Daqo New Energy has signed a ‘Procurement Framework Contract’ with a customer who will purchase 432,000 tonnes of solar-grade high-purity polysilicon from the company and its subsidiary Daqo Inner Mongolia between 2023 to 2028.

According to PV InfoLink’s latest data on the average price of mono dense polysilicon, which puts it at RMB303,000/MT (US$42,168, tax included), the estimated purchasing amount of the deal will be about RMB130.896 billion (US$18.2 billion, tax included). Although, the companies said the calculated price does not constitute a price commitment.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

On 25 October, the same day as Daqo’s deal was announced, TCL Zhonghuan announced that its subsidiary Tianjin Huanrui had recently signed a ‘Silicon Material Procurement Framework Contract’ with a supplier for the same amount of polysilicon over the same timeframe.

The contract agreed that Tianjin Huanrui will purchase 432,000 tonnes of solar-grade primary polysilicon from a supplier and its subsidiary from 2023 to 2028. The total trading amount, however, shall be subject to the final transaction and is expected to be about RMB63.1 billion (US$8.78 billion).

Although neither party has disclosed their partner, the procurement quantities are both 432,000 tonnes according to the announcements, with the same procurement term as from 2023 to 2028. It would be reasonable to infer that Tianjin Huanrui is buying the polysilicon from Daqo.

However, the biggest difference between the two announcements is the purchasing amount. The two sides have a large discrepancy in terms of the expected transaction amount for the 432,000 tons of polysilicon.

Daqo New Energy, which has seen its profits treble year-on-year following the high price of polysilicon, estimated that the purchasing amount will be RMB130,896 billion according to the latest average price of mono dense poly at RMB303,000/MT published by PV InfoLink.

TCL Zhonghuan made a prediction according to PV InfoLink’s quote forecast in October on the price of mono dense poly from 2022 to 2027. Calculated based on the average price of RMB146,000/MT, the purchasing amount is about RMB63.072 billion.

| Company | Polysilicon quantity (10,000 tonnes) | Estimated average price (RMB10,000/MT) | Estimated purchasing amount (RMB100 million) |

| Daqo | 43.2 | 30.3 | 1308.96 |

| TCL | 43.2 | 14.6 | 630.72 |

The two predicted amounts had a discrepancy of RMB67.824 billion based on mono dense poly’s current average price and predicted average price for next year, with the former twice as high as the latter. Industry analysts pointed out that the parties have different expectations, and the price gap of silicon materials will be further diverged next year.

TCL Zhonghuan said the contract is a long-term one that helps to ensure their raw material supply by locking in the quantity without sealing the price. Price will be negotiated on a monthly basis and purchases will be made in separated batches, which the company said was conducive to ensuring the stability of the company’s supply chain and enhancing silicon wafer business volume.

On the one hand, top silicon wafer companies try to guarantee their supply with long-term orders. On the other hand, top silicon suppliers are also relying on long-term orders for their future planning. The industry has been expecting reduced silicon prices moving forward as a load of new capacity is expected to come online in China in 2023, although demand is also expected to rise.

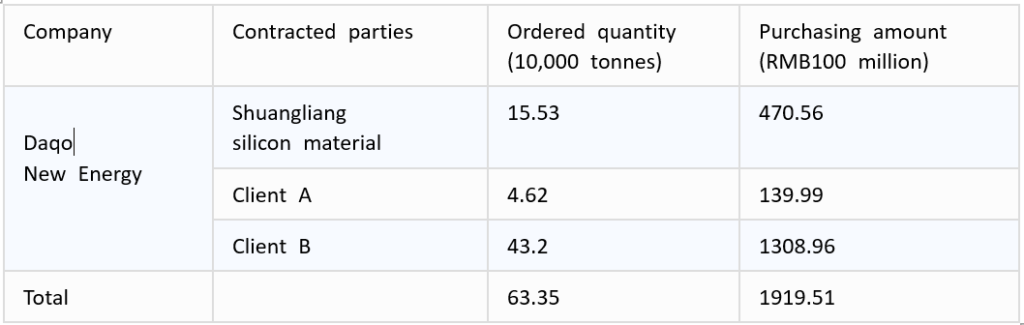

We can see that in addition to the contract signed with TCL Zhonghuan, Daqo New Energy also signed a long-term silicon order with Shuangliang Silicon Materials and another customer this month. Based on the estimated quote when the orders were signed, the quantity of the long-term orders within the month exceeded 630,000 tonnes, amounting to RMB191.95 billion.

Silicon material supply has been tight since the beginning of the year. Although Chinese manufacturers and many new players are expanding their capacity, the cycle takes a relatively long period of time in comparison with other links in the supply chain, so capacity release will be a gradual process.

For this reason, some people hold different views on the silicon price spread, noting that although the capacity is expanding, it will not catch up with expectations in the short term, so the tight supply will still bolster the price to some extent.