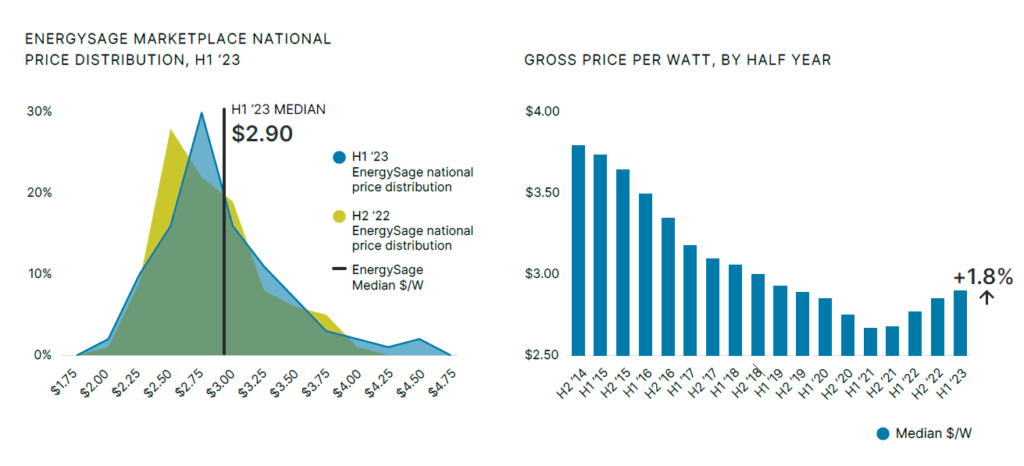

US solar prices increased to US$2.9 per watt in the first half of 2023, representing a 1.8% increase from H2 2022.

According to figures from EnergySage, the median quoted solar price increased for the fourth six-month period in a row, from US$2.67 per watt in the summer of 2021. Although reaching US$2.9 per watt in H1 2023, the increase in the median quoted solar price marked a slowdown in the pace at which solar prices have increased over the last two years, after 3.4% growth in H1 2022 and 2.9% growth in H2 2022.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, EnergySage said the solar price on its marketplace began to drop slightly over the course of Q2 2023 without mentioning the percentage or amount. In addition, solar prices began to decline in July and August, with early Q3 pricing data showing a 3.5% drop compared to pricing in H1 2023.

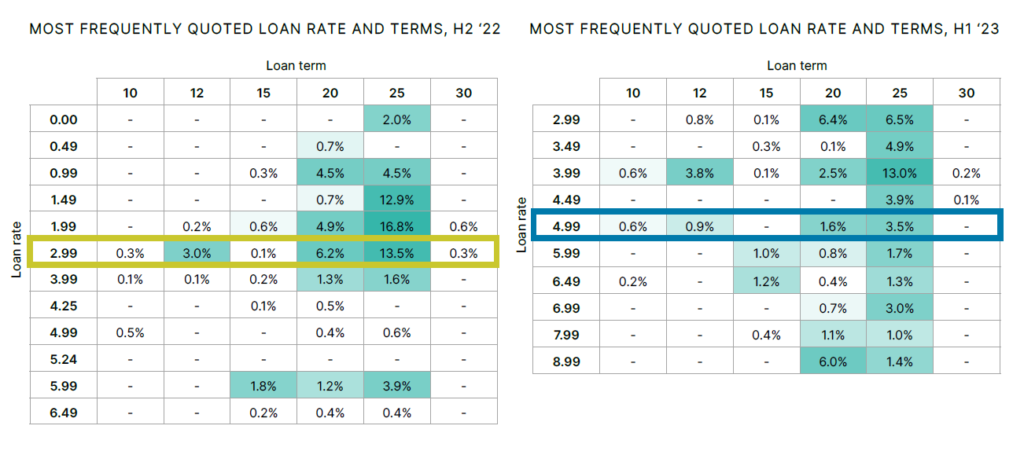

The report also studied solar financing terms. Between H2 2022 and H1 2023, the most frequently quoted solar loan on the EnergySage Marketplace shifted from a 1.99% interest rate on a 25-year loan term, to a 3.99% interest rate for a loan of the same period.

In H2 2022, 72% of loans on EnergySage had an interest rate of 2.99% or lower. But this situation changed in H1 2023, as 85% of loans on EnergySage had an interest rate higher than 2.99%. Additionally, over 10% of loans offered in H1 2023 included an interest rate of 7.99% or higher.

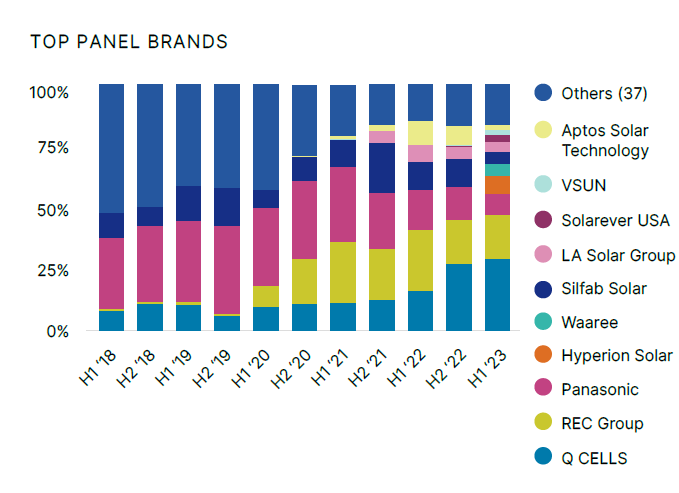

The report also studied the most quoted solar and inverter brands. In H1 2023, Qcells was the most quoted solar module brands, followed by solar company REC Group and Japanese electronics company Panasonic.

Regarding inverters, Enphase Energy has continued to dominate the inverter sector since H1 2020, followed by Israeli solar inverter manufacturer SolarEdge and solar and energy services provider SunPower.