In addition to this coverage of First Solar’s results, Mark Osborne has provided a detailed analysis of First Solar’s technology and manufacturing strategy, which is available to PV Tech Premium subscribers here. PV Tech is running an exclusive offer for the month of March, with PV Tech Premium subscriptions available at half price. Simply use the coupon code ‘PREMIUMFIRST50’ at check-out.

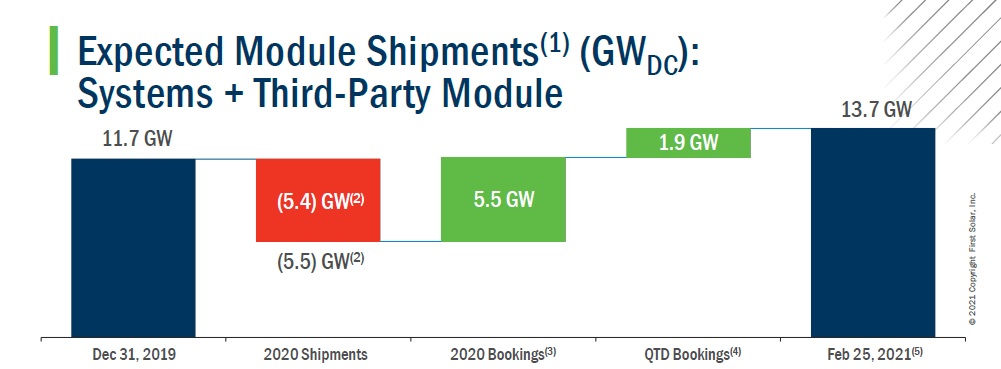

‘Solar Module Super League’ (SMSL) member First Solar has reported full-year PV module shipments of 5.5GW in 2020, generating net sales of US$2.7 billion.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The SMSL member reported fourth quarter 2020 revenue of US$609.2 million, compared to US$927.6 million in the previous quarter.

First Solar had previously said that it expected net sales to be between US$540 million and US$790 million in Q4, which accounted for potential delays in the sale of its Sun Streams 2 project and module revenue recognition timing, which was indeed delayed until February 2021.

Balance sheet cash and cash equivalents stood at US$1.79 billion at the year’s end, down 21%, year-on-year, primarily to capital expenditure related to its transition to Series 6 module production.

Guidance

First Solar said that it expected 2021 total revenue to be in the range of US$2.85 billion to US$3 billion.

However, First Solar is expected to gain around US$140 million from the closing of the sale of its O&M business in the first half of the year.

The company has also already booked 7.2GW of PV module deliveries in 2021 with plans to reach 8.7GW of nameplate capacity by the end of the year.

The company achieved around 10% manufacturing cost reductions in 2020 and similar levels planned in 2021. However, silicon-based PV manufacturers are being impacted from polysilicon capacity constraints that are driving ASPs higher in 2021, coupled to constraints in solar glass capacity and therefore ASPs that are also impacting rival manufacturers cost reduction and gross margins.