Following on from recent blogs exploring PV module pricing and the future of industry supply chains, Finlay Colville, head of market research at PV Tech, explores why – and how – Tongwei Solar could become the industry’s first vertically-integrated, leading global module supplier by the middle of this decade.

This article discusses what the PV industry could look like in 2025 and how it could be marked by the emergence of the next major global module supplier powerhouse within the sector, Tongwei Solar.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

I present a narrative outlining how this could happen, and why it has the basis to change the face of the solar PV industry as it moves towards a terawatt market by the end of the decade.

The topics follow on directly from the recent article earlier this week on PV Tech: The Xinjiang issue, supply chain transparency and answering the question of who makes what in the PV industry today. Here, I addressed the lack of truly vertically-integrated manufacturers in the sector today; companies that make everything in-house from polysilicon through to modules. And how there are just a few global module suppliers that have control over cell and module production, far less ingots/wafers and cells/modules.

At the end of that article, I hinted that there was only one company in the industry today that could step forward and fill that void, becoming the first leading global module supplier, making its own polysilicon, ingots, wafers, cells and modules. The discussion below reveals why Tongwei Solar could be this very company.

Recognising that 2022 is likely to be a watershed moment in the PV industry, the articles so far this year have been addressing many of the factors underpinning this. The topics have covered why the industry is now in a production-led paradigm, how global module supply is concentrated across about 50 module suppliers of significance, how n-type technology adoption is likely to proceed within the industry over the next few years, and why module pricing is expected to remain at current levels for the next 18-24 months.

Disclaimer and caveats – this article is forecasting the PV industry in 2025!

For most people involved in the PV industry, forecasting business models 3 – 6 months out is usually a tough ask: such are the rapid changes impacting the sector alongside a constant dose of uncertainty going forward.

Normally by about March each year, counting is still going on in earnest about what actually happened last year! Few are brave enough to give guidance or forecasting at this point for the rest of the calendar year.

So, a forecast about what will be happening in 2025 has to be treated with a great deal of caution. Perhaps the best thing to do is to concentrate on the key issues related to the themes within the article that identify the leading indicators that could bring about changes over the next few years.

Number one by global module shipments remains the key goal to aspire to

Over the past 20 years, companies have strived to have the largest module shipment volumes annually, and see their names at the top rankings tables at the end of the year. This is not a surprise, and this lust for pole position will never diminish.

Before 2010, the leading module suppliers (albeit within a sector that was in its infancy) were typically Japanese companies, most notably Sharp and Kyocera. It seems a long time ago now. Japanese activity in PV manufacturing is all but gone, steamrolled out of existence by Chinese competition. Only the brand names exist today, relabelling product made in China or Southeast Asia.

There was also a phase where South Korean PV investments – predominantly by multi-sector household names such as LG, Samsung, Hyundai and Hanwha – suggested a desire to take on the mantle that had been established by the aforementioned Japanese entities (including also Sanyo, Panasonic and Mitsubishi to name just three). However, being ranked outside the top 10 and often outside the top 20 as a global module supplier was never in the DNA of these companies, putting aside actually making any PV-related business unit profits.

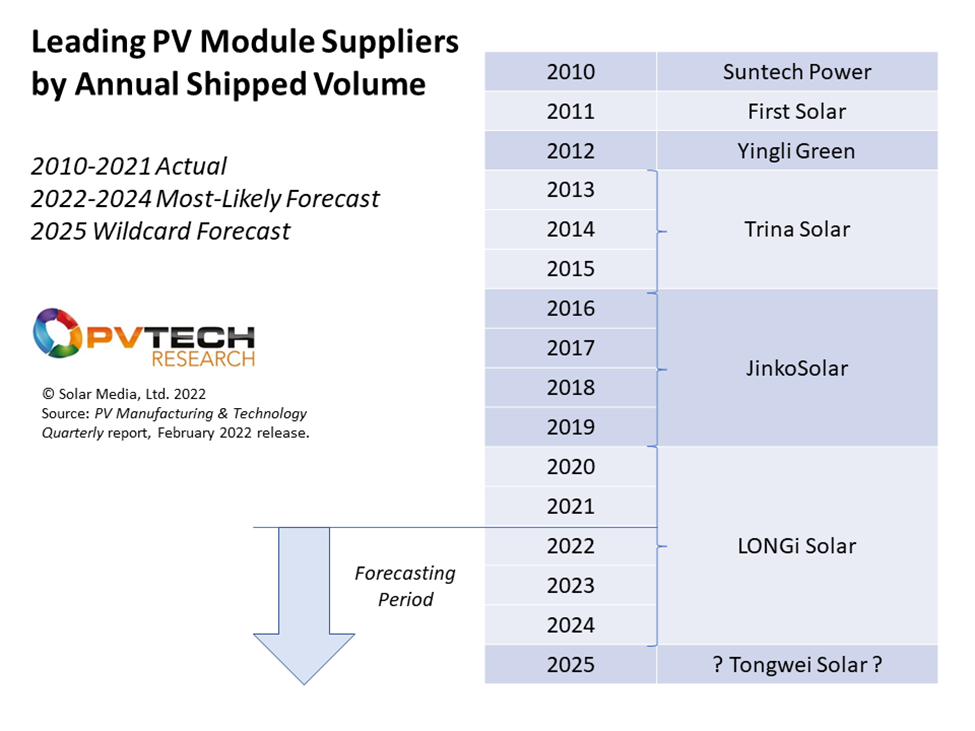

So, the reality has been two decades of Chinese companies leading the global module supplier rankings, except for a cameo appearance by First Solar back in 2011. This domination of the Chinese PV industry is shown in the figure below that lists the leading global module supplier by shipped volumes from 2010 onwards, in addition to the forecasting part out to 2025 that I will discuss later.

After a couple of failed attempts (Yingli and Suntech ran into cashflow and debt problems shortly after becoming market leaders), from 2013 it has been a more predicable landscape. Over the past nine years, the accolade of leading module supplier by volume has passed from Trina Solar to JinkoSolar and now to LONGi Solar from 2020 onwards.

While there are fundamental differences between each of these three Chinese-run operations, it has at times seemed somewhat like an orderly passing of the baton from one to another. Each company is Chinese-run, plays with varying intensity in the ingot/wafer and cell/module space and has nominal cell/module capacity levels located in Southeast Asia to address shipment targets to the US market.

Probably the one key difference, within the context of this article, between the global strategies enacted by Trina, Jinko and LONGi over the past decade relates to how Jinko established a strong non-Chinese operation so effectively between 2014 and 2018. It takes a great deal of work and success to be regarded as a regional operation around the world, especially if the heart of the company is based in China. It’s an old adage: people buy from people.

Now for the forward-looking part. This year, and most likely in 2023 and 2024, LONGi Solar will be the leading global module supplier by shipped volume. Maybe there is some kind of serial progression going on here: three years for Trina, four for Jinko and now five years on top for LONGi. Stranger things have happened.

The following discussion explains why 2025 could be the next year of change in global rankings, why Tongwei could become the new name in this regard, what would have to happen in order for this to occur and where the risks are.

Tongwei’s value-chain proposition as a fully-integrated market-leader

Before considering anything else, Tongwei needs to want to be the global module supplier leader in 2025! If that desire is not there, then forget everything else. Let’s park this rather important prerequisite however, and assume Tongwei is driven by this ultimate prize.

The background to forecasting Tongwei’s next move has form and there are several key steps the company has taken towards module leadership over the past decade.

This year, Tongwei will be the largest producer of polysilicon for the solar industry (with all existing and future capacity outside of the Xinjiang region) and the largest producer of solar cells. The company is now a circa. US$10 billion turnover entity, with sales tripling in the past few years. Operating margins typically trend in the high single-digits (higher in 2021 and 2022) and the company’s net capital ratio (a good long-term debt metric) trends typically at about 2.

By the end of this year, Tongwei will be in the top 10 for wafer capacity and the top 15 for module capacity, with further growth (upside) almost inevitable going into 2023. In PV Tech’s latest PV ModuleTech Bankability analysis, Tongwei is currently B-Rated, putting the company in the top 15 most bankable PV module suppliers today.

Back in 2019, Tongwei barely crept into the top 40 in terms of module production. This year, the company is pushing for top 10 status.

So, the signs are clearly there. Leading indicators are in abundance.

What needs to happen next?

What to do next? That is probably the phrase that gets banded around most often when key stakeholders driving Tongwei Solar review long-term planning and strategy.

While often PV manufacturers claim to be happy in their current value-chain ‘space’ (leading polysilicon supplier, pure-play merchant cell maker, etc.), history tells us that the lure of global domination from a module supply standpoint is simply irresistible.

Selling PV modules to end-markets globally is solar’s endgame. For all the accolades that can be thrust upon upstream producers year after year, nothing trumps the prize of global module leadership. And global means exactly that; having brand recognition the world over, backed up with highly efficient and effective local sales, marketing and support teams.

So, let’s look now at what needs to happen for Tongwei to be the leading module supplier globally by shipped volume in 2025. I list these in bullet format now:

- Shift the company’s modus operandi from a supplier-to-others to in-house prioritised, focused on production specifically for own-brand modules.

- Add 50GW-plus of new wafer and module capacity. The numbers sound big, but capex here is low and China has all the equipment suppliers in place.

- Set up autonomous overseas business unit subsidiaries to focus on sales, marketing and customer support (North America, South America, Europe, Middle East, India, Southeast Asia, Australia).

- Set up vertically-integrated ingot-to-module fabs (each 10GW) in Europe, the US and India, complementing circa. 30-40GW levels in mainland China.

The first two action items above are easy ones to do. In isolation, they can be done and still the company stays a China-centric operation. It is the final two points that really matter, especially the last bullet point that would make Tongwei’s play in the sector proactive and would set the company up as a true agent-of-change.

Interestingly enough, when looking at where to locate overseas capacity, I have passed over the current trend of putting cell and module capacity in Southeast Asia, purely to allow access to the US market. This is nothing more than a passing fad. Long-term, the US is not going to be supplied indefinitely by Chinese companies making cells and modules in countries such as Vietnam, Malaysia or Thailand.

The only guaranteed solution to being a top 3 module supplier to the US market (and also in Europe and India) is to go the whole hog, and set up 10GW-level ingot/wafer and cell/module production sites. Every other route is half-hearted and simply playing by rules in place today, not long-term. Anyone can be another me-too offering by setting up a module facility overseas in the PV industry today.

Of course, you might ask why any other leading Chinese module supplier could not do this? The difference here is that Tongwei was the leading polysilicon and cell producer last year, will be in 2022 and most likely will hold this position come 2025. The difference is that only Tongwei could become the first true global fully-integrated (poly-to-module) player in the industry in the near future.

Perhaps the PV industry will inevitably require companies of this stature, dominating proceedings between 2025 and 2030 as growth moves to the terawatt level. But to be in this position then, planning would have to be done now and over the next 2 – 3 years. Waiting simply until 2025 and then putting a strategy together will likely be too late and more reactive than proactive.

Where are the risks?

How long is a piece of string? Just where does one start in identifying the risks in forecasting the next global module leader several years out. And more so, choosing a company that is largely unknown outside China today (at least if you are a module buyer).

I could cite countless risks for all of the calls to action identified above. But the underlying risk is probably one of ambition and how much Tongwei wants to change from a supply-chain China-focused specialist to a global module brand with overseas operations (across manufacturing and sales/marketing). It would be easy to make a few tweaks to compete with existing Chinese module players such as LONGi, Jinko, Trina and JA Solar. To leapfrog them completely with a fundamentally different strategy is a completely different kettle of fish, with challenges and risks at every point.

How will we know if anything is going to change?

Certainly, if nothing has changed in terms of Tongwei’s investments over the next 12-18 months, then the 2025 forecast is not going to happen.

The first thing to watch out for, probably this year, is what moves the company makes to create a module brand offering outside China. This is needed before anything else is done. How this is done will also be important. Will it be done as a Chinese company effectively selling to the outside world from China? Or will it look like a global company selling regionally by local teams?

With most global exhibitions back to live events in 2022, this is one obvious means to assess the long-term goals for module supply. Low or minor key presence would be an indicator that nothing much is going to change in 2022 or indeed 2023. Going ‘big’ at the Intersolars and SPIs of this world will convey a different message.

So, it is not so much as setting a memo for 31 December 2025, and seeing if anything has changed. Rather, we will know within 18 months.

However, what may be more interesting is to see which of the themes are adopted by other players in the sector today to consolidate their positions as market leaders in the 2025-2030 period. That will certainly be fascinating going forward.

Another related indicator for global vertical-integration changes could also happen if there is consolidation (merger or acquisition based) of existing players in China. For example, one of the leading module suppliers acquiring an existing polysilicon-focused entity. Or a government-driven mandate in China for this to happen, to ensure continued manufacturing leadership in the sector.

Either way, the shape of PV manufacturing and the strategies of the leading stakeholders within a Terawatt size market will look very different to today. While it might look like the PV industry has ‘grown up’ having reached the circa. 200GW-level now, this is only relative to low deployment numbers in the past. However, sometime in the future, 200GW will look like a small number, and people will talk then about the old way of doing things back in 2022!