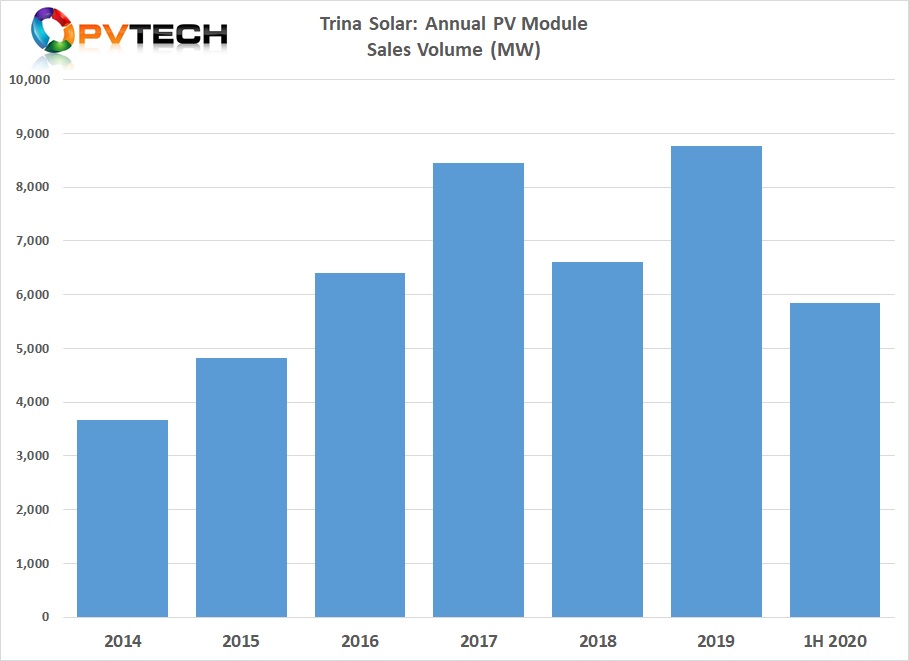

‘Solar Module Super League’ (SMSL) member, Trina Solar has reported its first financial results since delisting from the New York Stock Exchange (NYSE) almost four years ago, starting with record first half year PV module shipments of 5,840MW, a 37% increase of the prior year period.

The company noted that despite global solar demand declining in the first half of 2020, due to impact of COVID-19, Trina Solar was able to maintain production at its manufacturing operations across its facilities in China, Malaysia, Thailand and Vietnam.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Shipments in the first half of 2020 were almost equal to annual shipments in 2016 and 2018, and nearly two-thirds of record shipments of 8,757MW in 2019. Trina Solar’s shipments excluded modules used in its in-house project development arm.

PV module shipments outside China grew strongly in the reporting period. The firm shipped 1,071MW to North America, primarily from its overseas facilities such as Vietnam, avoiding current import duties, an increase of over 238% from the prior year period.

Shipments to Europe were also strong with a 60% year-on-year increase to 1,720MW. The company also noted a 162% increase in shipments to Latin America, totalling 508MW. The company did not breakout shipments for Asia or China, specifically.

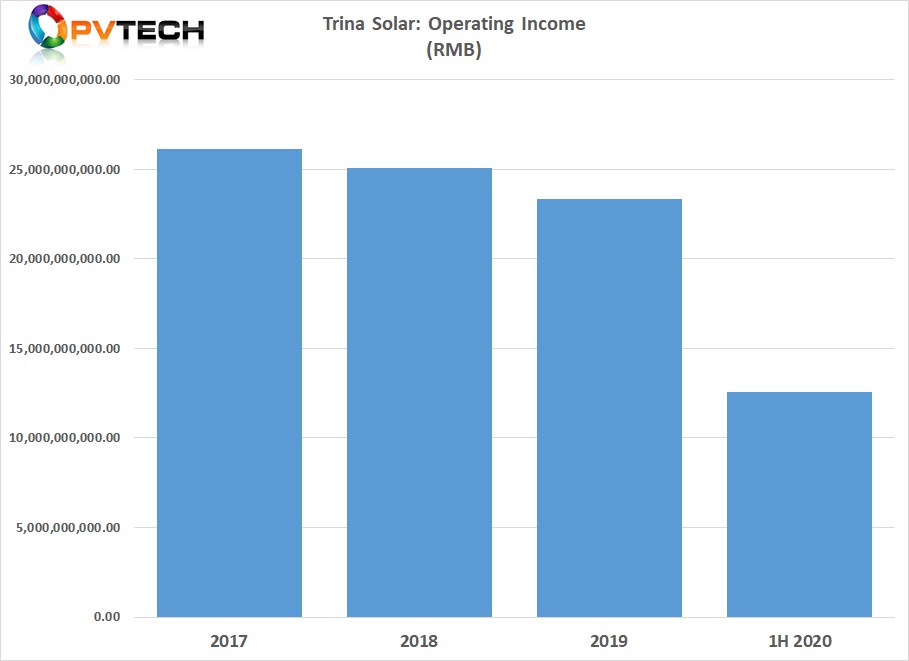

Trina Solar reported first half year operating income (revenue) of RMB12.54 billion (US$1.82 billion), an increase of 16.56% over the prior year period. Net profit in the reporting period (attributable to shareholders ) was RMB492.9 million (US$71.7 million), a year-on-year increase of 245.81%.

Manufacturing update

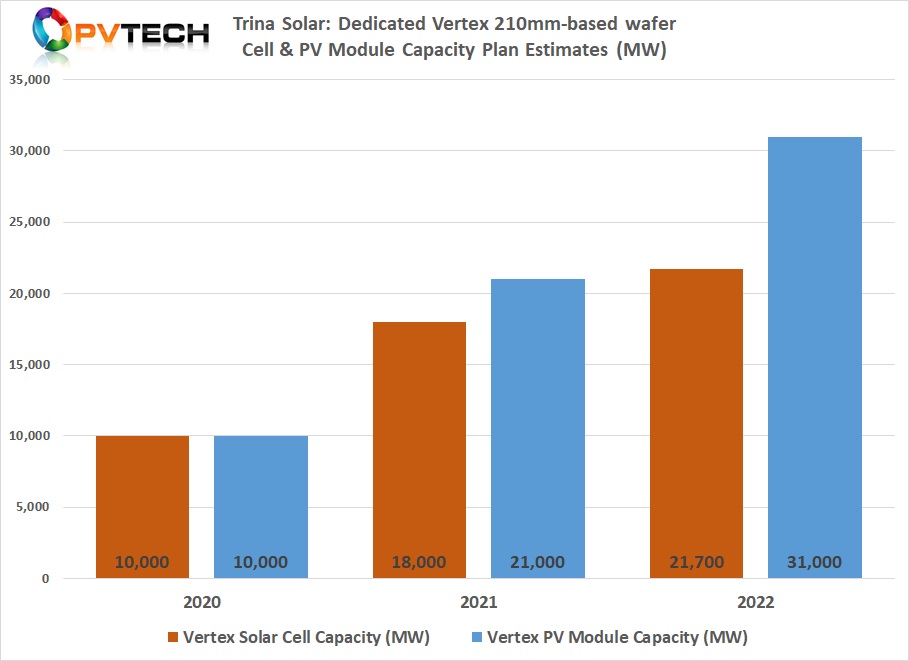

Recently, Trina Solar announced a new wave of capacity expansions that included adding 7.6GW of 210mm wafer-size capable cell line capacity to its production plant in Yancheng, China, while upgrading a further 2.4GW of cell capacity at the site to process 210mm wafers, an initial 10GW of nameplate capacity dedicated to its latest large-area Vertex module.

Capacity will also be added in Malaysia, Thailand and Vietnam totalling 2.5GW. In total, Trina Solar expects to have 26GW of in-house cell and 28.4GW of module assembly capacity by the end of 2021.

The company recent raised around US$360 million in a share offering to primarily fund initial capacity expansions related to a 3GW solar cell expansion at its Yiwu, China facility.