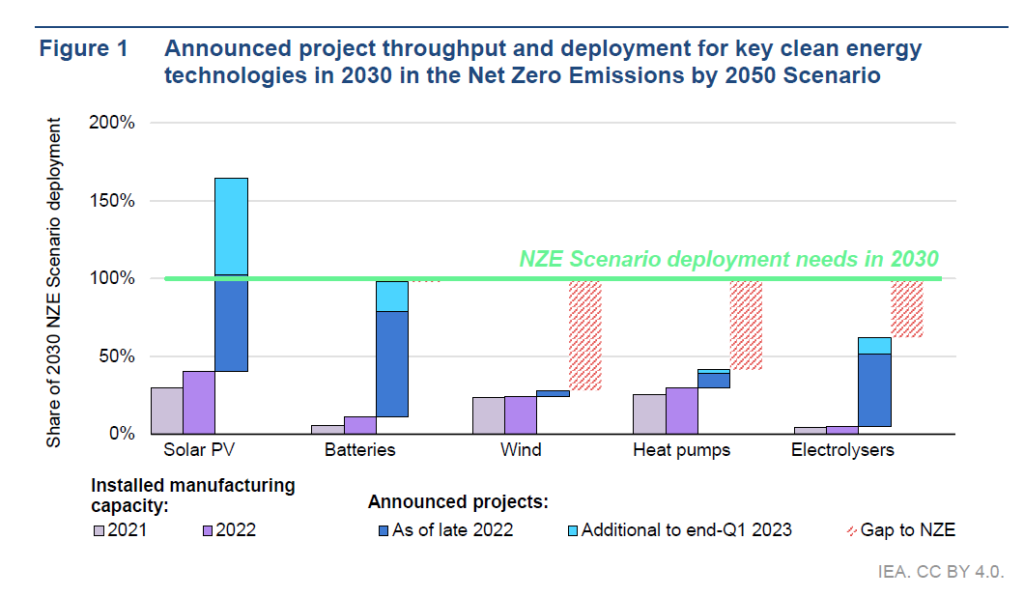

Announced solar PV manufacturing capacity across the globe has met the deployment levels suggested by the International Energy Agency towards 2030, but only 25% of the announced projects could be considered as committed, according to IEA’s recent study.

The report — the State of Clean Technology Manufacturing: An Energy Technology Perspectives Special Briefing — stated that announced project throughput, which is a fraction of the installed manufacturing capacity and depends on the utilisation of production facilities, and deployment for key clean energy technologies in 2030 as stated in Net Zero Emissions by 2050 (NZE) Scenario was 50% higher than the required deployment levels as of the end of March 2023.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

It also suggested that manufacturers were already on track to meet projected demand in 2030 in the NZE Scenario as of late 2022, with about 670GW of throughput by that year resulting from project announcements for additional manufacturing capacity.

Solar PV manufacturing continued to expand in recent years as it increased at a compound annual growth rate of 25% during the period from 2010-2021. In 2022, global manufacturing capacity increased by 40% to about 640GW, with 90% of the growth taking place in China. In the same year, manufacturing throughput was about 260GW, indicating a global average utilisation rate of about 40%.

Several major announcements were made in Q1 2023, including new manufacturing facilities from LONGi, Jinko Solar and Trina Solar. These major projects accounted for 45% of the total additional capacity announced as of Q1 2023.

However, only about 25% of the announced module manufacturing capacity was under construction or had reached final investment decision.

There was a regional concentration in clean technology manufacturing, according to the report. China accounted for about 80% of the current Solar PV manufacturing operations, while it also dominated (about 80%) the solar PV manufacturing pipeline.

LONGi’s plant in Taizhou, with a capacity of 38GW, is large enough to supply half of the capacity additions of solar PV modules in the European Union (EU) in 2022. The installed manufacturing capacity of Vietnam and India was the second and third largest in the world, but only accounted for 5% and 3% respectively.

Additionally, if all announced projects come to fruition, the concentration among the top three producers will remain similar to the current level of 90%. Vietnam will drop to the fourth largest country, behind India and the US.

The study also examined the concentration of solar PV components. China has been dominating silicon wafer production, accounting for about 80% in 2010. But its share increased to more than 95% in recent years. China’s cell and module production increased to 85% and 80% respectively in 2022, from about 55%-60% in 2010.

For polysilicon, China accounted for less than 30% of the world’s manufacturing capacity in 2010, with this share rising to more than 75% in 2022.

Lastly, China’s installed capacity of solar PV has grown at a compound annual growth rate (CAGR) of more than 65%, reaching 427GW in 2022. China’s CARG was higher than that of the US (40%) and Europe (less than 20%). The installed capacity in the US reached 140GW while Europe had a capacity of 200GW as of last year.