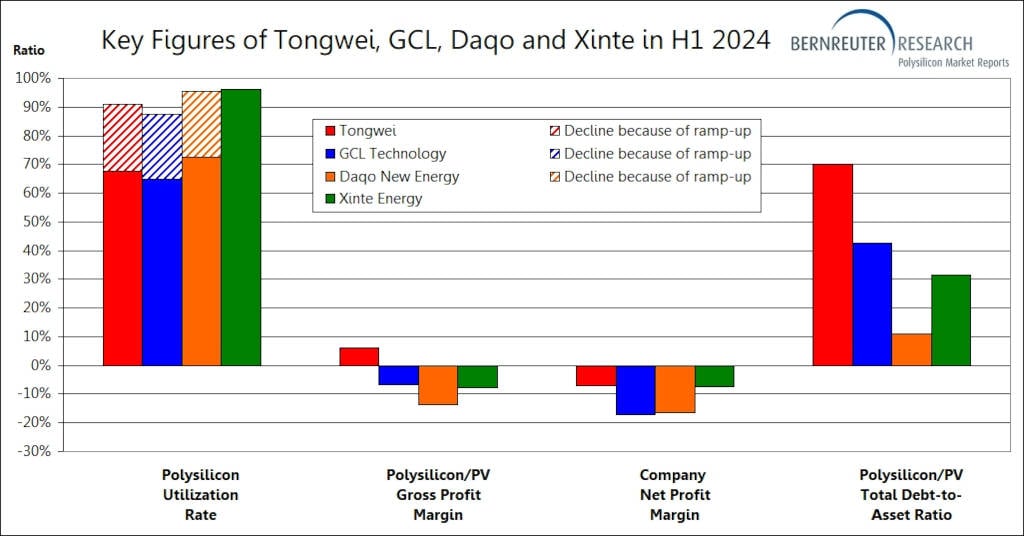

The world’s four largest polysilicon producers all recorded net losses in the first half of 2024 because of the ongoing crash in Chinese polysilicon prices.

According to reporting from polysilicon market analyst Bernreuter Research, Tongwei Solar, GCL Technology, Daqo New Energy, and Xinte Energy all posted net losses in H1 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The extent of the losses ranged between the four companies. Tongwei and Xinte posted single-figure negative margins (-7.1% and -7.8%, respectively) while GCL and Daqo posted net losses of 17.1% and 16.4% each.

In terms of financial figures, Tongwei – the largest polysilicon producer in the world – posted net losses of US$440 million. The second, GCL Technology, saw net losses of US$213 million; third place Daqo New Energy recorded losses of US$104 million and Xinte Energy – the world’s fourth-largest producer – lost a net US$124 million.

Q2 was more difficult than Q1, for Daqo and GCL in particular.

In a post on LinkedIn, Johannes Bernreuter, head of Bernreuter Research, said: “While the negative net profit margins of market leader Tongwei and the fourth largest manufacturer Xinte were still in a single-digit range, those of GCL and Daqo slipped to -17% and -16%, respectively. More dramatic was the development in the second quarter: The net profit margins of GCL and Daqo slumped from a positive value in the first quarter to -45.7% and -54.5%, respectively.”

Low prices and overcapacity

Polysilicon prices have plummeted since early 2023, from a high of RMB235/kg (US$33/kg) in February 2023 to RMB32/kg in late August 2024 – a drop of over 85%. Last month PV Tech reported that Daqo New Energy had been selling polysilicon below the cost of production in Q2.

Bernreuter reported that three of the four top companies have reduced the operational rates of their plants “significantly” in the third quarter since the end of June. Before that, in the first half of the year, Bernreuter said all four were producing at around 90% of total capacity. Simultaneously, GCL and Xinte are executing capacity ramp-ups for the future.

Tongwei

The exception to this rule has been Tongwei, which the report said “reportedly continues to churn out large volumes.” Bernreuter said Tongwei shipped 229,800 metric tonnes (MT) of polysilicon in H1 2024 and produced an estimated 240,000 MT.

“As if that weren’t enough,” Bernreuter said, “[Tongwei’s H1 report] says that the company’s second new 200,000 MT plant in Baotou, Inner Mongolia “is expected to be completed and put into production before the end of the year” – despite persisting oversupply.”

In a report last year, Bernreuter predicted that 2024 would see a Chinese polysilicon market “shakeout” led by Tongwei. The “shakeout” – where the industry consolidates and smaller producers are pushed out – would be triggered by massive production capacity expansions despite the plummeting price of polysilicon.

Johannes Bernreuter highlighted Tongwei specifically as the leader of this movement back in 2023. He said: “Tongwei is planning to bring 575,000 tonnes of new production capacity on stream next year, whereas we expect a market growth of 200,000 tonnes at most.”

In the most recent report, Bernreuter said “It remains to be seen how far Tongwei will come with its radical cut-throat strategy to push weaker competitors out of the market.”