Solar PV and other renewables accounted for a record share of electricity generation in Australia’s National Energy Market (NEM) in Q4 2021 at 34.9%, while average wholesale prices rose with the higher cost of fossil fuels despite their share of the energy mix shrinking.

The trend was revealed in the Australian Energy Market Operator’s (AEMO) Q4 2021 energy dynamics report last week (28 January), which also showed zero or negative spot prices during the middle of the day thanks in part to rooftop and utility-scale solar.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Clean energy in the NEM accounted for an average of 34.9% of generation across Q4, up from 31.6% in Q3, with a peak supply of 61.8% on 15 November, beating the previous record of 61.4% set in Q3 2021.

Record levels of distributed solar, combined with less extreme heat days and cooler temperatures saw quarterly average operational demand fall to 19,876MW, its lowest Q4 average since 2005, said the report.

“The changing generation mix saw zero or negative spot prices occurring during 16.6% of all dispatch intervals during the quarter and a total of 11.2% for 2021, more than doubling 2020’s average of 4.9%,” said AEMO executive general manager of reform delivery, Violette Mouchaileh.

“Grid-scale solar, wind, hydro and rooftop solar PV continued to displace thermal generation, with black coal-fired generation falling to its lowest Q4 average since 1998, while gas generation declined to its lowest Q4 average since 2003,” Mouchaileh said.

Although renewables made up a greater share of the energy mix and electricity demand hit a record low in several Australian states because of a milder-than-usual end to the year, the higher cost of fossil fuels still caused wholesale prices to rise.

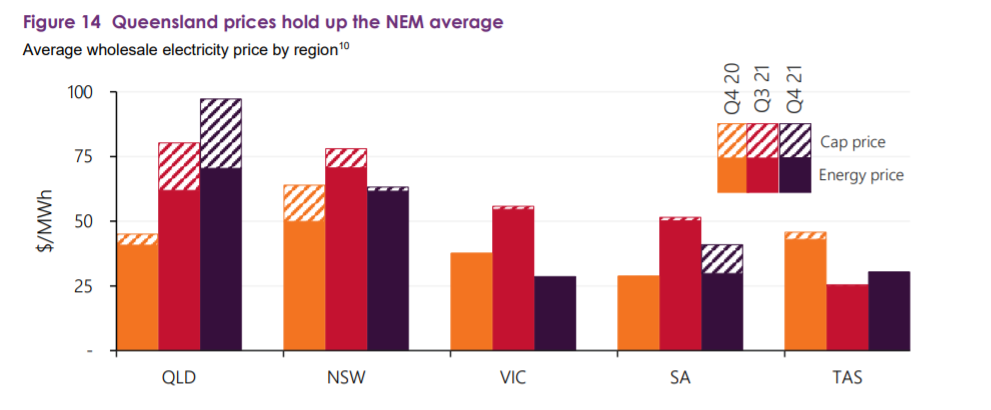

In the southern NEM regions, such as Victoria, spot prices fell or were stable. However, the larger share of fossil fuel-generated electricity in the states of Queensland and New South Wales, higher prices set by fossil fuel producers and limitations on transfers of lower cost energy contributed to an average AU$45/MWh (US$32/MWh) north-south price difference, Mouchaileh explained.

Queensland’s price of AU$97/MWh was its highest Q4 average on record, more than double the level last year, with price volatility in November and December lifting the region’s average by AU$27/MWh.

Conversely, Victoria’s quarterly average price of AU$28/MWh was its lowest Q4 average since 2014, with negative average spot prices between 9:25am and 2:20pm (AEST), while the overall average between 8am and 4:30pm was just AU$0.1/MWh.

NEM mainland electricity prices averaged AU$57/MWh (US$40.6/MWh) during the final quarter of 2021, which was below Q3’s average of AU$66/MWh but 31% higher than Q4 2020’s AU$44/MWh.

Meanwhile, emissions from electricity generation fell to their lowest quarterly total on record at 28 million tonnes carbon dioxide equivalent, which was 8% less than the previous quarterly low set a year earlier, according to AEMO.

Given the increasing share of renewables in Australia’s energy mix, and the pressure this puts on the national grid, AEMO has called for AU$156 million in funding over three years to 2025, a 66% increase on the previous period, to operate the electricity market in Western Australia, according to the Australian Broadcasting Corporation.

The organisation’s head, Daniel Westerman, has previously said he wants the country’s grids to be capable of handling 100% renewables by 2025.