The Australian National Electricity Market faces reliability issues over the next 10 years as coal plants retire and investment in renewables generation and storage continues to lag, according to the Australian Energy Market Operator (AEMO).

In its ten-year reliability outlook – the 2023 Electricity Statement of Opportunities report – AEMO amended its predictions for reliability issues across Australia in light of the country’s retiring coal fleet and anticipated hot, dry weather conditions that will increase electricity demand.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

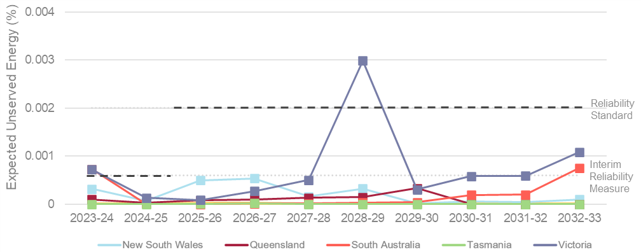

In a February report, it said that no mainland states would experience more than 0.002% “unserved energy” (USE) until 2027, a metric used by AEMO to indicate energy demand not met by existing infrastructure.

However, AEMO now expects that South Australia and Victoria will exceed the interim reliability standard of 0.0006% this summer, with the latter doing so consistently over the next ten years. The operator also expects South Australia to exceed the 0.002% standard from 2026, and Victoria to exceed this benchmark by 2028 respectively. New South Wales is also forecast to breach the reliability standard in 2025-26 and Queensland in 2028-29.

These figures were reached by considering only projects that AEMO regards as ‘committed’ or ‘anticipated’. ‘Committed’ projects are those that already meet AEMO’s criteria of land, contracts, planning, finance and construction; ‘anticipated’ projects have met at least three of these and provided a status update in the last six months.

AEMO did say that, if executed on time, state and federal plans for new transmission and generation projects could mitigate these risks.

CEO Daniel Westermand said: “Federal and state government initiatives, including transmission projects identified in the Integrated System Plan, and mechanisms delivering firming capacity, such as the Commonwealth’s Capacity Investment Scheme, can address many of the identified risks over most of the ten-year horizon, if delivered to schedule.

“There is also the opportunity for consumers’ rooftop solar, batteries and electric vehicles to actively participate in the power system, which would further reduce reliability risks.”

Australia is a world-leader in rooftop solar; last summer, rooftop solar generation contributed more to the country’s energy consumption than any other renewables source and brown coal generation with over 8GWh of power.

Specifically, AEMO identified a number of government incentives and schemes that could lessen the reliability risk, if they are supported by transmission upgrades as called for by the government’s Clean Energy Finance Corporation in April. They are:

- The federal Capacity Investment Scheme.

- The New South Wales Electricity Infrastructure Roadmap, and firming tenders.

- The Victorian Renewable Energy Target Auction 2.

- The Queensland Energy and Jobs Plan.

- The South Australian Hydrogen and Jobs Plan.

The reliability gaps themselves will come about as Australia’s coal generation fleet is decommissioned; 62% of the active coal today will be offline by 2033.

In tandem with this, investment into new renewables generation has been slow recently and the pipeline of projects in Australia for the coming years is relatively dry. Earlier this month the Clean Energy Council said that the slow investment trend in the first half of 2023 was ‘concerning’ for the country’s energy transition, particularly the lack of new financial commitments for future projects that would be connecting to the grid in 2025 and beyond.

Weather is due to play a part, too. The coming summer is expected to be hotter than previous years, which will drive up electricity demand. Increased electricity consumption from population growth and economic activity, as well as fuel switching from carbon generation to electrification across the economy.

“To ensure Australian consumers continue to have access to reliable electricity supplies, it’s critical that planned investments in transmission, generation and storage projects are urgently delivered,” Westerman said.