full list of prices as of 1 July 2022, and the corresponding price from 17 June 2022, can be seen in the table below, while the following chart illustrates how prices have hit a new high.

| Publishing date | Product | Type | Unit Price (Yuan/W) | Unit price (US$/W) |

| 07-01-2022 | Mono PERC cell | 166 (160μm) | ¥1.24 | $0.185 |

| 07-01-2022 | Mono PERC cell | 182 (155μm) | ¥1.26 | $0.188 |

| 07-01-2022 | Mono PERC cell | 210 (155μm) | ¥1.23 | $0.183 |

| 06-17-2022 | Mono PERC cell | 166 (160μm) | ¥1.17 | $0174 |

| 06-17-2022 | Mono PERC cell | 182 (160μm) | ¥1.20 | $0.179 |

| 06-17-2022 | Mono PERC cell | 210 (160μm) | ¥1.18 | $0.176 |

Aiko Solar and other solar cell manufacturers are also understood to have increased prices, Aiko’s 182mm cell climbing to RMB1.27/W (US$0.18/W), for example.

It can also be noted that Tongwei has reduced the thickness of its 182mm and 210mm cells from 160μm to 155μm, embracing the trend established by wafer providers Zhonghuan Semiconductor and LONGi for reduced wafer and cell thickness as polysilicon becomes more expensive.

Last week PV Tech reported how a fresh wave of increases to polysilicon prices had ricocheted down the value chain, sending wafer, cell and module prices upwards.

Tongwei also confirmed that it had signed two new long-term polysilicon orders with an estimated combined value of RMB120.4 billion (US$18 billion).

It has signed the deals with Shuangliang Silicon Material, which is to procure some 222,500 metric tons (MT) of polysilicon over the next four years, while Meike Silicon Energy will purchase just over 256,000MT of polysilicon between 2022 and 2027.