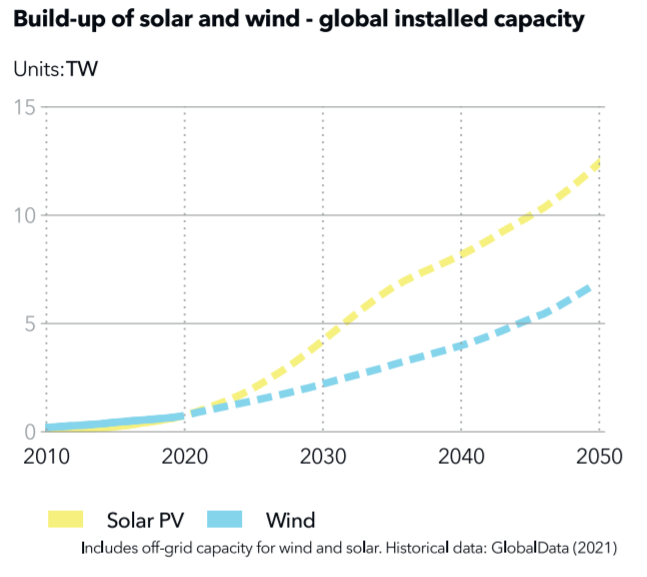

Solar PV will become cheaper, more efficient and more prolific over the coming decades, with more than 12TW installed by 2050, but its considerable contribution to global decarbonisation will not be enough to limit global warming to within 2 degrees Celsius, as called for by the Paris Climate Agreement struck at COP21.

With COP26 just two months away, that conclusion – reached by independent advisory DNV within this year’s edition of its Energy Transition Outlook – comes amidst a much wider warning issued by DNV that the world is simply not moving fast enough to avert a climate disaster. It should be enough to send global governments into crisis mode, invoking a response signalled in Glasgow in two months’ time.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Of course, the world can just sit and wait. The British Government, hosting the all-important summit, has talked a good game on clean energy issues but has been something of a laggard, while the US only rejoined the Paris Agreement earlier this year after what is perhaps best summarised as four years of climate madness. The world’s leading economies have the chance to grasp the nettle later this year and simply must do so.

Perhaps the most damning indictment of DNV’s Energy Transition Outlook is that, in the world’s response to the pandemic and in particular fiscal stimulus packages, the world was presented with a golden opportunity to affect a reset. To hit the climate panic button and restart economies anew. A post-COVID world could’ve been greener from the get-go. But instead, economies have reverted to type.

“The pandemic has been a lost opportunity,” writes DNV chief Remi Eriksen in his foreword, damning of nations that have used rescue packages to prop up industries that are simply not conducive to sufficient climate action. “Recovery packages have largely focused on protecting rather than transforming existing industries,” he says.

There are, however, exceptions to that damnation. DNV’s forecast is more optimistic regarding clean energy and its contribution to the overall mix than it was a year ago. Solar in particular is expected to expand exponentially this decade, the asset class’ generation capacity increasing 20-fold by 2050.

Other statistics included within DNV’s data-laden research only strengthen the case for solar’s dominance of the power sector. By 2050 more than one-third (36%) of all grid-connected power generation will be solar, with PV being the largest provider of power across the world. When combined with wind, the two sources will contribute nearly 70% of global power.

Key drivers of solar’s growing role in global energy systems are listed as power-to-x markets, increasing power connectivity, demand-side response, carbon pricing and, of course, energy storage. Storage in particular, when combined with PV, is already emerging as a “new power plant category”, DNV says, and colocated hybrid projects will make up 12% of all grid-connected power generators by 2050.

The combination will see solar-storage become more directly competitive with other baseload power generators such as nuclear – while also being cheaper – a development which could put the baseload power argument to bed once and for all. “Twinned with the plunging costs and advancing technology of battery storage, variable renewables are already enabling a phase out of thermal power generation and the business case will become overwhelming by 2030,” Eriksen says.

Together, standalone solar PV and hybrid solar-storage PV installations will amount to 12.4TW of capacity by 2050, with growth over the next three decades charted below.

| Installed capacity (2019) | Installed capacity (2030) | Installed capacity (2040) | Installed capacity (2050) | |

|---|---|---|---|---|

| Standalone solar | 601GW | 3.364TW | 5.807TW | 7.597TW |

| Solar-storage | 9GW | 665GW | 1.864TW | 3.852TW |

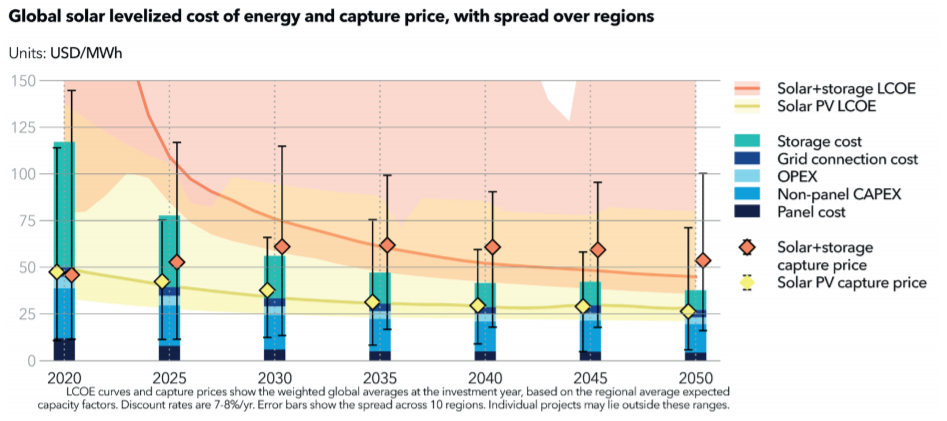

Solar will, predictably at this stage given its trajectory of the past decade, continue to tumble in cost, with both Capex and Opex forecasts falling. DNV’s levelised cost of electricity (LCOE) forecasts – detailed below – detail how costs will fall out to 2050, with hybrid solar-storage LCOEs in particular falling sharply between now and 2035.

Not only that, but solar will become a more efficient generator of power. Capacity factors are expected to increase from today’s average of 19% to a global average of 26% by 2050, driven by the growing adoption of single-axis trackers and bifacial panels. Furthermore, in selective, favourable regions capacity factors will exceed 30% by the end of this decade.

But that is not to say that solar PV, and indeed solar-storage, is not without its challenges. As significant quantities of zero-marginal cost renewables enter the system, wholesale power markets are expected to experience not insignificant volatility. DNV’s analysis shows in Europe alone power prices will hit zero for 8% of the time by 2050, meaning 88GWh – roughly 3% of solar’s total output on the continent – will need to be curtailed.

This price cannibalisation will impact on deployment rates, with annual solar PV installs expected to slow after reaching a peak of ~370GW per year around 2030. The grid, too, will remain a hurdle, and upwards of US$12 trillion will need to be invested to build a larger, more adaptable grid.

The notion of the grid and power market adaptability are not new or particularly surprising hurdles for solar to overcome. They’ve been known for some time and, truthfully, the industry is continuing to persevere and collaborate on solutions and workarounds to approach these.

But solar is now, clearly, entering a new phase. Released from the shackles of its nascent nature and relative market immaturity, the next decade will see solar PV establish itself as the eminent source of power across the world and the technology that is best-placed to do much of the heavy lifting required to decarbonise large swathes of global economies. It’s now time for global governments to respond to calls for greater urgency and truly allow solar PV to fulfil its potential. COP26 is in just two months’ time – world leaders must lift the expectations on solar and allow the technology to step up to the task at hand.