‘Silicon Module Super League’ (SMSL) member Canadian Solar reported first quarter 2018 financial results that were better than expected as revenue and shipments were higher than guided with further PV power plant sales completed in the quarter.

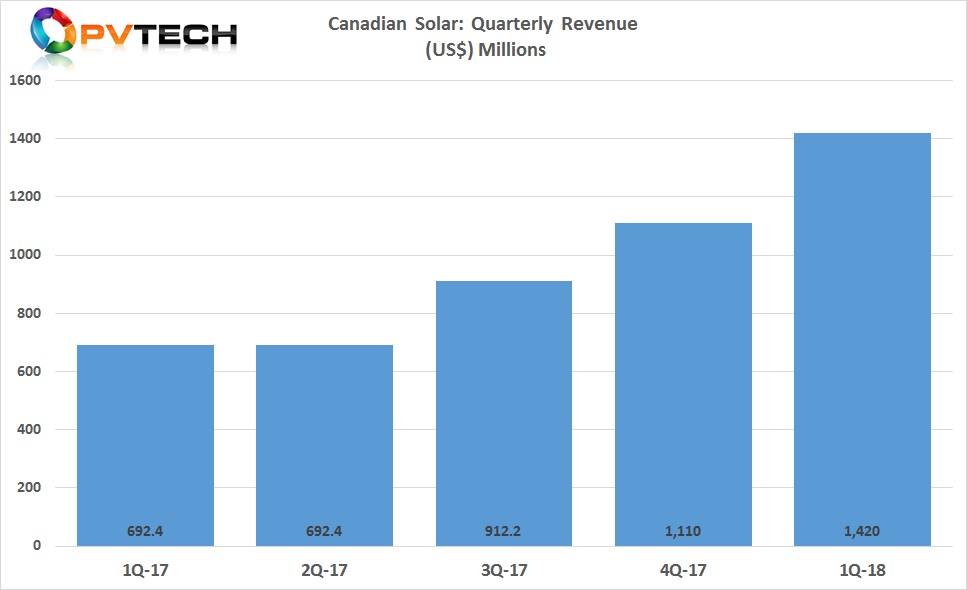

Canadian Solar first quarter 2018 revenue of US$1.42 billion, up 28.5% from US$1.11 billion in the fourth quarter of 2017 and up 110.5% from US$677.0 million in the prior year quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company reported a gross profit in the first quarter of 2018 of US$143.9 million, compared US$218.6 million in the fourth quarter of 2017 and US$91.4 million in the first quarter of 2017.

Gross margin in the reporting quarter was 10.1%, compared to 19.7% in the fourth quarter of 2017 and 13.5% in the first quarter of 2017, which was at the low-end of guidance of 10.0% to 12.0%.

The sequential decrease in gross margin was said to be primarily due to the low margin associated with the 309MWp of U.S. solar power plants sold in the quarter, partially offset by an increased module average selling price in the first quarter of 2018.

Dr. Huifeng Chang, Senior Vice President and Chief Financial Officer of Canadian Solar commented, “We are encouraged by our success in monetizing our solar power plants globally. During the quarter, we completed the sale of the 28MWp Gaskell West 1 project to Southern Power, sold 142 MWp of solar power plants in the U.K. to Greencoat and sold three solar power plants in the U.S., totaling 309MWp to KEPCO. Gross margin was in line with our guidance in the range of 10.0% to 12.0%, as we absorbed the impact of the lower margin solar power plants sales in the U.S. and higher than expected purchase prices for raw materials used in module manufacturing. We are working to secure approval for the sale of three other U.S. solar power plants totaling 399MWp. All together our actions have strengthened our balance sheet and allow us to redeploy our capital to support the profitable growth of our business and build value for shareholders.”

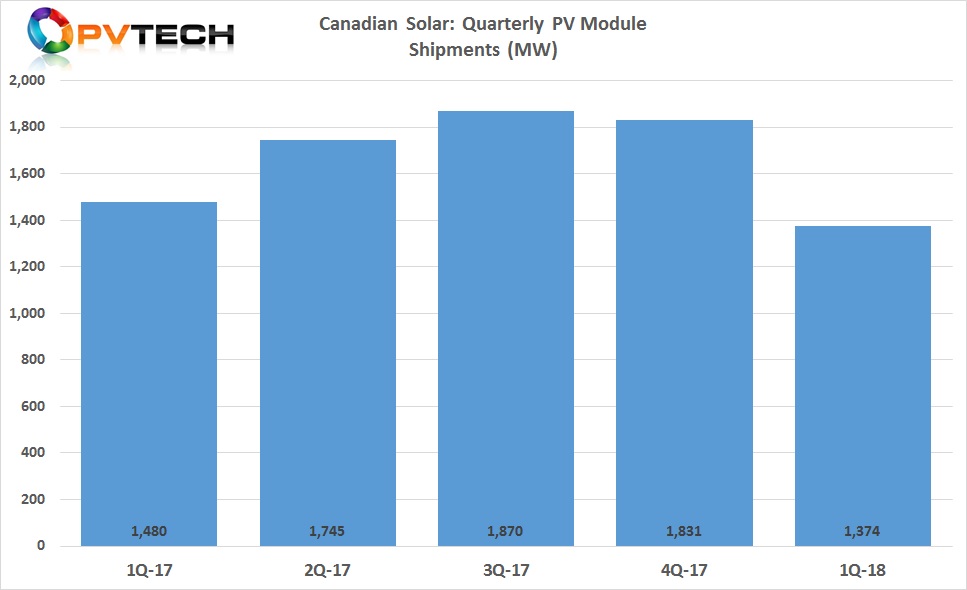

Canadian Solar reported PV module shipments in the first quarter of 2018 were 1,374MW, compared to 1,831 MW in the fourth quarter of 2017, which was slightly higher than previous guidance of shipments being in the range of 1.30GW to 1.35GW.

Inventories at the end of the first quarter of 2018 were $414.1 million, compared to $346.1 million at the end of the fourth quarter of 2017. The company noted that demand had impacted capacity utilisation rates, supporting the increase in inventory in the quarter.

Dr. Shawn Qu, Chairman and Chief Executive Officer of Canadian Solar commented, “Results for the first quarter 2018 are within our expectations, with solar module shipments and revenue exceeding our guidance. The capacity utilization level was lower than the fourth quarter of 2017, due to several reasons, including seasonally low demand and holidays in China, the Section 201 safeguard decision on solar products by the U.S. government and the safeguard trade investigations in India. On the positive side, we maintained a flat to slightly up module average selling price during the quarter.”

Manufacturing update

Canadian Solar only tweaked expected nameplate capacity levels by the end of 2018, compared with updates given in the previous quarter.

Ingot and wafer capacity is to be kept at 2GW and 5GW, respectively, while solar cell capacity is expected to reach 7,050MW by the end of the year, up slightly from 6,350MW guided in the previous quarter. PV module capacity is expected to increase marginally to 9,910MW, from 9,810MW guided in the previous quarter.

During its earnings call, Dr. Qu also noted that the company was shifting cell and module production to multi busbar and cell technology for its majority of capacity based on multicrystalline wafers, while it was increasing shipments of P-Type mono PERC (Passivated Emitter Rear Cell) technology, due to demand and market share gains in Japan.

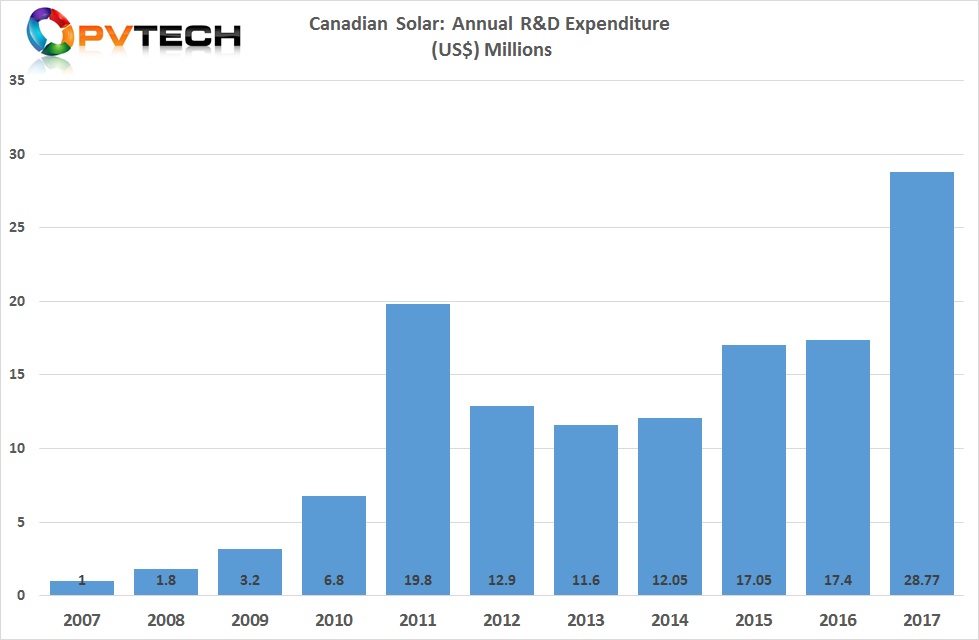

However, R&D expenditure increased to US$9.5 million in the first quarter of 2018, compared to $8.6 million in the fourth quarter of 2017 and $5.6 million in the first quarter of 2017.

Canadian Solar (Ranked 3rd) in PV Tech’s Top 10 Module Manufacturers list for 2017, has long been at or near the bottom of PV Tech’s annual analysis of R&D spending since 2007.

However, in 2017, Canadian Solar increased by R&D spending by US$11.4 million, or 65.3%, from $17.4 million in 2016 to US$28.8 million by the end of 2017. Breaking through the annual spend of less than US$20 million for the first time in its history, according to PV Tech’s analysis and is no longer an R&D spending laggard.

Guidance

Canadian Solar guided PV module shipments to be in the range of approximately 1.50GW to 1.60GW in the second quarter of 2018, which included approximately 100MW of shipments to its utility-scale, solar power projects.

Second quarter revenue is expected to be in the range of US$690 million to US$730 million and a significant boost in gross margin, which is expected to be between 20.0% and 22.0%.

“We expect a shift in global demand to developing markets to offset China, India and the U.S. We also expect demand in other markets to improve, including Europe, Africa, Argentina and Mexico. These trends align themselves with the Company's global footprint and should serve as a catalyst for continued growth,” added Dr. Qu.

The company did not revise full-year 2018 guidance from the previous quarter, which included module shipments of 6.6GW to 7.1GW and total revenue in the range of US$4.4 billion to US$4.6 billion.