Maria Popova of the European Federation of Energy Traders makes the case for power purchase agreements from renewable sources, as the sheer volume of renewables growth required to reach Europe’s climate target means that public financial support is unlikely to be sufficient for the task, and market-based instruments and mechanisms need to be deployed alongside.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It is unlikely that there is an energy professional who has not heard of long-term power purchase agreements for the offtake of energy from renewable energy sources (RES), or the so-called RES PPAs. Be it in recent legislative proposals, from the revised EU Renewable Energy Directive and RePowerEU to the electricity market design reforms in the EU and the UK, in corporate sustainability statements, or on the pages of the Financial Times, PPAs are pretty much the talk of the town.

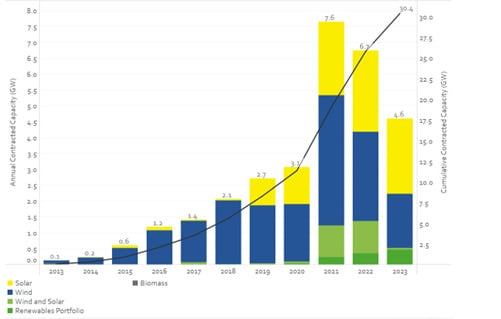

There are two reasons for that: the need to decarbonise our energy system and the need to hedge against future price risks. Reaching Europe’s 2050 climate target would require the rapid scale-up of renewable energy, including adding more than 700 GW of new RES capacity already by 2030. In addition, the energy crisis has been a stark reminder of the importance of diversifying energy supplies, optimising energy use and prudent risk management.

An invaluable instrument for the market-based growth of renewable energy

Over the past decade, there has been an increasing interest in RES PPAs in Europe.

These are long-term commercial contracts for the offtake of renewable energy with a typical tenure of seven to 15 years ahead of delivery. While earlier PPAs had a longer tenure, of 15-25 years, with the energy crisis and in certain regions, PPAs with much shorter tenure – 2-3 years ahead of delivery – have also emerged.

RES PPAs allow buyers, such as corporate and industrial bodies, to make claims that they are consuming renewable energy, as the Guarantees of Origin (GoOs) exchanged under a RES PPA offer a unique claim to the renewable attributes of the consumed electricity, or even that they are contributing to the financing of additional renewable capacity. The ability to evidence renewable energy consumption is becoming increasingly important. It can be used for reporting in compliance with the Greenhouse Gas (GHG) Protocol Corporate Standard and under voluntary renewable sourcing and reporting initiatives. Moreover, a sustainable business is a business that can attract green investment and is also better prepared to meet the requirements of the growing body of sustainability regulation.

Renewable PPAs can also be beneficial from a costs management perspective. They can offer competitive prices, give buyers greater predictability over their long-term electricity costs and allow them to manage the risk of electricity prices going up in the future. Thus, a RES PPA would not only strengthen the green credentials of a business, but also benefit its long-term competitiveness and resilience.

Renewable PPAs are valuable to project developers, as without them a renewable energy project may not even be possible. They provide long-term predictability of returns and are an important indicator for lenders about the viability of a project, which can reduce the cost of borrowing.

With public financial support for renewable energy decreasing, long-term PPAs offer an alternative that ensures the continued growth of such assets. They can also support the continued operation of existing renewable energy assets by providing them with a stable revenue stream and helping them to manage future price risks.

Long-term commitments in challenging times

The extreme price volatility over the past two years did not spare the PPA market. However, given the circumstances, it has shown remarkable resilience. As per a Pexapark report, there has even been a slight increase in deal count across Europe between 2021 and 2022, from 154 to 161, and a strong start to 2023, although a 21% drop in contracted volumes was observed, as corporate demand for renewable energy remains high.

Performance was affected both by the energy crisis and the uncoordinated responses to it. The high prices and volatility made some buyers more hesitant to conclude long-term contracts. Interest in shorter-term deals, however, increased, as they allowed buyers to spread out their high energy costs. In addition, investment uncertainty, as well as supply chain, permitting and grid connection issues, contributed to a shortage of projects and moved the market from the traditional buyers’ market to a sellers’ market.

The second critical element was the patchwork of national level emergency measures put in place in response to the crisis. The Agency for the Cooperation of Energy Regulators counted 439 such measures across the EU. This lack of coordination and the disruptive effect of regulatory interventions on the market has had a significant impact on investor confidence, further impacting the availability of projects. Whether that would have a lasting impact on renewables investment in Europe depends – in no small part – on the outcome of the ongoing EU Electricity Market Design reform.

The relative roles of RES PPAs and continued public financial support for renewables are also under discussion in the context of electricity market design reforms both in the EU and the UK. It is the view of this author that any future electricity market design needs to allow commercial contracts for the procurement of renewable energy, that is to say consumer-led demand for renewable energy, to develop to their full potential. This would ensure the availability of resources to meet our ambitious climate targets, where public financing is unlikely to be sufficient, and cost-efficiency in renewables growth. It would also incentivise better risk management, which would improve the resilience of businesses to future price fluctuations.

A variety of PPAs to fit diverse needs

One of the benefits of RES PPAs is that they offer a great variety of contractual structures, which could meet the diverse needs and preferences of different buyers and sellers. Some common PPA types include:

- Pay-as-produced. The off-taker buys whatever volumes are produced. Additional volumes to match their load would have to be procured from the market and excess volumes would have to be sold in the market. Such contracts remain widespread and are also the preferred choice of sellers without trading capabilities.

- Baseload. The volume to be delivered to the off-taker is determined in advance and is independent from the actual production. The seller is then responsible for procuring in the market any further volumes that may be needed to meet the required profile. Baseload PPAs would normally be priced at a premium to pay-as-produced PPAs, because the shaping risk would be managed on the seller’s side.

- Physical. There is physical delivery of the contracted electricity – usually on the wholesale market – to the buyer’s supplier if the buyer is a consumer.

- Virtual. This is a financial contract where there is no actual physical exchange of electricity, however GoOs are usually transferred to the buyer. Virtual PPAs are essentially a contract for difference where the seller and the buyer agree on a strike price. The buyer pays the difference when the market price is below the strike price and the seller pays the difference when the market price is above the strike price.

- Cross-border. This is not a different contract structure, but there is a cross-zonal element, that is to say the producer is located in one market zone, while the off-taker is in another. Usually, such contracts would take the form of virtual PPAs. Physical cross-border PPAs would require acquiring long-term cross-zonal transmission rights. Those are usually limited to one year ahead of delivery, which is a constraining factor on the growth of cross-border PPAs. However, it is likely that transmission rights with longer durations, of two to three years, will also become available.

Key sticking points in PPA negotiations

As long-term contracts, PPAs usually involve complex and time-consuming negotiations. A number of commercial risks need to be allocated between the counterparties and managed by them or a third party acting on their behalf. Some common types of risks include:

- Price risk. For developers, the main risk is that the price of a contract will be below the Levelised Cost of Electricity, while for an off-taker, it will be above the market price. Therefore, the objective is usually to strike a balance between these two concerns.

- Counterparty credit risk. This is the risk that a counterparty may default. The risk is greater in cases where credit ratings are weak or not available. When credit ratings are not available, for example in the small and medium enterprise segment, this could be a barrier to PPAs’ growth. In such cases, public or private credit guarantees could be a valuable instrument to facilitate the conclusion of such long-term contracts.

- Volume risk. The risk stems from the variability of renewables output over a longer period of time. This may result in fewer GoOs being available to the buyer, or lower revenues to the seller, for instance in pay-as-produced PPAs.

- Shaping risk. Shaping risk refers to the intermittency of renewable energy generation in the short-term, as a result of which the production profile of the seller is likely to differ from the demand profile of the buyer. This discrepancy means that additional volumes would have to be procured from or sold in the market, exposing the party that has taken on that risk to spot market prices for the respective volumes.

- Balancing risk. This is the risk of exposure to imbalance prices resulting from an asset’s forecast generation differing from its actual generation. With the costs of managing the system increasing, balancing costs are also going up to the extent that they could have a considerable impact on PPA deals.

- Regulatory risk. This concerns the risk of aspects of the regulatory regime changing while the contract is still in force. With the responses to the energy crisis, PPA counterparties saw this risk increase considerably.

Contractual standardisation could help to reduce negotiation time, such as the use of standard clauses, limiting the negotiation process to commercial and project-related clauses only, and transaction costs, including reduced need for advisory services. The European Federation of Energy Traders, in cooperation with the Re-Source Platform, have developed one such template, free of charge and available in several languages, which offers a sound legal framework, as well as flexibility, allowing users to tailor the contract to their needs.

GoOs as the essential proof of renewable content

GoOs are electronic certificates that attest to the renewable origin of the energy that has been produced. They are instruments that can be traded separately from the associated energy. GoOs are also an essential component of RES PPAs where they are sold together with the contracted electricity. They are the element that allows buyers to make sustainability claims.

For years, the prices of GoOs across Europe were low, between €0.30-€0.40. More recently, this situation has changed, with GoO prices shooting up to highs of €9-10/MWh. They have now dropped slightly to €6-7/WMh, but remain high.

While in the past their low and stable prices made them a financially marginal element of PPA deals, the importance of which came mainly from their role as a disclosure instrument, the more recent price increases and growing market volatility have made them more financially relevant.

Negotiations on GoOs clauses are becoming more complex, with GoOs being increasingly priced separately from the associated electricity. Merchant structures are emerging, with possibilities for periodic changes to the price and the use of price floors or caps.

Renewables need long-term price stabilisation and short-term optimisation

RES PPAs are commercial instruments. As such, they are part of the wholesale electricity market in the same way as over-the-counter forwards and futures, and spot market contracts, both for day-ahead and intraday periods. Due to their long-term tenure, they belong to the forward market timeframe, the purpose of which is to offer opportunities to hedge the risk of future changes to electricity prices.

Due to their intermittency, renewable energy assets also require short-term optimisation close to real time. The allocation of shaping and balancing risks is a matter of negotiation and capabilities. It can also be outsourced to a third-party. Using the services of skilled traders acting as intermediaries could help parties optimise resources and reduce costs. The alternative would be developing one’s own trading capabilities.

Co-locating renewable energy assets with battery storage or demand-response capabilities, where this is possible, is also an area of growing interest. The assets can be contracted under the same PPA, which would reduce cannibalisation effects and extend the revenue certainty to the respective flexible assets. At the same time, the buyer would benefit from continuous renewable energy supply.

Such contracts could also offer benefits to the grid. The growing volumes of intermittent renewable energy are posing considerable challenges for grid management and development. If balancing can be done at the individual contract level and in the same location, then that would contribute to reducing grid management costs.

We need more renewable PPAs for the climate and for business resilience

In summary, renewable PPAs are a commercial instrument for the offtake of renewable energy, supported by evidence of renewable energy origin in the form of GoOs. They allow for the consumer-led growth of renewable energy.

This helps to reduce the need for public financial support and decrease the costs of the energy transition. They make renewable energy projects possible by providing the long-term revenue stabilisation required by lenders, and offer buyers visibility on long-term energy costs and shielding them from future price volatility.

We need more of them to accelerate the growth of renewable energy; the sheer volume of renewables growth that is required to reach Europe’s climate target means that public financial support is unlikely to be sufficient, while market-based instruments and mechanisms help to reduce the costs of the transition.

We also need more of them to improve corporate and industrial buyers’ competitiveness and resilience at a time when European businesses and industry have been severely impacted by the energy crisis of the past two years and global competitive pressures.

Author

Maria Popova is director for carbon neutrality and renewable electricity at the European Federation of Energy Traders, an association which represents more than 130 companies trading energy and environmental products across Europe. Maria has over 14 years of experience with European energy and climate policy and regulation and is currently focusing on the market-based growth of renewable energy and low carbon technology.