Amongst a flurry of M&A activity and new product launches, PV Tech’s Carrie Xiao reflects on the tracker market status quo, the fortunes of China-based tracker manufacturers and what the future might hold for a market that’s set to get even more competitive.

Last week’s news that two module manufacturers had made strategic investments in tracking companies meant that competition in that particular subsector looks set to reach new highs.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The news plays into a broader strategic restructure of PV power systems and the large-format module ecosystem, with the prominent role trackers look set to play reinforced. While newcomers are accelerating, the established industry stalwarts and leading module manufacturers are competing for market share too.

Arrival of the newcomers

While a large number of tracker manufacturers were once operational in China, it’s a richly competitive market to operate in and only a small number have been able to progress.

The rise and subsequent IPO of Arctech Solar, alongside Trina Solar’s acquisition of Nclave, caused something of a breakaway and ushered in a new era of brand awareness for trackers. With other major module companies making similar moves, Trina Solar has been pushed into rolling out a combination of its high efficiency modules and smart tracking structures, which it hopes will give it a competitive edge.

Trina designs its product with two considerations in mind. One is a reduction in system cost, with optimised product designs using less material while enabling more efficient installation and O&M. The other is product lifecycle management, where reduced failure rates of trackers can produce improved returns on investment.

Jason Duan, managing director of Trina Solar’s tracker division, told PV Tech that its tracking structure enables power performance gains, which further enhance system efficiency and profitability.

By the end of this year, Trina Solar will have delivered more than 6GW of trackers in total and shipped to more than 400 PV projects across in excess of 30 countries. Its performance in the field has attracted the interest of peers and other market participants alike. While JA Solar and Canadian Solar have invested in JSolar, other major module manufacturers are also understood to be considering investments in the sector.

As M&A increases, the tracker market will inevitably accelerate and become more competitive. But just how promising is the market?

According to the renewable energy team of investment bank Haitong Securities, for a US$0.62c per Watt PV system, a fixed structure is priced at US$0.047c/W with a profit of US$0.0031c/W. However, a tracking structure is priced at US$0.094c/W, but delivers a net profit of US$0.007c – US$0.009c/W.

And with an average price of US$0.07c/W, the tracker market – against a solar market of around 200GW of installed capacity each year – would be worth around US$14.1 billion, broadly equivalent to the solar inverter market in terms of value.

This is also evident from Arctech’s most recent earnings report, which showed that gross profits for fixed and tracking structures have increased on a per watt basis in each of the last three years, while price per watt has remained relatively stable.

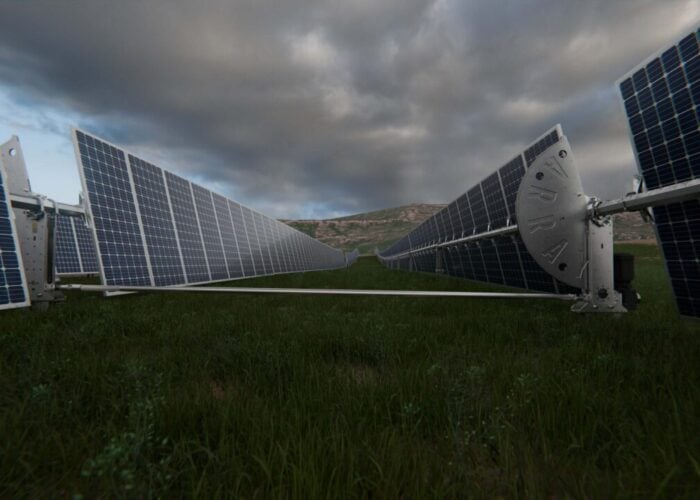

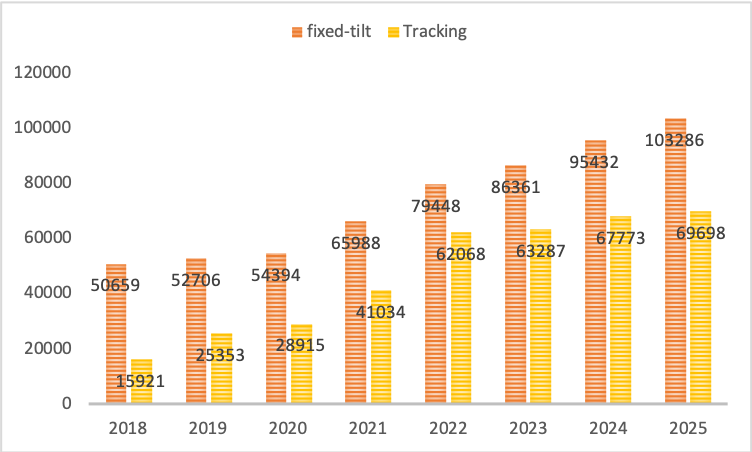

At the same time, the potential of trackers is also being evidenced by their increasing market share. Bifacial modules are now widely used, lending weight to tracker technologies and increasing power gains of 10 – 25% compared to fixed-tilt systems.

Trina Solar has collected and compared power generation data from both fixed-tilt and tracker mounted modules at a project located in Tongchuan, China. Data collected after one year of operation showed that, while the single-axis tracker occupied 20% more land space, its system LCOE was 1.43 – 2.39% lower.

Sicheng Wang, a former researcher from the Energy Research Institute of China’s National Development and Reform Commission, cited the example of an ultra-high voltage project in Qinghai province which, by adopting a tracker system over a fixed-tilt structure, was able to reduce its LCOE by US$0.023c/kWh.

IHS Markit has predicted that, with trackers now being used in around one-third of all ground-mount solar PV installs, the capacity of systems featuring trackers will exceed 150GW during 2019 – 2023. That said, trackers are now being used more widely overseas, and in some markets their penetration has already reached nearly 70%.

A global race

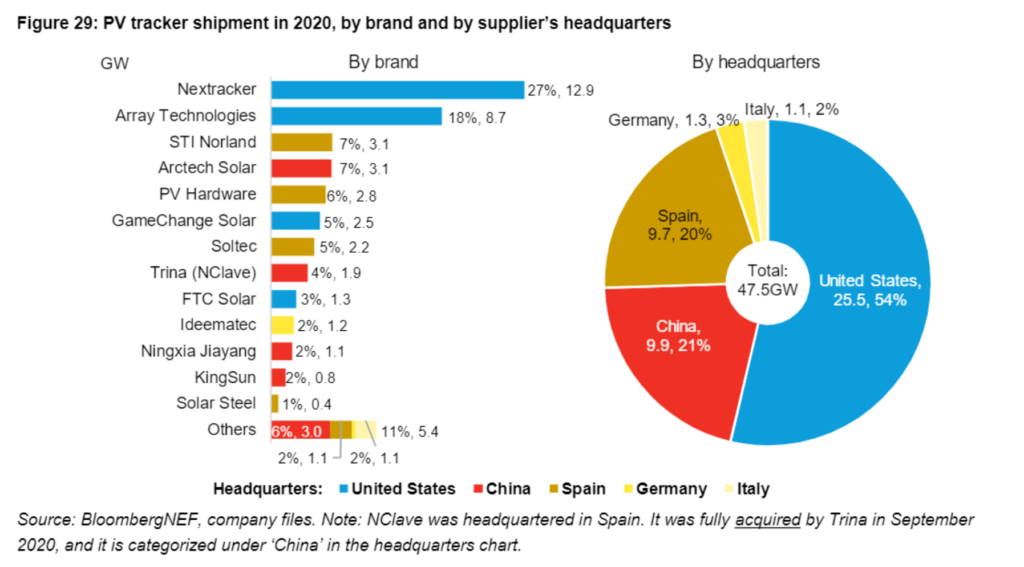

Thanks to those rising penetration rates, overseas tracker manufacturers are currently outperforming their Chinese counterparts. According to BloombergNEF data, the leading manufacturers in 2020 were Nextracker, Array Technologies, STI Norland, Arctech Solar, PV Hardware, GameChange Solar, Soltec, NClave (Trina Solar), FTC Solar and Ideematec. Of that list, just two are based in China.

Taking another perspective, tracker companies have plenty of room to grow further compared to module and inverter manufacturers.

Solar projects, and by association trackers, are going smart, with trackers now highly customised per project and integrating more advanced technology. Terrain and location information is analysed during the structural design for each project to find the ideal solution. This has placed new demands on manufacturers, which now need significant experience in project management and O&M, while also having strong R&D track records.

“Trina Solar acquired 51% of Nclave’s equity in 2018 and 100% in 2020. Nclave was a mature tracker manufacturer with years of power plant experience and, with this acquisition, we gained 15 years of tracker development experience,” commented Kai Sun, R&D director of Trina’s tracker division. Trina now has more than 80 patents, 35 of which are valid patents with 17 being valid invention patents.

After establishing a comprehensive after-sales support system, Trina followed up on 58 specific projects from around the world over five years, the results demonstrating its product failure rate to be lower than the industry average.

In order to gain a clearer understanding of the application of its own tracker structures, Trina compared the performance of a fixed-tilt and a tracker structure, testing each within the same terrain at Tongchuan, one of China’s so-called “Top Runner” projects. One year power generation data indicated that, compared with a traditional tracking structure, Trina’s SuperTrack technology achieved power gains of 3.06% on the plant level and maximum power gains of 4.86% in a single row.

Trina’s combination of high efficiency modules and tracking structure systems has also won recognition overseas, with European research institute Fraunhofer ISE calculating the LCOE of mainstream ground-mount power plants. These plants were equipped with next generation large-format 210mm and 182mm modules and IP tracking structures. It found that the combination of 1-axis IP tracking system and bifacial modules achieved 1+1>2 power gains, significantly reducing LCOE to enable higher ROI.

Jason Duan went on to underline to PV Tech that the pursuit of high standards in technology and quality is the company’s consistent goal. As an industry leader, Trina Solar’s mission is to reduce system costs through design innovations, enhancing power gains for its clients.

Speaking of the Chinese market, Duan added: “Trina Solar’s global capacity is topping 6GW and it is prepared to meet the demands of various application scenarios in China. The Chinese market at present still does not fully understand and accept trackers. The industry is borrowing general construction standards, not taking into account the specialities of PV plants, such as design specifications, load criteria, structural safety and smart control functions. This is not only detrimental to owners, but also harmful to the development of the whole industry. Therefore, we need to continue to work together to make a change.”