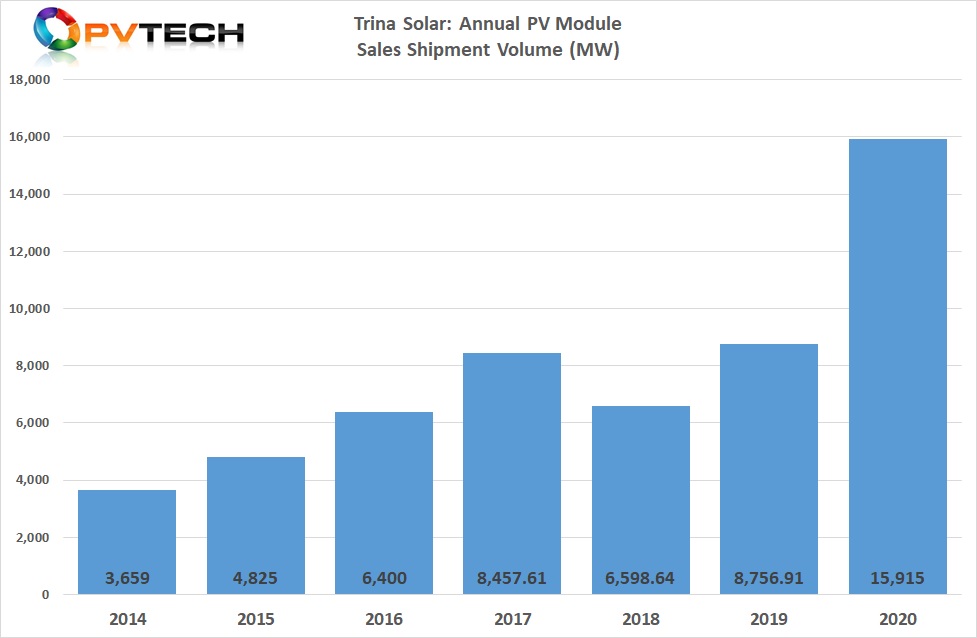

‘Solar Module Super League’ (SMSL) member Trina Solar has reported total module shipments in 2020 of 15,915MW, an increase of over 81% compared to the 8,756MW shipments recorded in 2019.

This increase represents an unprecedented surge in shipments from a single company in the PV industry.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

PV Tech recently reported that fellow SMSL member JA Solar had recorded PV module shipments of 15.88GW in 2020, up from 10.26GW in 2019, a 54.8% increase, year-on-year, setting new records for total shipments and shipment growth.

In its first year back as a publicly listed company, Trina Solar had previously reported H1 2020 module shipments of 5,840MW, an increase of 37% over the prior year period.

Overseas shipments, predominantly what the company described as ‘high-margin regions’, had increased significantly and contributed majorly to the growth of net profit in the first half of 2020. Trina reported shipments of 1,071MW to North America, an increase of over 238%, from the prior year period, while shipments to Europe had reached 1,720MW, an increase of 60% year-on-year.

Shipment growth in the second half of 2020 therefore stood at an incredible 172.5%.

Included in the full year PV module shipment figure was around 2,630MW shipped to its PV power plant systems business, possibly including shipments to its turnkey customer business ‘Trina Pro’.

The company had noted that its Chinese domestic power plant system business exceeded expectations, gaining nearly 1GW of PV bidding projects compared with the previous year.

Most of the project related business shipments were predominantly in the second half of the year.

The distributed PV system shipments and revenue both increased by more than 200% year-on-year, according to the company.

At the end of 2020, Trina Solar’’s total module production capacity had reached around 22GW.

Financials

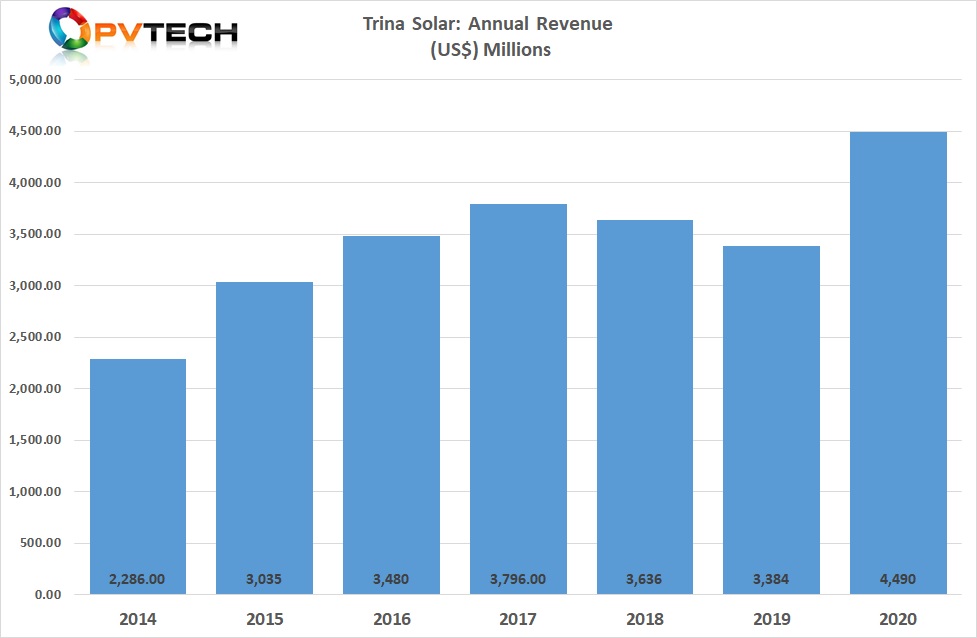

Trina Solar’s revenue (operating income) for the full-year reached RMB29.418 billion (US$4.49 billion) in 2020, a year-on-year increase of 26.14%. Overseas markets accounted for 70.30% of operating income in 2020.

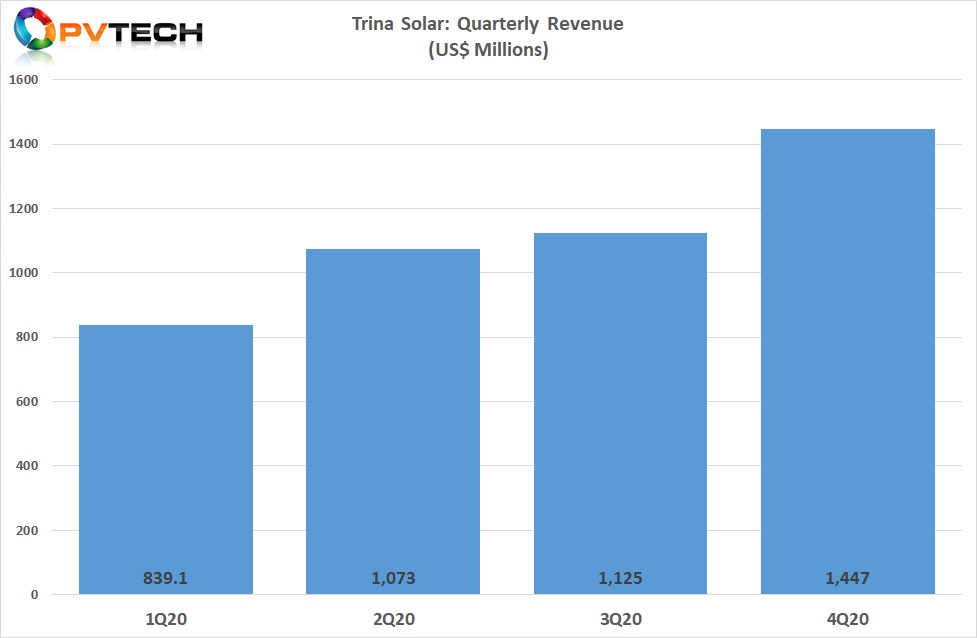

As with many PV manufacturers in 2020, Trina Solar was impacted by COVID-19 in the first quarter of the year. Sales in the first quarter were around US$839 million, the lowest quarterly figures it would report in 2020.

Revenue remained above US$1.0 billion in the second and third quarters, peaking at US$1.44 billion in the fourth quarter of 2020.

Increased PV project business revenue as well as revenue attributed to its new TrinaTracker business unit, which was said to have achieved shipments of around 2GW in 2020, contributed to the record revenue in the reporting period.

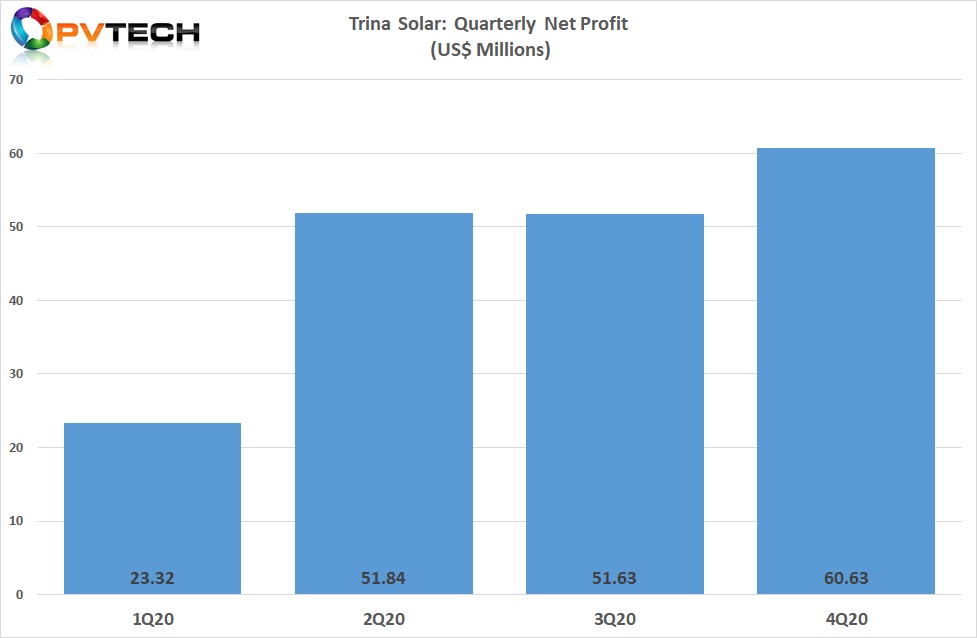

The SMSL manufacturer reported net profit of RMB1.229 billion (US$186.99 million), a year-on-year increase of 91.90%. The company’s net sales profit margin in 2020 was 4.18%, up from 3.01% in 2019.

According to Trina Solar, the gross profit margin of PV modules was 14.90% in 2020, or 19.31% excluding the impact of higher logistical costs and miscellaneous expenses.

Trina Solar’s fourth quarter net profits surpassed US$60 million on revenue of just over US$1.44 billion, compared to a net profit of US$51.63 million in the previous quarter on revenue of US$1.12 billion.

Like its close rival, JA Solar the company was impacted by hikes in material prices and transportation costs as well as rising wafer and solar cell prices.

Trina Solar also reported a bad debt provision for accounts receivable of over US$557.6 million (US$84.82 million) in 2020. In comparison, JA Solar had announced asset impairment charges in 2020 of approximately RMB169.1 million (US$25.74 million).