Wood Mackenzie has forecast cumulative floating solar PV (FPV) installations to reach 77GW by 2033.

The report, ‘Floating Solar Landscape 2024’, projects the Asia Pacific (APAC) region to lead the FPV market with 81% of the global market, representing 57GW of capacity by 2033. Nine of the top ten global FPV markets are expected to be from the APAC region.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

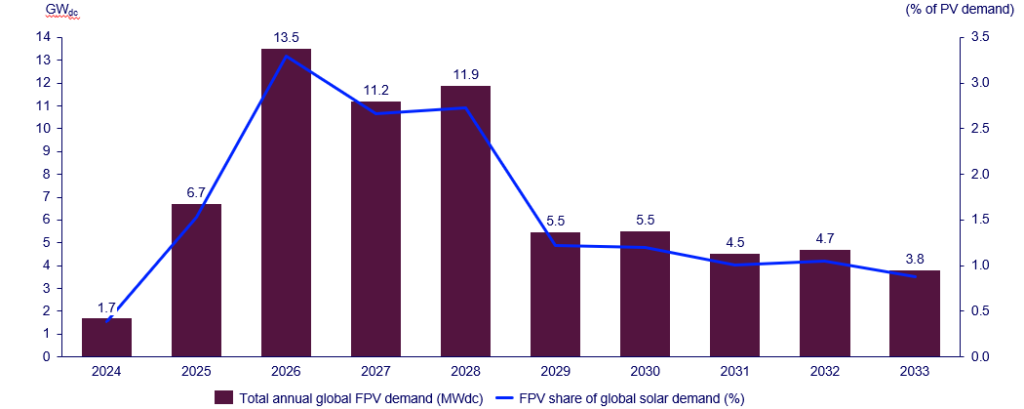

This year, WoodMac forecasts 1.7GW of FPV capacity additions globally, before growing nearly fourfold to 6.7GW in 2025 and doubling the following year to a peak of 13.5GW in 2026. Capacity additions are targeted to remain above 10GW in 2027 and 2028 before halving to 5.5GW in 2029.

“India, China, and Indonesia are the top three countries globally for FPV capacity, together boasting a total installed capacity of 31GWdc. In 2024 alone, approximately 1.7GWdc of new FPV capacity is expected to come online, with the APAC region contributing 90% of this growth,” said Harshul Kanwar, research analyst at Wood Mackenzie.

Both India and China have recently seen two large FPV projects come online this month, one of which at the gigawatt-scale. State-owned China Energy Investment Corporation (CHN Energy) completed a 1GW project, which it claims is the largest and first of its kind in the world. The open sea floating solar power plant is situated around 8km off the coast of Dongying City, on the eastern coast of China, adjacent to the Bohai Sea.

In India, developer Tata Power Renewable Energy commissioned what it claims is the country’s largest FPV plant with an installed capacity of 126MW. Located in the central state of Madhya Pradesh, the Omkareshwar Floating Solar Project was built between two major reservoirs.

Floating solar in Indonesia emerged as one of the front-running technologies set to be deployed in the country, according to a recent report.

In Europe, three countries – Germany, France and the Netherlands – are expected to represent the majority of FPV capacity additions (60%) in the next decade, with Germany leading with 2.2GW projected capacity by 2033. France and the Netherlands are projected to add over 1GW of FPV capacity each in the coming decade, with 1.2GW and 1GW, respectively.

Offshore solar has also seen an increased interest in Europe, especially from the Netherlands and the Dutch North Sea, with several joint projects announced this year, including one from FPV company SolarDuck and another from offshore specialist Oceans of Energy.

Coverage and distance limitations

However, the report highlights that the growth of FPV in Europe faces challenges due to restrictive criteria, such as coverage and distance limits.

Despite being one of the leading countries in solar PV additions globally, the FPV market in the US will remain constrained due to lack of land availability and high capital expenditure compared to ground-mounted projects. WoodMac projects 0.7GW of capacity additions by 2033 for the US.

“The optimistic growth of FPV systems is driven by rising demand, decreased capex, and supportive policies for lower-carbon energy. While FPV capex is approximately US$0.13 to US$0.15 per watt higher than that of ground-mounted solar PV systems, the recent drop in the prices of PERC and TOPCon modules to below US$0.10 per watt has significantly reduced the overall FPV capex ,” added Kanwar.

As the FPV market continues to grow year after year, module manufacturers have been targeting the market with products catered for FPV. Last month, Chinese solar manufacturer Huasun secured a 1GW heterojunction module supply for a FPV project in China. Huasun’s G12-132 V-Ocean heterojunction (HJT) solar modules will be used for the project, which have been specifically designed for offshore PV applications and has been certified as such in China, according to the company.

Other technological advancements in the FPV market include a new solar tracker from Spanish tracker manufacturer Soltec (Premium access), which is designed for inland water bodies such as reservoirs and ponds.

“Recognising the benefits of floating PV and providing dedicated support schemes through auctions and innovative tenders for FPV, is key to further incentivise the development of the technology, enable market growth and level the playing field among other solar technologies,” Kanwar concluded.