The Australian Energy Market Operator (AEMO) has reported that grid-scale solar generated an average of over 1.4GW in Q2 2024, a 132MW increase year-on-year (YoY).

The organisation’s Quarterly Energy Dynamics Q2 2024 report detailed that distributed PV and grid-scale solar output increased YoY, predominantly due to the addition of new capacity. The commissioning of new facilities in New South Wales (NSW) was a particular driver of this change.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Australia has established a target to reach 82% renewable energy in the country’s electricity mix by 2030. Solar PV has been lauded as a means to attain this target, particularly given the country’s favourable climate conditions. However, members of the Australian energy industry have questioned whether the country is on course to reach this target.

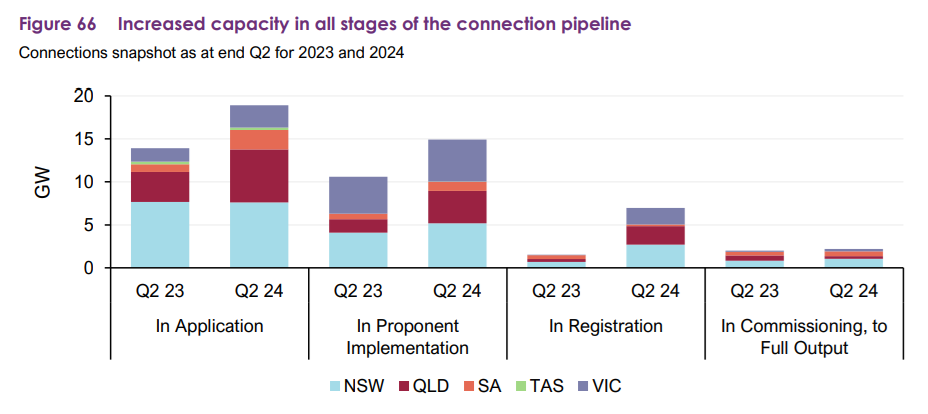

Solar also features heavily as the primary renewable energy generation technology to increase green energy on the National Electricity Market (NEM), covering Australia’s south and east coasts. AEMO’s report outlined that 43GW of new capacity is progressing through the end-to-end connection process from application to commissioning.

This represents a 50% increase compared to the end of Q2 2023. Around 40% of this capacity is in NSW, 29% in Queensland, 23% in Victoria and 10% in South Australia

Around 79% of projects are in the early stages of development, in either application or proponent implementation stages. Of these early stage projects, solar projects account for 46% of the total capacity under development, battery energy storage projects account for 32%, wind projects account for 14% and hydro projects account for 8%.

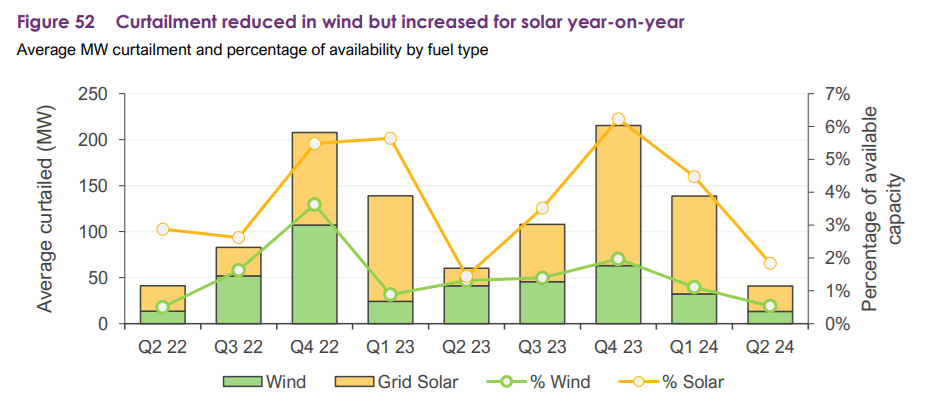

However, there is a growing recognition that transmission infrastructure investment must be scaled alongside the rollout of renewable energy generation technologies. Otherwise, the grid will not be able to accommodate all renewable energy generation. This results in curtailment and can have significant impacts on the price and availability of electricity.

Concerningly, AEMO’s report stated that grid scale-solar average curtailment increased from 19MW in Q2 2023 to 28MW this quarter, representing 1.8% of quarterly average availability.

The report also discussed solar energy’s role in determining prices. According to AEMO, grid-scale solar energy set prices more frequently in Queensland in the second quarter of 2024. This increased from 8% of intervals a year ago to 13%, as higher levels of coal-fired minimum generation and restrictions on southward exports led to solar energy more often dictating the marginal price in that region.

Finally, AEMO’s research found that established grid-scale solar facilities showed increases in quarterly volume-weighted available capacity factor in all regions except Queensland, yielding a small net increase in available output, an increase of 6MW, from existing solar farms.

The Queensland fleet still had the NEM’s highest available capacity factor at 20.1% this quarter. NSW had the largest increase from Q2 2023.