EDIT: This story has been amended from its original version to clarify that the subject matter relates to Hangzhou First Applied Material and not Applied Material. PV Tech would like to apologise for any confusion caused.

Market leading PV module film material manufacturer Hangzhou First Applied Materials has reported soaring profits on the back of growing demand, increased capacity and higher average selling prices (ASPs) for the fourth quarter and full-year 2020.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

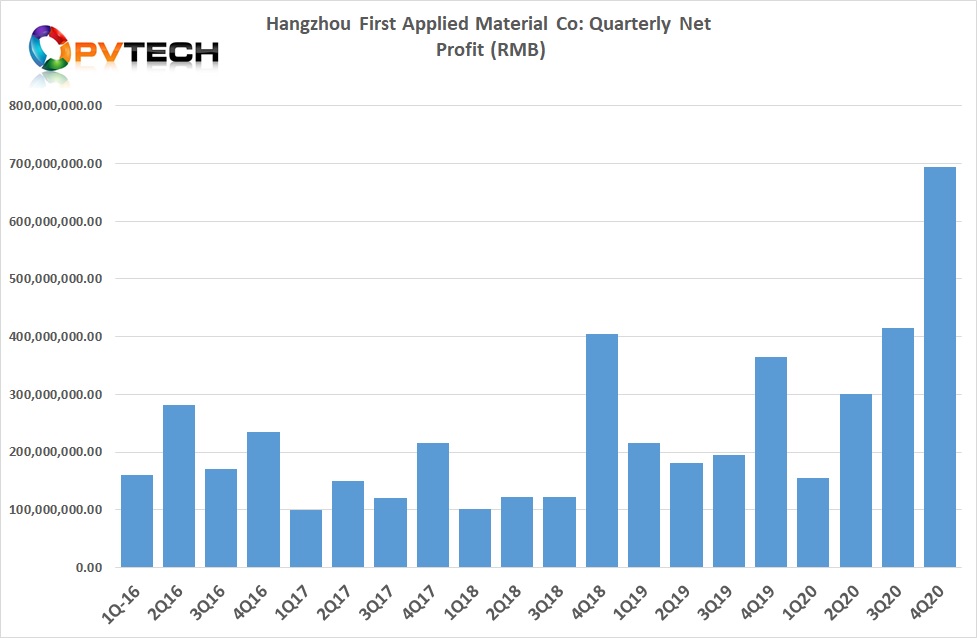

The market leader in PV backsheet materials was able to rebound strongly from the impact on its operations from COVID-19 in the first quarter of 2020, and reported three consecutive quarters of record revenue coupled to two consecutive quarters of record net profits. Fourth quarter net profits of RMB698.71 million (US$106.4 million) were almost double the US$55.73 million reported in the fourth quarter of 2019.

Net profits in the first quarter of 2020 had taken a major hit due to the impact of COVID-19 on the company’s ability to obtain raw materials as well as suffering from major logistical constraints. Net profit in fourth quarter of 2019 had been around US$55.7 million, but dropped to around US$23.6 million in the first quarter of 2020.

However, First Applied’s net profits bounced back strongly in the second quarter and soared in the fourth quarter of the year.

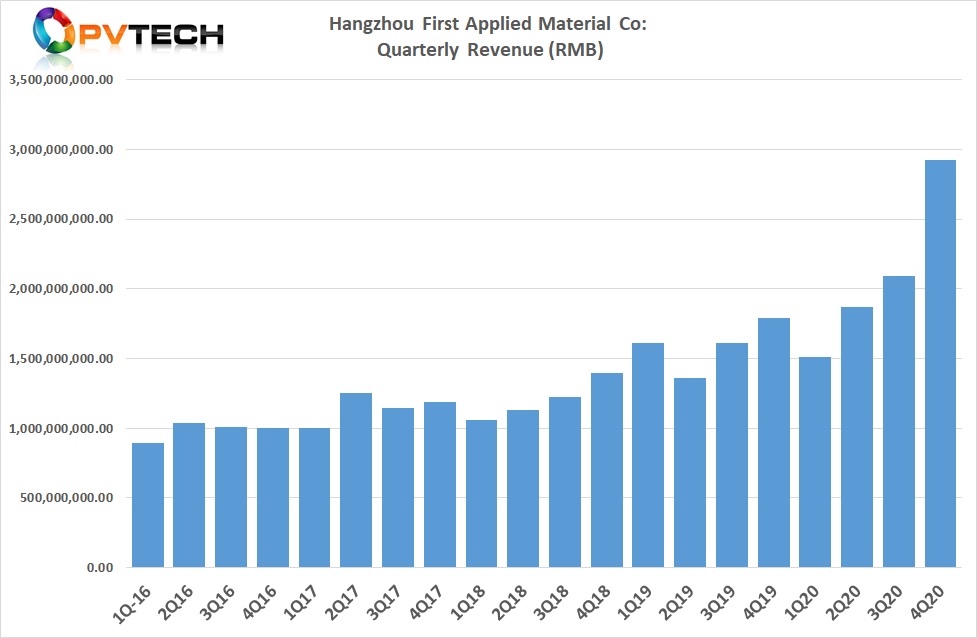

The company reported record net revenue of approximately RMB2.92 billion (US$446.96 million) in the fourth quarter of 2020, up from around US$273 million in the prior year period.

Total annual revenue reached around RMB8.39 billion (US$1.28 billion) in 2020, up from around US$975 million in 2019, a 31.6% increase, year-on-year.

Annual sales volume of total PV film (encapsulants) was 865 million square meters, a year-on-year increase of 15.57% from 749 million square meters in 2019. However, sales growth in 2019 had been 28.88% higher than in 2018.

Sales volume in the fourth quarter of 2020 reached 268 million square meters, an increase of 20.78% month-on-month.

ASPs increased quarter-on-quarter in 2020 due to supply constraints and subsequent strong demand. The company noted that ASPs increased 18.67% in 2020.

The company also sold 57,120,300 square meters of PV backsheets, a year-on-year increase of 14.98%. The total operating income of the PV material segement was over RMB 812 million (US$124 million), a year-on-year increase of 30.50%.

The company estimates that 1GW of PV module assembly production requires around 10 million square metres of PV film.

Total PV film market share was said to have increased from around 50% in 2019 to between 55% to 60% in 2020.

This was partially driven by increased sales volumes into existing major PV manufacturers that have been increasing capacity throughout 2019 and 2020. The company is a major supplier to ‘Solar Module Super League’ (SMSL) members such as LONGi Solar, JinkoSolar, Trina Solar, JA Solar Canadian Solar, Q CELLS, as well as First Solar for its CdTe thin-film production plants in Malaysia and Vietnam.

First Applied is also a major supplier to CHINT and Suntech.

It should also be noted that rival PV backsheet manufacturer Cybrid Technologies, which went public in China last year, reported full-year revenue of around US$333 million in 2020. Revenue and net profits both increased by just over 2%, year-on-year.

Manufacturing update

First Applied continued to increase PV film capacity in 2020, reaching a nameplate of capacity of 1.051 billion square meters by the end of the year, a year-on-year increase of 41.07%.

According to First Applied’s 2020 annual report, in the first half of the year its 500 million square meter PV film project (potentially catering for 50GW of PV module production needs for PV films) in Chuzhou was expected to start large-scale construction of factory buildings and supporting facilities in the first half of 2021.

The company’s Jiaxing’s 250 million square metre (25GW) of PV film expansion project, which is expected to cost around US$156 million), was slated to start construction in the fourth quarter of 2020.

The company expects total nameplate capacity to be around 1.4 billion metres by the end of 2021.

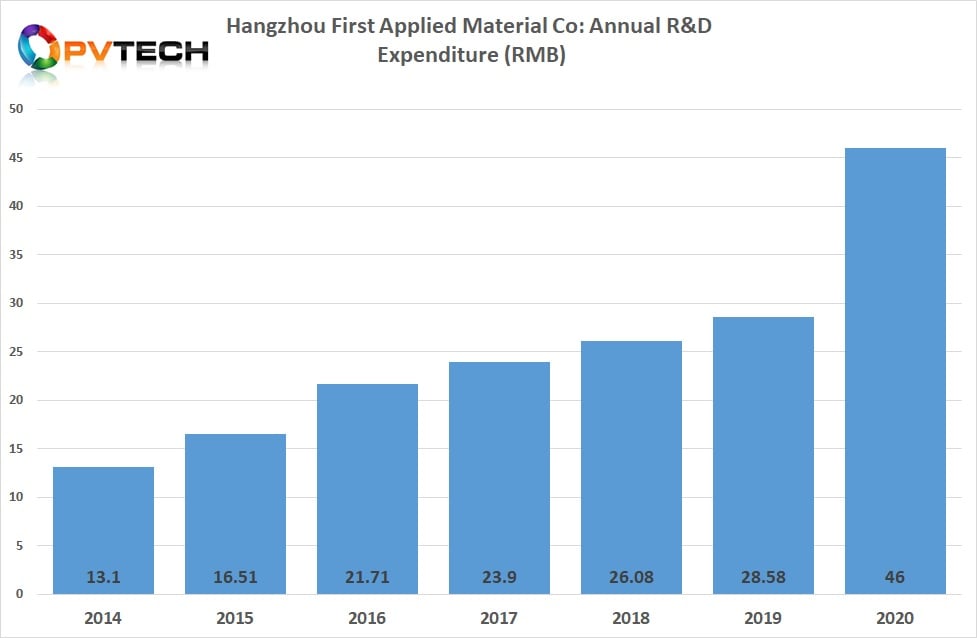

First Applied is also one of the few PV companies that has never reduced R&D spending in any given year. The company significantly increased R&D expenditure to US$46 million in 2020, up from around US$28.5 million in 2019, around a 60% increase year-on-year.

In addition to materials and formulas, the company’s R&D investment includes investment in equipment and processes as well as the establishment of First New Materials Research Institute, equipped with advanced experimental instruments and testing equipment, and has a national-level enterprise technology center, Zhejiang Provincial Key Enterprise Research Institute, Zhejiang Province Photovoltaic Packaging Materials Engineering Technology Research Center, post-doctoral research workstation, and a CNAS testing center.