R&D spending patterns

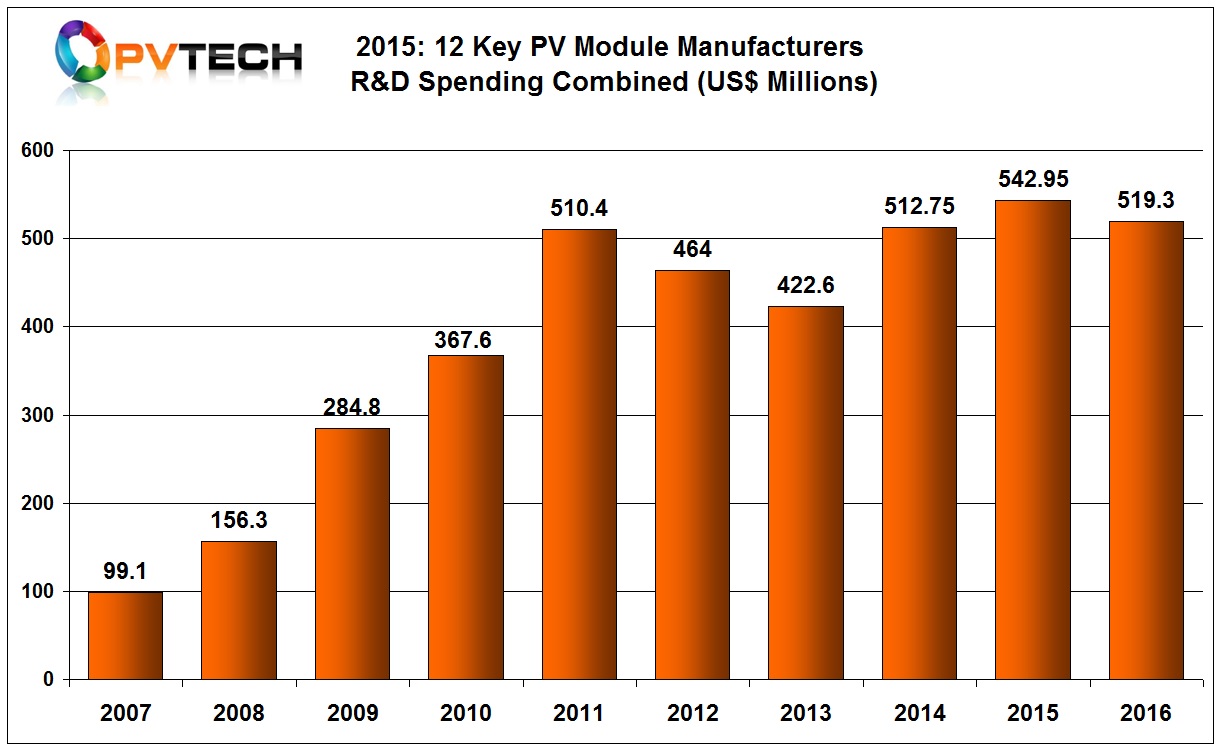

Combined R&D expenditures of 12 major PV module manufacturers in 2016, tracked since 2007, declined by approximately 4.4% in 2016 to US$519.3 million (see Chart1), compared to US$542.9 million in 2015. As 2015 expenditures were a new record high, 2016 becomes the second highest year of spending and 2014 the third highest. All three years highlight total combined annual R&D expenditures above US$500 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Interestingly, two expenditure peaks, both above the US$500 million mark have occurred in the last 10 years with 2011 standing out at US$510 million, being the first time the US$500 million mark was exceeded and five years later in 2015, when second peak occurred.

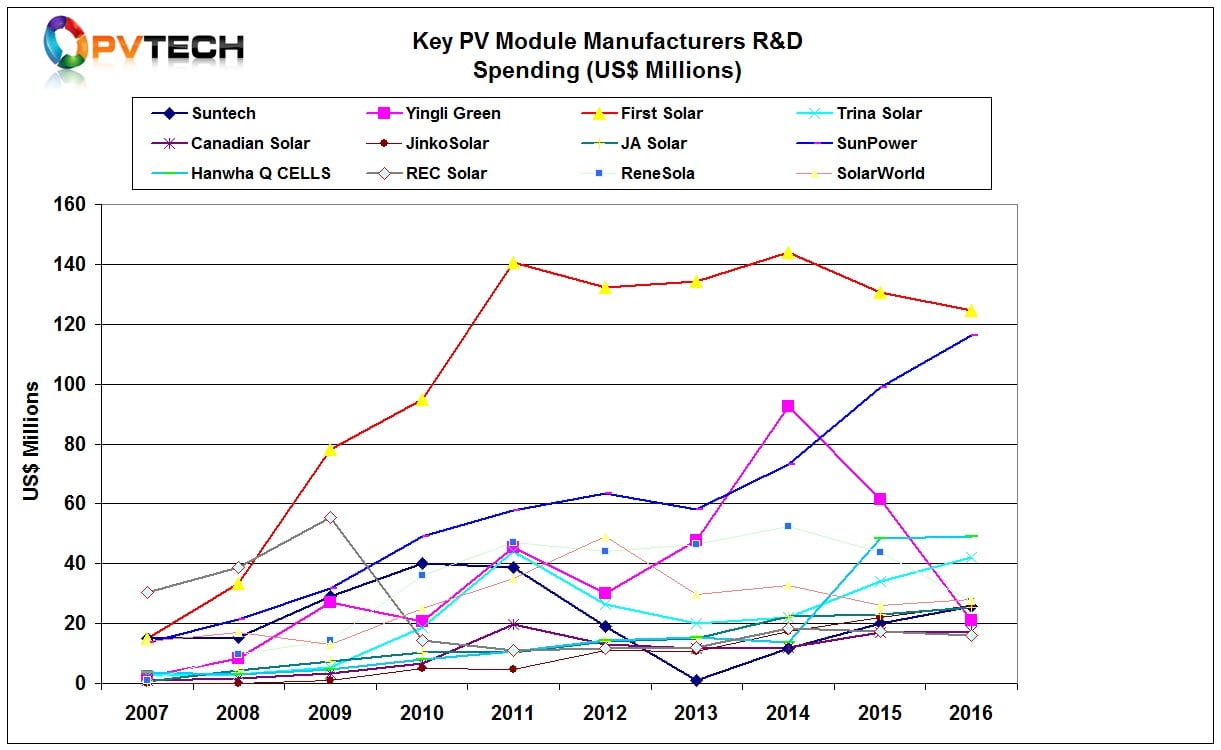

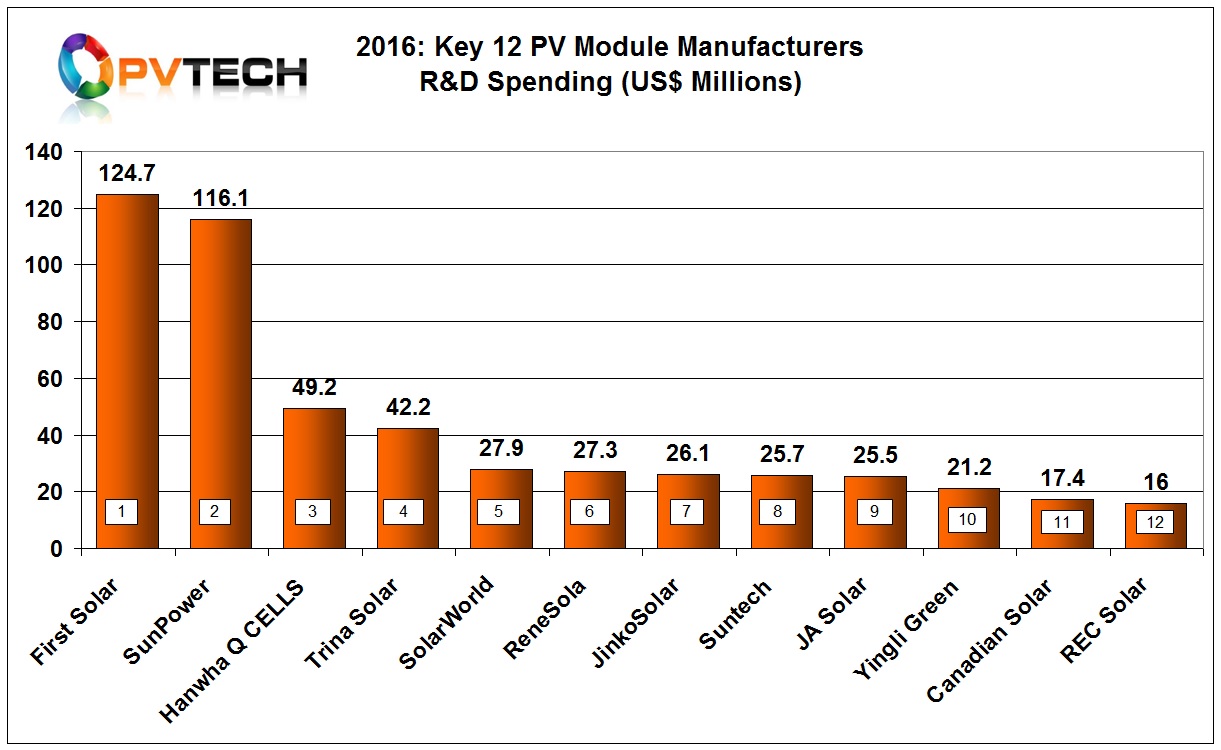

There were four manufacturers that reduced R&D spending in 2016 (see Chart 2), these included First Solar, Yingli Green, Renesola and REC Group. All four had also reduced R&D spending in 2015 from 2014 levels. R&D spending had bottomed in 2012, when the PV industry was going through its worst period of overcapacity, yet that year saw six companies reduced spending, many for the first time.

Notable in the expenditure decline year-on-year were Yingli Green, Renesola and First Solar, which reduced spending by 65.4%, 37% and 4.4%, respectively.

The overall increase in spending in 2014 and 2015 had led to more companies spending above the US$20 million mark annually, which left only two companies (Canadian Solar and REC Group) below that level. With REC Group estimated to have reduced spending slightly in 2016 and Canadian Solar making a marginal increase but below the US$20 million mark, no changes at this low level occurred in 2016.

Trina Solar was estimated to have moved into the above US$40 million to US$60 million range in 2016, which was populated by Renesola and Hanwha Q CELLS in 2015. However, with Renesola significantly reducing expenditures, only Trina Solar and Hanwha Q CELLS populated the US$40 million to US$60 million range in 2016.

The US$20 million to US$40 million range is now the most populated with six companies (SolarWorld, Renesola, JinkoSolar, Suntech, Yingli Green and JA Solar). More accurately, these six manufacturers are clustered tightly together with the lowest spender in this bracket being Yingli Green with US$21.2 million spent on R&D activities in 2016 and the highest, SolarWorld spending US$27.9 million in 2016 and before its bankruptcy and subsequent rebirth.

In relation to the two manufacturers (First Solar and SunPower) in the top echelons of R&D expenditure the gap between the two firms has closed significantly for the first time. With First Solar reducing spending for two years in a row and SunPower increasing spending three years in a row, resulting in the two companies being separated by only US$8.6 million, compared to US$31.6 million in 2015 and US$70.6 million in 2014.

Both First Solar and SunPower spent over US$100 million each on R&D activities in 2016, which was the first time for SunPower (US$116.1 million) and the sixth time (consecutively) for First Solar (US$124.7 million).

On a year-on-year R&D expenditure increase basis, Trina Solar was estimated to have increased spending by around 24%, while Suntech and JinkoSolar reported the same 17.5% increase and SunPower a 17.3% increase. Other manufacturers (Hanwha Q CELLS, Canadian Solar, JA Solar and SolarWorld) increased spending in the single-digit percentage range.

R&D staffing patterns

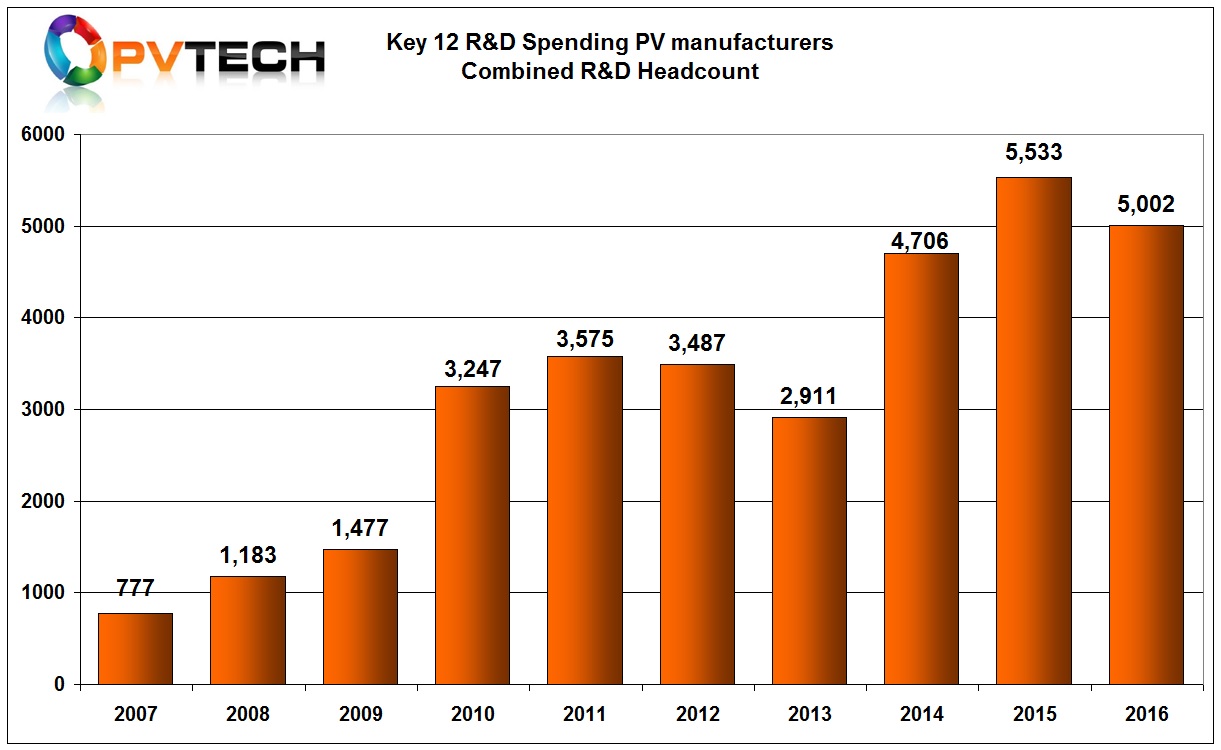

A key difference in 2016 to previous years covered by this report was the higher decline (9.5%) in the number of employees designated to R&D activities than when R&D expenditure also declined but at a lower (4.4%) rate.

After a major decline in the number of employees designated to R&D activities in 2013, staffing levels have rebounded strongly. Having reached an initial headcount peak in 2011 of 3,575, numbers declined to a low of 2,911 in 2013. With higher spending came increasing staffing as well as the previously highlighted, re-designation of R&D personnel at Yingli Green in 2010 and Trina Solar in 2014, which significantly weighted overall staffing levels higher.

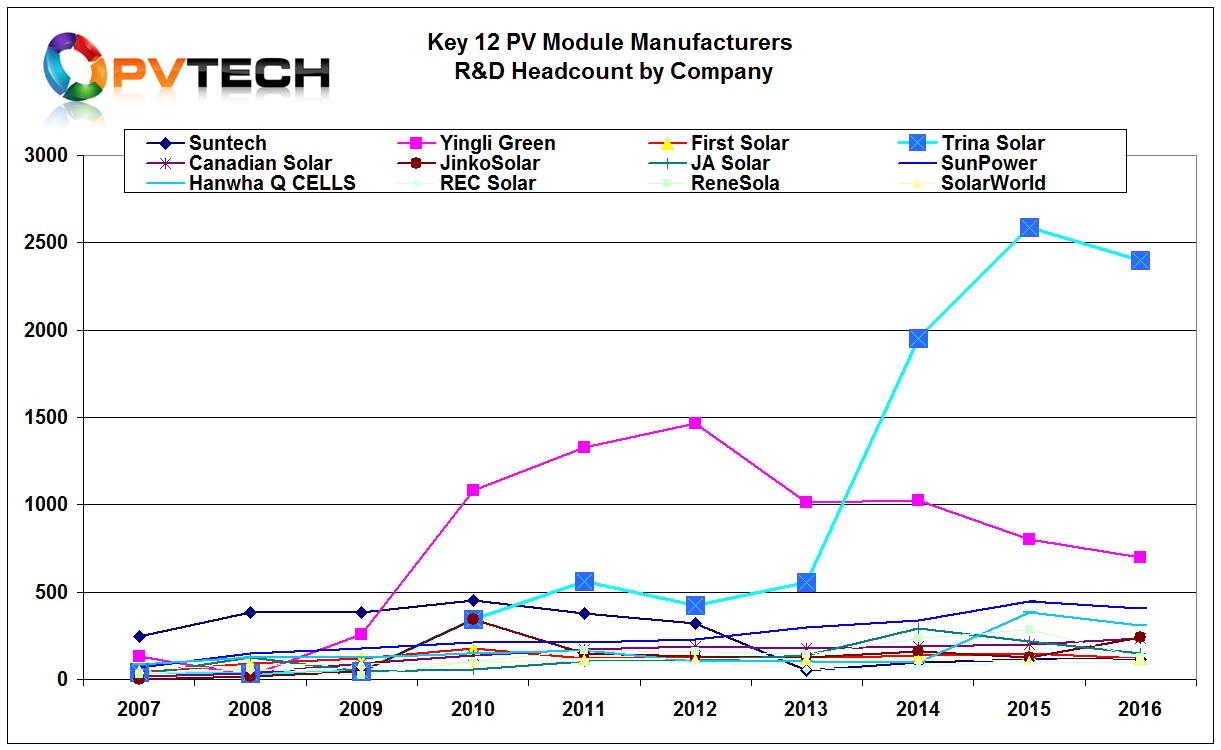

A total of eight manufacturers in 2015 added R&D headcount. However a total of nine manufacturers (including estimated) reduced R&D headcount in 2016 (See Chart 4) These included manufacturers (Trina Solar, JA Solar, SunPower and Hanhwa Q CELLS) that actually increased R&D spending in 2016.

The four manufacturers (First Solar, Yingli Green, Renesola and REC Group) that reduced R&D spending in 2016 also reduced R&D headcount in 2016. It should be noted that both First Solar and REC Group headcount are estimated and the reductions negligible.

The standout reductions in R&D headcount come from ReneSola (162), Yingli Green (103) Trina Solar (188 estimated), Hanwha Q CELLS (78) and SunPower (43).

The R&D headcount reductions in 2016 from the four highlighted manufacturers are generally due to restructuring, cost reductions and business transitions. In the example of Yingli Green, a major restructuring has been underway, resulting in a massive 3,908 headcount reduction by the end of 2016. A company in transition away from manufacturing, ReneSola also reduced its overall employee headcount by 524 in 2016. On-going cost reduction strategies at Hanwha Q CELLS led to 1,901 job losses in total in 2016.

In contrast, SunPower actually increased its overall headcount in 2016 by 1,714. However, SunPower has since closed facilities and is undergoing a major restructuring effort.

The total number of employees designated to R&D activities from the 12 PV module manufacturers tracked was 5,002 in 2016, down from 5,533 in 2015, a decline of 531 or 9.5%.

R&D spending rankings in 2016

Once again there were certain changes to the spending rankings (See Chart 5) as cuts impacted the middle cluster of manufacturers, while the gap at the top may have closed sharply, there were no changes to the rankings for the first and second positions in 2016.

First Solar

First Solar once again has been ranked first in annual R&D spending, making it the eighth consecutive (2009 – 2016) year for the CdTe thin-film module manufacturing leader, despite a second year of expenditure reductions and confirms the view highlighted in the 2015 report that R&D spending would seem to have peaked in 2014.

The decrease in R&D expenditure was partially due to a lower R&D headcount but also the cycle in developing its large-area Series 6 modules, with emphasis shifting to capital expenditures to completely migrate all manufacturing (including new build) to its next-generation CdTe modules. Less emphasis is also being attached to PV systems development, such as trackers, preferring to collaborate with leading third party suppliers, especially with the Series 6 module transition.

The company is continuing to operate its ‘vertical integration’ R&D model from advanced research to product development through to manufacturing roll-out, which includes continue module conversion efficiency improvements, despite the large-area module format change.

First Solar held two world records for CdTe PV efficiency, achieving an independently certified research cell efficiency of 22.1% and a full-area module efficiency of 18.2%.

SunPower Corp

SunPower was ranked second in 2016, the second consecutive year for the company that has the highest efficiency solar cells and modules that deploy IBC (Interdigitated Back Contact) cell technology.

In fairness to SunPower, apart from one year (2014) when Yingli Green spent more on R&D than SunPower, it had easily been the second highest spender since 2010.

The boost in spending in 2016 does not correlate to increase R&D staffing levels, instead its surrounds its P-Series module and new PV systems development and roll-out for residential, commercial and utility-scale downstream markets.

The increase can also be attributed to establishing a new R&D facility at its headquarters in San Jose, California. Only recently has SunPower Corp said that it had invested around US$25 million in the last 12-months on the facility, which includes several high-volume production-sized manufacturing tools and automation, and specialized testing equipment, designed to support its next-generation of high-efficiency N-type monocrystalline IBC solar cells and modules, which are being designed with greater emphasis on lower cost manufacturing. The new facility was said to be housing around 100 engineers and support staff.

SunPower noted that the new R&D facilities pilot line, which had already produced the first next-gen module to replace its X Series (25% conversion efficiency) solar cells (22% conversion efficiency) modules.

Hanwha Q CELLS

Despite an R&D headcount reduction, Hanwha Q CELLS moved up the rankings in 2016, due to spending almost US$50 million and Yingli Green’s continued drastic spending cuts due to major restructuring of the company. The company was ranked third in the spending rankings in 2016, up from fourth in 2015.

R&D focus continued to be centred on P-type multicrystalline PERC and mono-PERC cell efficiency gains and production cost reduction initiatives such as migrating all capacity to the larger (156.75mm by 156.75mm) wafer size.

Average P-type multi PERC cell conversion efficiencies have reached 20% and 22% for P-type mono PERC cells. Other R&D efforts have continued on LID and PID process limitation.

Trina Solar

Increased R&D spending in 2016 helped Trina Solar jump from being ranked sixth in 2015 to being ranked fourth in 2014. The company also benefited from the spending cuts by Yingli Green and ReneSola to move up two ranking positions.

Trina Solar had increased R&D spending in the first half of 2016, compared to the prior year period. However, due to delisting from the NYSE the company was not obliged to provide further quarterly reports or a 2016 annual report.

This meant that full-year 2016 R&D spending figures and R&D headcount numbers was estimated based on the first half year publically reported details.

Recently, Trina Solar reported that R&D efforts with N-type monocrystalline IBC solar cells had led to a conversion efficiency of 24.13%, which was verified by the Japan Electrical Safety & Environment Technology Laboratories (JET). This was produced on 156×156 mm solar cells with a low-cost industrial IBC process, featuring conventional tube doping technologies and fully screen-printed metallization. In December 2014, Trina Solar announced a 22.94% total-area efficiency for an industrial version, large size (156x 156mm2, 6″ substrate), IBC solar cell.

The company has also been developing PERC and bifacial cells in recent years and reported in 2016 that it had achieved a new world conversion efficiency record of 22.61% for a high-efficiency P-type monocrystalline PERC solar cell, independently confirmed by the Fraunhofer ISE CalLab in Germany.

SolarWorld AG

SolarWorld AG increased R&D spending to US$27.9 million in 2016, up from US$25.9 million in the previous year. Also benefiting from spending cuts at Yingli Green and ReneSola, the company was ranked seventh in 2015 but moved up two positions to fifth in 2016.

The company has focused resources on high-efficiency P-type multicrystalline and monocrystalline PERC solar cell development in recent years including bifacial cells. However, the company realigned to focus on mono-PERC and bifacial technology.

The company had achieved average efficiencies of over 22.0% with PERC cells manufactured on its high-throughput pilot line with 5BB and M2 large area 156mm x 156mm wafers. SolarWorld was working on conversion efficiencies above 24.0% that retained screen-printing PERC and other process improvements.

However, in May 2017 the company entered insolvency proceedings but its German manufacturing and R&D operations were acquired by former founder and chairman of SolarWorld AG, Dr. Ing. Eh Frank Asbeck, which included manufacturing and R&D operations under the subsidiaries SolarWorld Industries Sachsen GmbH, SolarWorld Innovations GmbH as well as SolarWorld Industries Thüringen GmbH.

The new company, SolarWorld Industries plans to continue to focus on mono PERC and bifacial cell R&D and production in partnership with Qatar Solar Technologies, its new 49% shareholder.

ReneSola

With ReneSola cutting both R&D expenditure and headcount in 2016, it was relegated to fifth from fourth in the rankings, spending US$27.3 million that was primarily attributed to continued development of technologies to manufacture high-conversion efficiency solar cells with improved performance.

The company was able to achieve conversion efficiency rates of 21.1% for P-type monocrystalline cells and 18.6% for P-type multicrystalline cells manufactured using its in-house developed solar wafers.

However, ReneSola is transitioning its business to become a downstream PV project developer and in 2017 has announced a potential sale of its manufacturing and therefore main R&D operations.

JinkoSolar

Having been a perennial low spender, JinkoSolar was ranked seventh in 2016, up two ranking positions from ninth in 2015 after spending US$26.1 million on R&D, compared to US$22.2 million in the previous year.

The company outstripped spending by JA Solar in 2016 and was supported by the spending cuts forced upon Yingli Green as it restructured its operations.

JinkoSolar begun research on its “Eagle+” solar modules, which are expected to have multicrystalline cells that reached conversion efficiencies of approximately 20.4% in lab tests by a third party in 2016. The company has also achieved a record P-Type multicrystalline cell efficiency of 21.63% in 2016.

The company also made a decision to increase P-type mono PERC R&D including migrating to diamond wire and ‘black silicon’ texturing.

Wuxi Suntech

Wuxi Suntech now the PV module manufacturing arm of Shunfeng International Clean Energy (SFCE) increased R&D spending to US$25.7 million in 2016, up from US$20.2 million in 2015 after full integration into SFCE.

R&D activities have focused on continued efficiency improvements for PERC cell technology. The company has achieved average cell efficiency of over 21%, and champion cell efficiency of 21.3% in production.

The company continues to collaborate on a hydrogenation process with the UNSW and confirmed the development and testing with Taiwan Carbon Nanotube Technology Corporation (TCNT) of a high-strength, lightweight carbon and glass fiber composite PV module frame, the first such development of its kind in the PV industry.

JA Solar

Although JA Solar increased R&D spending in 2016 to US$25.5 million, up from US$23 million in 2015 it was ranked ninth, compared to eighth in 2015.

Importantly, JA Solar is the only manufacturer in the group study that has increased R&D spending consecutively for the last 10 years, a remarkable feat, considering the dynamics of the PV industry.

The company has continued to develop high-efficiency multi and mono technologies having introduced its monocrystalline PERCIUM series utilizing PERC technology with an average conversion efficiency of over 21.0%, and its multicrystalline RIECIUM series utilizing RIE (Reactive Ion Etching) texturing to enable the use of diamond wire technology on multicrystalline wafer and has conversion efficiencies of over 19.2%.

A key focus of development has been bifacial PERC-based cell and module development in 2016, which led to new product introductions in early 2017.

Yingli Green

Major financial issues have forced Yingli Green to drastically cut costs across its entire operations in the last two years. With R&D spending cuts, Yingli Green was ranked tenth in 2016, down from third in 2015.

However, Yingli Green continued to invest in its Project PANDA, a research and development project for next-generation high efficiency monocrystalline PV cells, established back in June 2009. The company noted that by the end of 2016, it had achieved an average cell conversion efficiency rate of 20.8% on the PANDA (N-type mono PERT) commercial production lines.

Further development is on-going to improve N-PERT cell performance with doping, passivation and metallization enhancements. Yingli’s roadmap is aiming for 22% efficiency of N-PERT cell for production.

The company also had its PANDA bifacial module receive China’s ‘Front Runner certification at the end of 2016 and is the leading supplier of the technology to date and is aiming to develop a bifacial cell with bifaciality greater that 95%.

Canadian Solar

Canadian Solar has continued to place greater emphasis on module efficiency improvements, focused on P-type multicrystalline technology and has been a perennial low spender on R&D.

The company allocated US$17.4 million to R&D activities in 2016, up slightly from US$17.05 million in 2015. As a result the company just about traded places with estimated spending from REC Solar to be ranked eleventh, compared to twelfth in 2015.

Canadian Solar began commercializing its in-house developed black silicon technology, Onyx technology, on multicrystalline wafers to be used with PERC technology, which entered mass production in March 2016.

Indeed, Canadian Solar is placing a potentially risky bet on pushing ahead with this technology combination after stating at the PV CellTech conference in early 2017 that it would continue to focus on this technology in R&D. However, the company also has small-scale initiatives on N-type bifacial and heterojunction cell development.

REC Group

We have estimated that the REC Group continued to tweak R&D expenditures slightly down from US$17.4 million from figures provided by the company that year to around US$16 million in 2016.

This meant it traded places with Canadian Solar, almost six times larger, from a module manufacturing capacity standpoint to be ranked twelfth in the R&D spending rankings in 2016.

The company was sold to Bluestar in late 2014 and delisted from the Norwegian Stock Exchange in 2016.

With the adoption of PERC cell technology and an ongoing transition to 100% P-type multicrystalline PERC production with half-cut cells, R&D intensity into PERC was expected to slowdown and therefore R&D expenditure lowered in 2016.

However, spending on PERC efficiency and production cost reductions was expected to account for a key percentage of R&D expenditure in 2016 and beyond. The company had focused on improving light capture of PERC cells and migrate to 5BB technology to reduced cell resistance in 2016.

R&D efforts were expected to continue in the field of diamond wire and black silicon technology ahead of the migration in 2017. Like other previously exclusive multicrystalline manufacturers, development of monocrystalline PERC product offerings would also receive investment in 2016 and beyond.

Cumulative R&D spending rankings and analysis

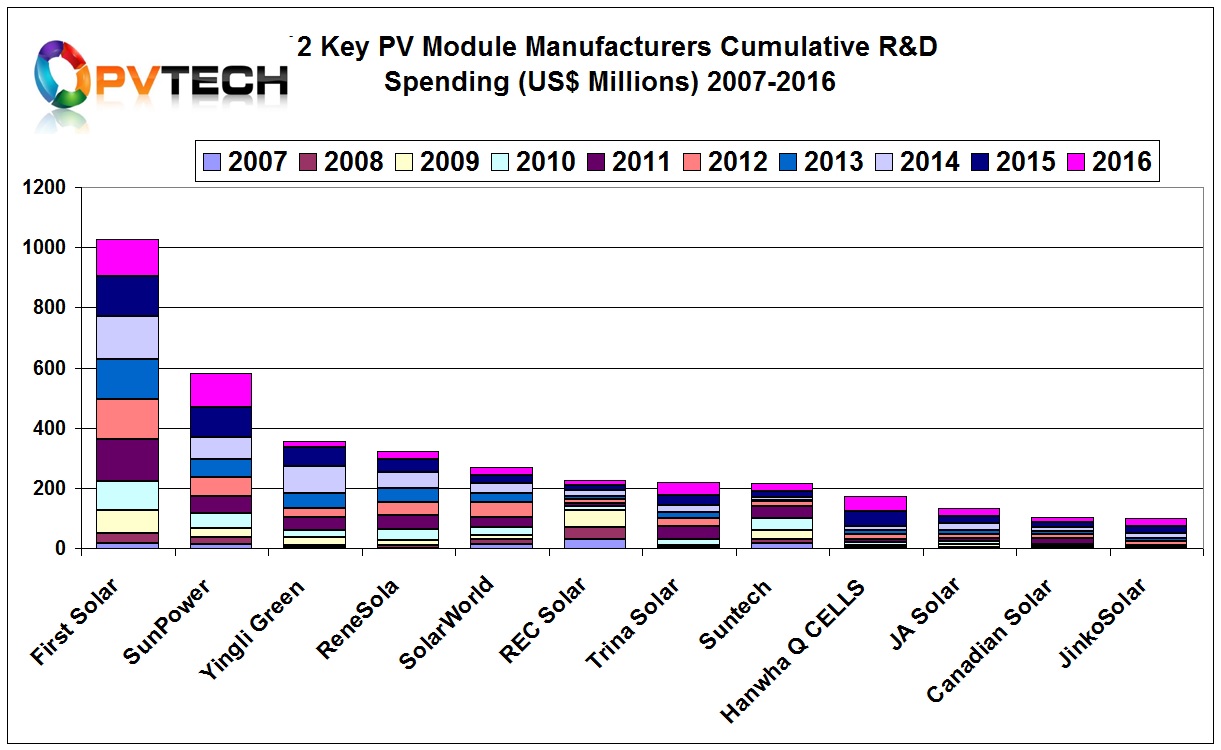

As previously highlighted in our 2015 report, we expected First Solar to exceed the US$1.0 billion mark in cumulative (since 2007) R&D spending. Indeed, First Solar surpassed that mark in 2016, reaching a cumulative US$1,027.8 million in R&D expenditure, making it the first module manufacturer to do so.

First Solar has no equal in the PV industry for investment in R&D activities over the last 10 years.

Second in the cumulative R&D spending rankings is SunPower, which was expected to surpass the US$500 million market in 2016. Through much of the period, SunPower has been ranked second or third in annual spending and with its increased spend in 2016, easily surpassed that figure reaching a total spend of US$583.2 million over the last 10 years.

SunPower is only the second company to surpass cumulative R&D spending of over US$500 million, a figure not expected to be reached by another company over the next four years or more.

Due to its previous high R&D expenditure and PV market leadership position, Yingli Green is the third ranked for cumulative R&D spending. The company reached cumulative R&D spending over the last 10 years of US$356.7 million.

In fourth place is ReneSola, having cumulative R&D spending over the last 10 years of US$322.8 million. Since 2010, ReneSola had been a consistently high investor in R&D activities, which only in 2016 experienced a significant decline, due to its business transition. R&D spending peaked in 2014 at US$52.6 million.

SolarWorld was ranked fifth with cumulative R&D spending over the last 10 years of US$269.4 million. The company had spent no less than US$25 million per annum from 2010 onwards and peaked spending just short of US$50 million in 2012.

In the middle of the field, REC Solar, Trina Solar and Suntech had cumulative R&D spending of US$225.5 million, US$218.8 million and US$215.9 million, respectively over the 10 year period.

Three companies, Hanwha Q CELLS, JA Solar and Canadian Solar had cumulative R&D spending of US$171.4 million, US$132.4 million and US$103.6 million, respectively, highlighting spending over the 10 year period was below the US$200 million market but above the US$100 million level.

The only company that had cumulative R&D spending below US$100 million was JinkoSolar, which achieved a total spend of US$98.3 million between 2007 and 2016.

What does 10 years of R&D spending tell us?

On the surface, the most telling aspect of tracking R&D spending for a decade is the lack of correlation to market leadership, notable by JinkoSolar’s current leadership position and that of Trina Solar, preceding 2016 for two years.

Perennial laggard Canadian Solar has also supported that thesis having climbed the rankings tables (of annual module shipments) in recent years to become the third largest producer.

At the other end of the scale, First Solar and SunPower have dominated R&D spending levels in this period and yet only First Solar topped the rankings table for a short period. Although retaining a top 10 position for many years, it has been surpassed by companies with a need to spend a fraction in R&D to be leaders.

Worse is the position of SunPower through the last 10 years, having lost market share and ranking positions almost throughout the period without fail.

Interestingly, both SunPower and First Solar have proprietary technologies that require custom production equipment yet both are in major manufacturing transitions. It would be highly unlikely either company could come out the other side stronger without the history of investment in R&D.

Time will tell if that theory holds true but it is reasonable to assume that a major technology transition by the likes of JinkoSolar or Canadian Solar would not make the companies stronger given the lack of investment.

Indeed, JinkoSolar has probably seen the writing on the wall and started a major boost in R&D spending a few years ago. This has been led by p-type mono PERC expansions and less reliance on P-type multi technologies. In contrast, Canadian Solar is sticking with P-type multi technologies, so time will tell if that strategy works.

It should also be noted that until 2015 there had not been a major technology buy cycle with a significant migration to PERC technology and the adoption of IBC and HJ technology outside historical incumbents SunPower and Panasonic, respectively.

What we are alluding to is that 10 years of R&D spending behaviour has not forward projected market leadership, unlike what has been seen in the semiconductor industry. That said, 10 years of R&D spending behaviour in the solar industry may take longer to work its way through. Clearly, that theory rests with the likes of First Solar and SunPower over the next few years.

End of an era

Reflected throughout the 2016 report has been the increased reliance on estimated figures. When the analysis originally began, all 12 manufacturers were publically listed companies and therefore official and verifiable figures were available.

There had been moments when estimates had to be made, such as when Suntech was bankrupt but was soon back in action in another publically listed company, enabling continued reporting. Problems occurred when REC split into two companies but these two companies remained public.

However, a few years later, REC’s module manufacturing arm was acquired by a private Chinese enterprise and has since stopped providing the necessary figures for this report. Trina Solar, the second largest PV manufacturer in 2016 went private before having to release official figures for 2016, adding to the need to use estimates.

The issues continued to mount in 2017, when SolarWorld entered insolvency proceedings and, although back in business, it is no longer publically listed and estimates would have to be used for the next report. The same could happen with ReneSola, with its manufacturing operations potentially spun-off into private hands. JA Solar and JinkoSolar could follow Trina Solar in delisting and going private as well.

Already four of the twelve manufacturers have gone private and the study has become significantly less representative of the sector than in the past. The greater dependency on estimated figures would also further undermine the value of the report and its analysis in the future.

We should all be aware of how dynamic and sometimes brutal the PV manufacturing industry can be and this report has clearly plotted some of those events over the years, not least the first major industry downturn.

However, we have been closely watching the rise of other manufacturers in the last few years, notably LONGi Solar, GCL-SI and more recently Jolywood, all publically listed in China with the possible inclusion in a new collection of companies with those still relevant from our original group since 2007.

With the uncertainties surrounding how many companies will still be relevant to continue with from the original group and how best to integrate much newer companies, means that it is definitely an end of era with this report, but a decision on continuing, although with new additions, will be made at a later date.