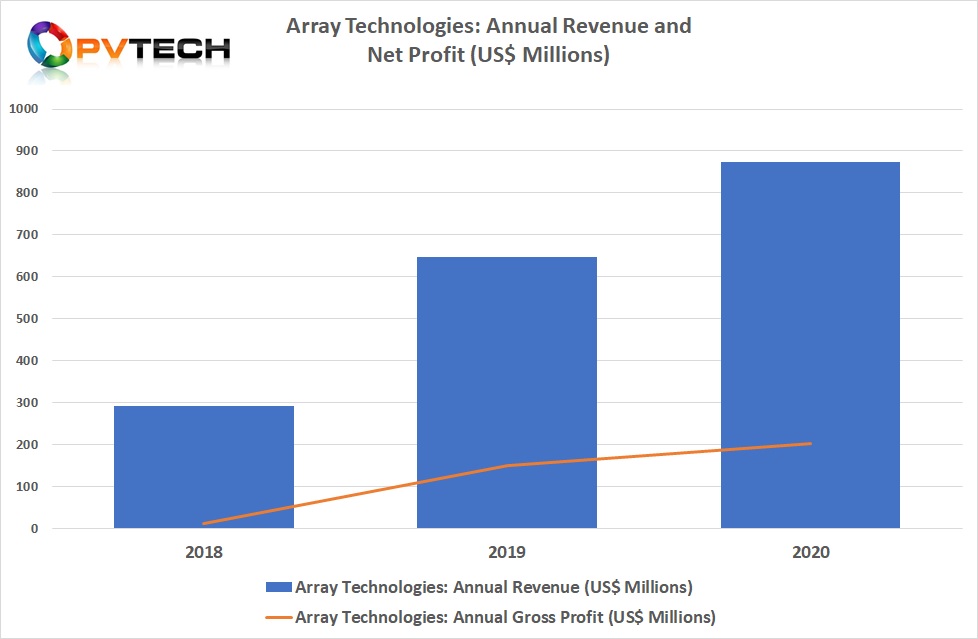

Major single-axis tracker supplier, Array Technologies has reported its first annual results after an IPO in 2020, achieving a 35% increase in revenue and gross profit.

The company reported record full-year revenue of to US$872.7 million, compared to US$647.9 million for the prior-year period, which was driven by an unspecified increase in tracker system volume sales and the expected ITC step-down in the US that was scrapped by incoming President Biden.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company reported gross profit increased to US$202.8 million, 35% higher than the previous year figures of US$150.8 million. Gross margin was basically flat with the prior-year period at 23.2%.

Array also reported a net income US$59.1 million, compared to $39.7 million during the same period in the prior year, an increase of 49%, year-on-year.

The company said that its total executed contracts and awarded orders at the end of 2020 was US$705.3 million, similar to the prior-year period, although figures were not disclosed.

The company noted that it added 38 new customers in 2020, including project developers that had an international footprint. This included UK headquartered Lightsource bp in 2020.

The majority of Array’s customer base and revenue recognition has historically been US-based.

Array said that it expected to recognise around US$654.2 million in revenue from its order backlog in 2020. However, management noted in the earnings call that this accounted for around 60% of expected 2021 revenue as more orders had been placed since the beginning of the year.

Guidance

Array expects full-year 2021 revenue to be in the range of US$1,025 million to US$1,125 million, representing a 23% year-over-year increase based on the midpoint of the guidance.

The company expects adjusted EBITDA to be in the range of US$164 million to US$180 million in 2021.

Jim Fusaro, CEO of Array Technologies commented, “In 2021, we remain focused on the three core growth strategies that we outlined on our third quarter conference call – continued market share gains in the US, international expansion and acquisitions of companies that provide complementary products, services or technology – and we are already making good progress. In the US market, we are continuing to grow our wallet share with existing customers as well as convert new customers to Array as demonstrated by our strong order book. Outside of the US, we are in the process of building the sales, supply chain and fulfillment infrastructure we need to service international customers. We expect to be able to accelerate the build-out later this year as travel restrictions and other challenges created by the pandemic abate. We also made a recent investment in a company with a unique technology that we believe could revolutionise the way utility-scale solar is installed.”