US solar tracker manufacturer FTC Solar has posted its financial results for the third quarter of the year, which include revenues of US$10.1 million, in line with its earlier forecasts.

The company’s revenue fell 11.3% quarter on quarter and declined 66.8% compared to the same period in 2023 when the company posted a figure of US$30.5 million. FTC continued to make a gross loss in the third quarter of this year, losing US$3.9 million, in line with its forecasted losses of between US$1.5-4.3 million.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Last year, then-CEO Sean Hunkler suggested that ongoing trade tensions between the US and China had made it difficult for US developers to install Chinese-made modules, reducing demand for ancillary products such as trackers.

FTC responded swiftly and today announced that it plans to sell 17.5 million shares to an unnamed investor for US$15 million, subject to “customary closing conditions”; the company expects to complete this sale by the end of November. It also appointed Yann Brandt, former chief commercial officer of FlexGen, to the position of CEO and the company’s board in July.

Since Brandt’s appointment, FTC has cashed out its earn-out payments from community solar developer Dimension Energy, from which it sold its stake in 2021, which has generated more than US$9 million in payments. FTC expects to earn an additional US$5 million from this transaction before the end of the year.

“As I take stock of our positioning at the 90-day mark [since taking over], I believe the company is in an enviable position in many respects,” said Brandt. “This includes having a product portfolio that customers love, a business they appreciate working with, and a cost structure poised to enable strong margin growth and profitability.

“In addition, the company now has a compelling and expanded 1P product set that opens up the vast majority of the market that wasn’t available to the company in the past.”

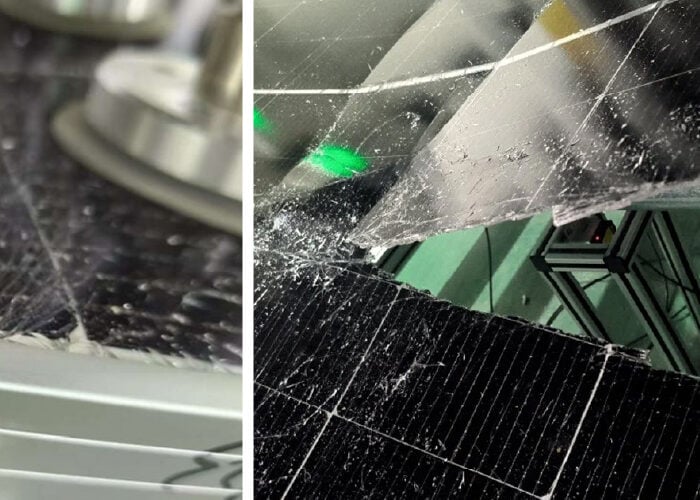

Over the summer, the company launched an automated hail stow programme and last week signed a new tracker supply deal for 1GW of trackers as it looks to recover from a challenging year. In the first nine months of the year, FTC’s total revenue reached US$34.2 million, down from US$103.8 million in 2023, and comparable to the US$30.5 million earned in just the third quarter of 2023.

The company’s divestments have also helped minimise losses in its operations. From 31 December 2023 to 30 September 2024, the value of FTC’s total assets fell from US$123.1 million to US$91.7 million as it looked to cut losses. FTC’s operating expenses also fell from US$46.7 million in the first nine months of 2023 to US$30.6 million in the first three quarters of 2024, and this helped slightly lower the company’s overall net losses, from US$39.1 million in the first three quarters of 2023 to US$36.4 million in the same period this year.

Looking ahead, the company expects to post revenues of US$10-14 million in the fourth quarter of the year, slightly up on its revenues in this quarter. FTC also expects its losses to remain steady in the fourth quarter, forecasting losses of US$1.5-4.2 million, almost the same as the losses forecast for the third quarter.