PV Tech Research’s Finlay Colville reveals which manufacturers are driving the PV industry’s transition to n-type, explaining why what these companies do in the next two years will shape the sector moving forward.

Last week I delivered two PV Tech webinars, discussing how the PV industry is poised to make the next major technology transition: from p-type to n-type cell production. During these webinars, I focused on how this transition phase may unfold and which companies are essential in driving the industry as a whole.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In this article, I present how I think this will happen: which companies should be considered the change-agents; and what are the timelines involved before n-type becomes the mainstream technology offering?

The graphics and data discussed below are taken from the forthcoming release of our PV Manufacturing & Technology Quarterly report. The themes will also form the basis of the next PV CellTech conference, scheduled to take place live in Berlin on 25-26 April 2022.

The macro picture; top-down out to 2030

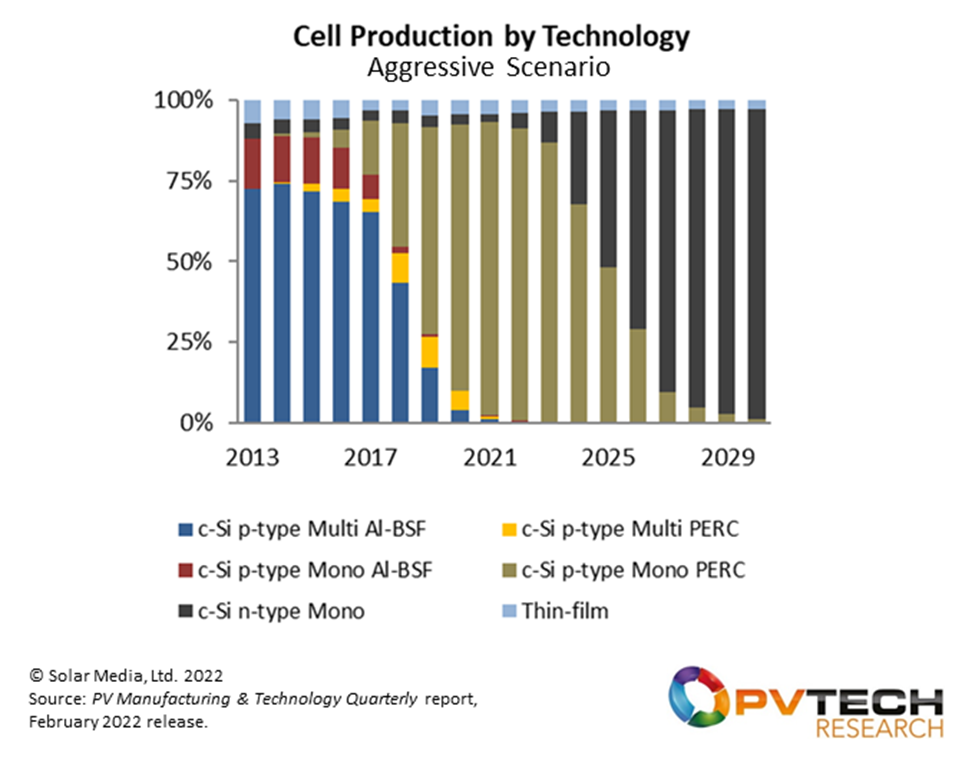

Our research team at PV Tech has been busy for the last couple of years forecasting different technology roadmap options out to 2030. Each assumes n-type is dominant and mainstream by the end of the decade. The only questions are: how soon; and how does the p-type to n-type transition unfold?

Below is our most aggressive technology-change forecast, and this may be the most likely transition cycle as things unfold.

The above graphic is top-down; i.e. assumes an overall market-size/production, and then considers the share to each of the PV technologies, as shown in the legend above. There is no other way to forecast out beyond 12-18 months in terms of PV technology. Even the market leaders in cell production today do not know what their manufacturing split will be a couple of years out.

Doing top-down forecasts is relatively simple. Bottom-up is much harder as you need to have >97% knowledge of all production, at any given time. Also, you really need to have a good feel for what each of the top 20 cell producers are going to do over the next 12 months (even if they don’t).

However, another way to look at the technology path (p-type to n-type) is by way of a more generic ‘technology adoption lifecycle’ model approach. This is described below.

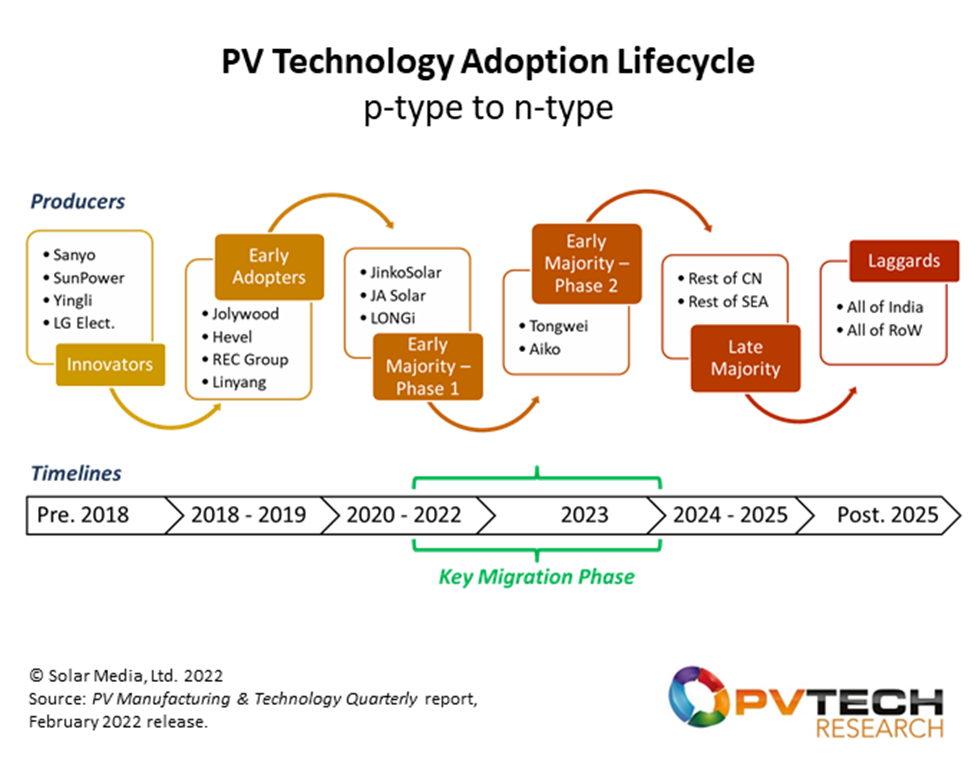

From innovators to laggards: which PV producers will drive the n-type flip

The lifecycle of a technology change (new innovation) routinely starts with a small group of innovators; they pave the way for early adopters. As production levels ramp, a group of key influencers then take over, called the early majority. This is followed by the late majority (those following the early majority), before finally we have the last production grouping, the laggards.

Let’s now consider this model, but factoring in what we know about production and technology in the PV industry; and specifically, which companies fall into these categories, as it relates only to moving from p-type to n-type mass production. Finally, let’s also put timelines to the cycles or phases, considering the PV technology forecast to 2030 shown above.

I did exactly this leading up the webinars last week, and the graphic below was shown for the first time during the presentations.

Let’s talk through each of the stages, as shown above.

Until 2018, n-type production consisted of a small group of innovators: Sanyo, SunPower, Yingli Green and LG Electronics. (Panasonic bought Sanyo, after Sanyo had done all the initial innovation work on n-type.) These companies offered niche n-type product to the market, mainly focusing on rooftops, and often at the residential or small commercial scale.

Things started to change for n-type in the 2018-2019 period, with new facilities from the likes of Jolywood, Hevel, REC Group and Linyang. With the exception of Linyang, the others retain strong n-type expansion ambitions today. This is our early adopters grouping.

I decided to split up early majority into two phases, because there are two critical parts of this push to n-type within China. The first phase involves three companies that are the most important technology leaders within the PV industry today – by some margin; JinkoSolar, JA Solar and LONGi Solar.

I have written extensively about this point over the past 12-18 month on PV Tech. The PV industry follows these companies. Crucially, if these three companies are not on board, any major technology change is highly unlikely. There are many reasons for thinking in this way; I won’t go into the details now. But to move on with the n-type adoption cycle, just assume this to be true for now.

From 2020 through to the end of 2022, these three companies will set in motion a sequence of events that will make n-type’s dominance guaranteed within a few years.

Now we have the other ‘half’ of the early majority drivers; those needed in phase two. These cell producers are Tongwei and Aiko, the two largest in the world. These companies ‘serve’ the global module assembly world; because of their existence, many module suppliers that had to make their own cells no longer need to worry about cell production: they buy from Tongwei or Aiko. Most module-assembly only companies just buy cells from one of these companies. Tongwei and Aiko go with the market’s needs; they don’t set new boundary conditions or impose new technologies on their customers. But when Jinko, JA and LONGi start to get an advantage over their global module competition during 2022, Tongwei and Aiko will have to go big on n-type. Until now, it has been R&D or marketing-driven only.

In the graphic above, I call this the Key Migration Phase, covering the period 2022 to 2024. Looking at the upper graph, 2024 is the final year in which p-type is dominant. From 2025 onwards, n-type starts to dominate the PV industry.

The final two stages of the lifecycle above include the late majority (rest of China, rest of Southeast Asia) and then laggards (all of India, depending on how much cell production is set up at the time there, and the rest of the world).

By the end of 2023, if JinkoSolar, JA Solar, LONGi Solar, Tongwei and Aiko are well on the way to being n-type dominated (purely from a cell production standpoint), the transition argument is over; there is no debate anymore. The only question is how quickly p-type is phased out.

But which n-type technology will win?

Amazingly, we did all this analysis at PV Tech without thinking about PERT/TOPCon or heterojunction production shares. It turns out this is secondary to the fundamental n-type move. Collectively what is happening on n-type will drive the move away from p-type. Yes, there are companies that clearly have strong targets for TOPCon production levels, and this will almost certainly be the technology preferred by the key five companies I spoke about above. But, heterojunction production levels are set for strong Y/Y gains in the next few years also and with a more global approach than TOPCon-in-China.

Any move from p-type to n-type will help producers of both PERT/TOPCon and heterojunction, and will probably even inject some new impetus into IBC.

There are plenty of others who have a different views, but no one has a crystal ball. The best you can do is look at leading indicators. For n-type, this has to be the group of companies that control cell technology today, and there are five of them. All attention should be on them during 2022.

Hopefully by the end of this year, we will be able to see if things are starting to move as discussed here.

PV CellTech in Berlin on 25-26 April 2022; hear what others have to say

All the analysis and discussion above comes from PV-Tech’s PV Manufacturing & Technology Quarterly report. The latest release comes out this week; follow the link here to get more information about subscribing to the report.

On 25-26 April 2022, we return to live PV CellTech conference activity, for the first time since the start of the pandemic. The entire event in Berlin on 25-26 April is based around the themes of this article; it will be the must-attend PV technology in manufacturing event of the year. Click here to learn more about the event and how to attend. Further information appears here, in a blog I wrote on PV-Tech last week.