US solar PV module prices have stabilised at just over US$0.28/W in the three months to November 2025, but this is likely to be a fragile state of affairs as a decision on Section 232 compliance looms over the US solar sector.

These are the key conclusions to be drawn from Anza’s latest report into the US solar and battery energy storage system (BESS) sector, published this week. The report notes that, while module prices in the US are up considerably over the course of the year, from around US$0.25/W in January, module prices have remained stable since September, when Anza reported a jump in module prices as developers sought to start work on operations by 2 September, in order to secure Investment Tax Credit (ITC) support.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

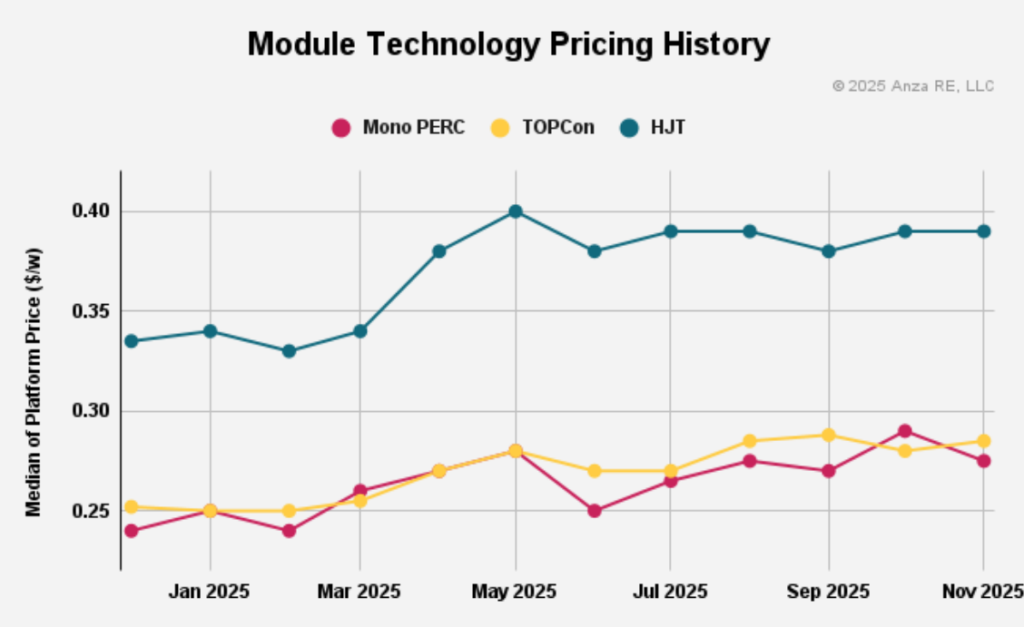

This price stability is reflected across technology types, which have seen a similar trend in prices over the course of the year. As shown in the graph below, prices of monocrystalline passivated emitter rear contact (mono PERC), tunnel oxide passivated contact (TOPCon) and heterojunction (HJT) modules have increased since the start of the year, but remained relatively consistent since April. The most notable change has been in the PERC and TOPCon sectors, which have swapped positions between the second- and third-most expensive technology type in each of September, October and November.

In September, Anza noted that the September ITC deadline created a “pull forward” effect, compressing the last half of the year’s worth of projects into a single quarter. It expects this delicate status quo to continue into the new year, until the US government releases final guidance on Section 232, which covers imports of polysilicon and its derivatives into the US; considering the US’ reliance on such imports for its solar sector, the ruling will have significant impacts on the industry.

According to PV Tech Market Research, Chinese manufacturers continue to dominate global upstream solar manufacturing production, with global cell production forecasts this year of 817.4GW. Chinese manufacturers account for the top 13 manufacturers by output, and the top six manufacturers—Tongwei, LONGi, Trina Solar, JinkoSolar, JA Solar and Solarspace— accounted for more than half of this production, with 451.6GW produced this year.

There is a similar fragile status quo for US-made cells, where prices have remained stable around US$0.45/W since September. The price of imported modules, meanwhile, is much lower, at around US$0.26/W, but has also remained consistent.

The biggest change in manufacturing pricing comes for cells that are imported from overseas, but then assembled into modules in the US, moving from under US$0.35/W in September to over US$0.35/W in November. This is a 5.9% increase from August to November, and suggests that US-based module manufacturers are putting a premium on their products, which often consist of cells imported from overseas that are then assembled into modules in the US.

This reflects the current state of US solar manufacturing, where there is considerably more domestic module assembly capacity than domestic cell manufacturing capacity. Figures from PV Tech Market Research forecast the US to produce 61.5GW of modules this year, compared to 11.8GW of cell production over the same period.

However, Anza expects the US to continue to invest in both cell and module manufacturing capacity in the coming months, forecasting the number of US-based module suppliers to increase from nine in the second half of 2025 to 13 in the first half of 2028. Meanwhile, the number of US-based cell suppliers is expected to increase from eight to 11 over the same period.

Storage prices fall, US expected to onshore manufacturing capacity

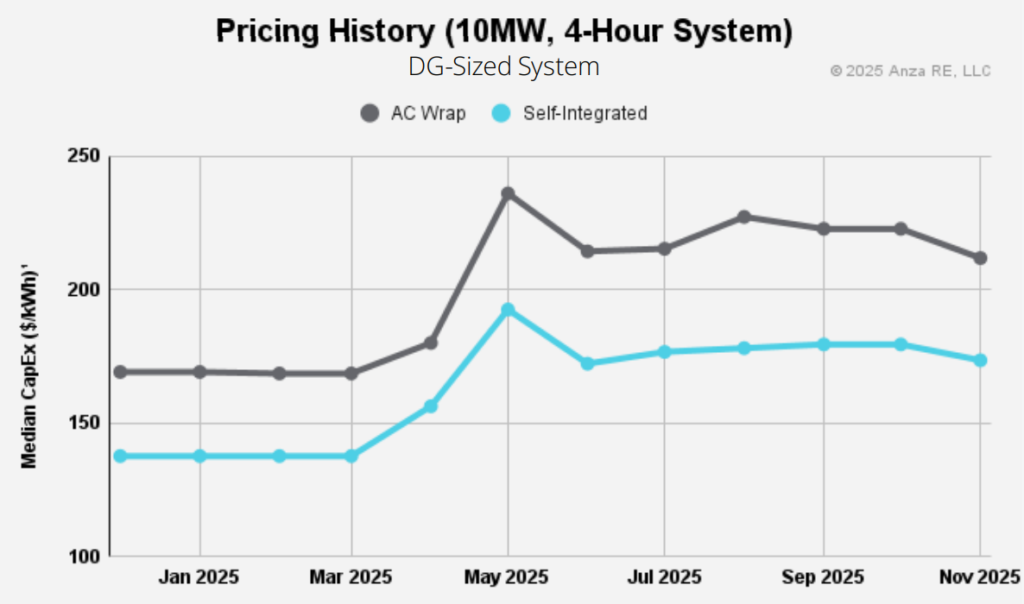

In the BESS sector, meanwhile, prices dropped in the last quarter across technologies. For 10MW, 4-hour systems, capex for AC Wrap products fell from a May peak of US$236/kWh to US$212/kWh, and has fallen 6.8% since August. While self-integrated batteries of the same size saw a lower price fall of just 2.6% between August and November, prices still tumbled to US$173/kWh at the end of November, as shown in the graph below.

The same general trend is present for utility-scale BESS. For 200MW, 4-hour projects, Anza reported that AC Wrap project capex hit US$194/kWh in November, while self-integrated products saw capex fall to US$158/kWh. This marks a 10.6% and 6.8% decline in prices, respectively, from May for these products, which marked the highest prices seen this year for all four product types profiled by Anza.

Looking ahead, Anza expects the US to onshore more manufacturing capacity, forecasting 13 BESS cell, module and container suppliers to be in operation, each, by the first half of 2027. This would be up from three cell suppliers, five module suppliers and seven container suppliers present in the US as of the second half of this year.