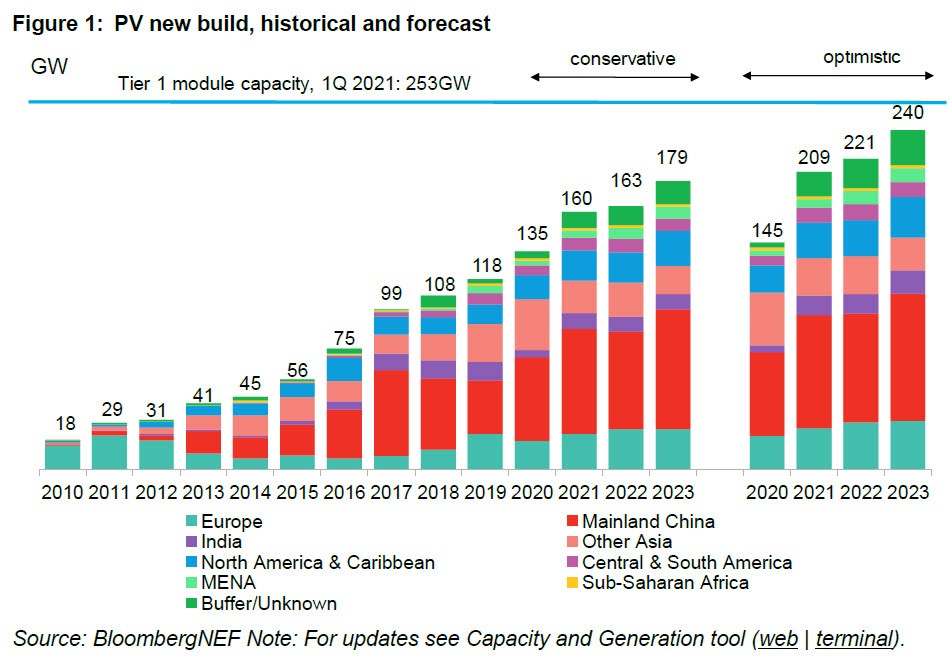

As much as 209GW of solar PV could be installed this year, BloombergNEF (BNEF) has said, with project activity booming in most international markets.

Annual deployment is also expected to continue to climb over the coming years, with BNEF’s optimistic forecast expecting 221GW to be installed in 2022 and 240GW in 2023.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The research organisation has today published its Q1 2021 Global PV Market Outlook, which states that at least 160GW of solar will be deployed in 2021. But its range for the year extends up to the optimistic forecast of 209GW, citing strong deployment forecasts in India and China in particular.

Even the lower end of guidance would constitute a 13% jump on 2020’s installation figure of around 141GW, with the 209GW figure amounting to a near 50% increase in installations.

That optimistic projection exceeds the previous high forecast of 194GW issued by BNEF last month, indicating the scale of confidence in high-growth markets including China.

Speaking to PV Tech today, BNEF’s head of solar Jenny Chase said China was ready to “hit the accelerator” after establishing a target of becoming net zero by 2060. “I don’t think anyone really knows how they’re going to get to net zero yet, but the obvious place to start is just to build a load of renewables,” Chase said.

BNEF expects China to have installed around 52GWdc of solar last year, with this set to increase to between 65 – 75GW this year.

Despite this level of growth BNEF has dismissed any potential concerns around supply shortages, pointing towards “massive” expansions of polysilicon, wafer and glass capacity that have been planned. Numerous new facilities have been announced and new partnerships formed in order to meet industry demand. While some polysilicon bottlenecks will remain, prices for the material are expected to stabilise at around US$12/kg this year.

This steady stream of raw materials will also help facilitate module capacity, which BNEF expects to remain strong. Prices for standard modules – based on 166mm wafers – are expected to fall to around U$0.19c/W this year, dropping again to US$0.18c/W in 2022 and hitting US$0.15c/W in 2025. Larger-format modules such as those featuring 210mm wafers are expected to command a premium, however, with their benefits helping to achieve cost reductions elsewhere on the system.