Is maximizing power per string the only right answer?

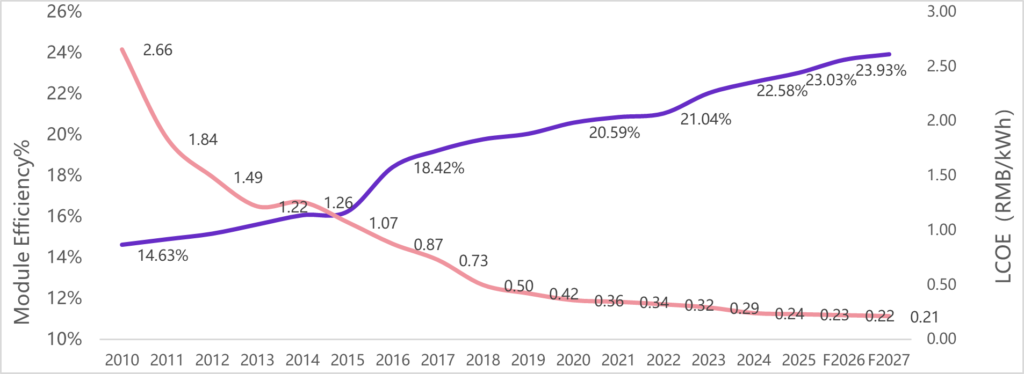

If we imagine the development of the photovoltaic (PV) industry in terms of both scale and quality as a single curve, then from the first practical silicon solar cell (6% efficiency) developed at Bell Labs in 1954 to today’s terawatt-scale supply of PV modules with typical conversion efficiencies above 20%, this curve may have seen occasional dips or fluctuations, but its overall trajectory has clearly been moving upward.

Running counter to this, however, is another curve: the levelised cost of electricity (LCOE) from PV, which once declined rapidly and has now begun to flatten out.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

As module efficiencies continue to rise and costs and prices approach their practical limits, the ability of modules alone to further reduce LCOE has entered a zone of diminishing returns. The marginal contribution of module-level improvements to LCOE reduction is shrinking.

To push LCOE out of this “shallow-water trap” more quickly, the industry needs to look beyond a single component and instead start from the actual needs of different project scenarios. We must think from a full-system perspective, coordinating everything from individual modules to all elements of the power plant, and tailor solutions for each site. Much like job hunting, sending a one-size-fits-all résumé everywhere will never be as effective as tailoring your résumé to each specific role.

Looking back at how the PV industry has evolved, there has long been a “standard formula” for lowering LCOE: increasing the power of each string. If the power of a single string is doubled from 5kW to 10kW while keeping the number of pile

foundations, the steel used in mounting structures, and cable lengths the same, then the associated cost per watt falls by 50%. The CAPEX savings are immediate and obvious. This is why this system-design mindset has almost become the default answer to the LCOE question.

The most straightforward way to increase string power is to increase the power of each individual module. Over the past decade, module formats have evolved from 156, 158, 166 and 182 to 210R and 210mm, while cell technologies have shifted from BSF and PERC to TOPCon, BC and HJT. Together, these advances have pushed module power from the 200W+ range to over 700W per module, thereby naturally increasing the output of each string.

At the same time, module and inverter manufacturers have worked hand in hand to raise system voltage. From the early 600V and 1,000V systems to today’s mainstream 1,500V designs—and now toward 2,000V systems widely regarded as the next step—every increase in DC voltage is aimed at allowing more modules to be connected in series in a single string, boosting the power per string.

This is easy to visualise: even if the number of grains on each wheat ear remains the same, expanding the cultivated area will still increase total grain output. In this analogy, modules and inverters are like diligent family members constantly opening up new fields to harvest more grain.

Beyond raising system voltage, module manufacturers have also optimised module layouts. For example, conventional 72-cell formats have been re-engineered into 66-cell designs, reducing the voltage of each module by around 4–5V. This allows two more modules to be connected in the same string while staying within the system voltage limit. In other words, manufacturers are not only expanding the “field” but also narrowing the “spacing between wheat plants,” enabling more plants—and thus more yield—on the same land.

Through higher module power and more modules per string, string power has climbed from around 8kW to more than 20kW in recent years. This has contributed significantly to LCOE reductions. Today, however, mechanically applying this formula is no longer sufficient to meet the needs of all application scenarios worldwide. In some cases, the “higher string power” answer is no longer the right or only answer.

So under what conditions does this formula cease to be valid?

When utility-scale tracker plants break the old formula

When it comes to LCOE, utility-scale plants are naturally the most sensitive scenario. A few years ago, discussions focused on whether PV could be cost-competitive with thermal power over the long term. Today, the question has evolved into: how much additional profit can a PV project generate at a given LCOE?

In this segment, the two common plant types are fixed-tilt systems and tracker-based systems. The focus of this discussion is utility-scale plants using tracker systems.

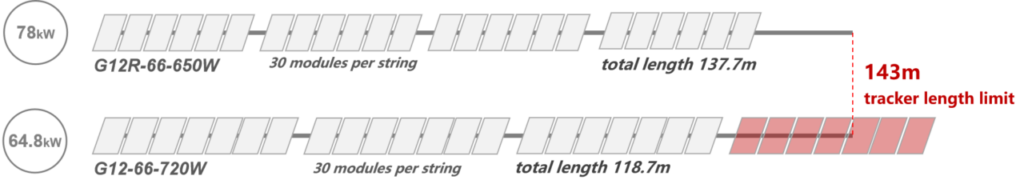

Compared with fixed-tilt structures, trackers are more expensive and account for more than 20% of total system costs. Whether a project can utilise trackers efficiently therefore becomes the key to optimizing LCOE in tracker scenarios. Taking the mainstream 1P single-axis tracker as an example, a typical unit has a maximum mechanical length of around 143m. How effectively that 143 m of tracker rail is utilised directly impacts the revenue of the plant.

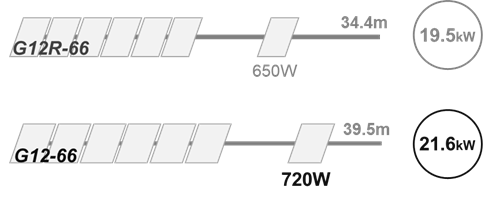

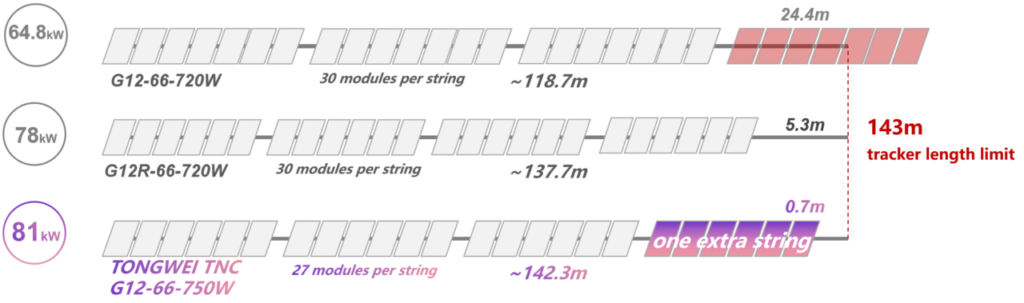

For such projects, a common design choice is to use either standard 210-format 720W modules or high-efficiency 210R-format 650W modules. Following conventional thinking, both modules are used in 1,500 V designs with 30 modules per string, fully utilising the system’s DC voltage window. This yields per-string power outputs of 21.6kW and 19.5kW respectively, with string lengths of roughly 39.5m and 34.4m.

We can see that even compared with high-efficiency 210R modules, 210-format modules still offer higher power per string—but also a longer string length. In today’s global tracker market, which is expected to reach around 110GW in 2024, more than 80 GW of projects are likely to use three strings (or fewer) per tracker.

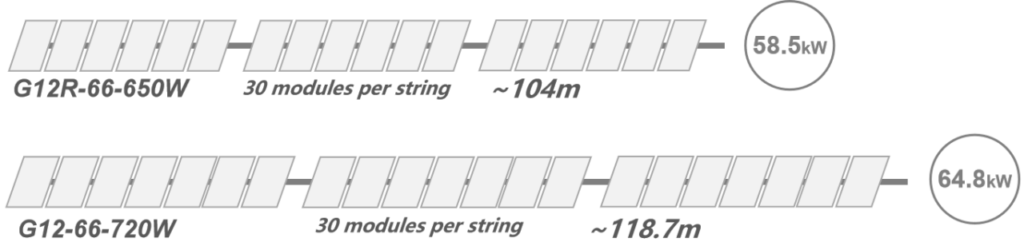

In a three-string design, the two module options deliver around 64.8kW and 58.5kW per tracker, with total lengths of about 119m and 104m, respectively. In this configuration, both designs fall within the tracker’s 143m length limit. The 210-format module, with its higher string and tracker-level power, can reduce tracker quantity by nearly 10%, offering a clear system-cost advantage.

However, in the remaining ~30GW of tracker projects—typically in regions such as the Middle East and Australia, where ground conditions are relatively flat and leveling is easier—owners may opt to install four strings of modules on each tracker to maximise land and tracker utilisation.

In such designs, the shorter string length of the 210R modules allows a fourth string to be mounted on a single tracker. The longer strings of the 210-format modules, by contrast, mean the fourth string can no longer fit within the 143m length limit. Under these site conditions, 210R modules can achieve higher total installed power per tracker and thus gain a cost advantage at the system level.

Shifting from “more power per string” to “more power per tracker”

Faced with this scenario, Tongwei chose not to remain constrained by traditional system design thinking. Instead, it took an innovative approach: reducing the number of 210-format modules per string—and therefore shortening string length—so that a fourth string of 210 modules can be accommodated on each tracker.

This design breaks away from the conventional pursuit of maximum power per string. Instead, it slightly reduces the power of each string, in exchange for higher total power per tracker. As trackers account for a much larger share of system costs than modules, this approach enables savings in tracker-related CAPEX and thus delivers a more meaningful optimisation of LCOE.

At the same time, as a pioneer in 210-format modules, Tongwei has also taken the lead in launching and mass-producing high-efficiency 210 modules. Built on Tongwei’s TNC 2.0 technology platform—featuring 908, TPE, Stencil Printing and Poly Tech—the company’s 210-format modules can reach up to 750W in mass production, while bifaciality has been improved by more than 5%. This further reduces BOS costs and enhances rear-side energy yield in bifacial applications.

Take a 100MW project in Saudi Arabia as an example. Compared to a conventional 210R-module design, Tongwei’s solution can reduce initial investment by around 0.9% and further cut LCOE by 0.48%. Through the combination of higher module efficiency and an optimised system design philosophy, Tongwei’s 210-format module–tracker solution delivers higher installed capacity and lower system costs on trackers than 210R modules, extending the application space of 210-format modules in utility-scale power plants worldwide.

Today, LCOE optimisation has entered a “shallow-water” zone, where it is increasingly difficult to solve all project-level pain points with a single, universal solution. The right answer is to start from the real needs of project sites and to systematically re-engineer all aspects of the plant from a system-level perspective. Only by doing so—by rethinking the relationships between all elements of the plant—can we continue to drive meaningful reductions in PV LCOE in the years to come.