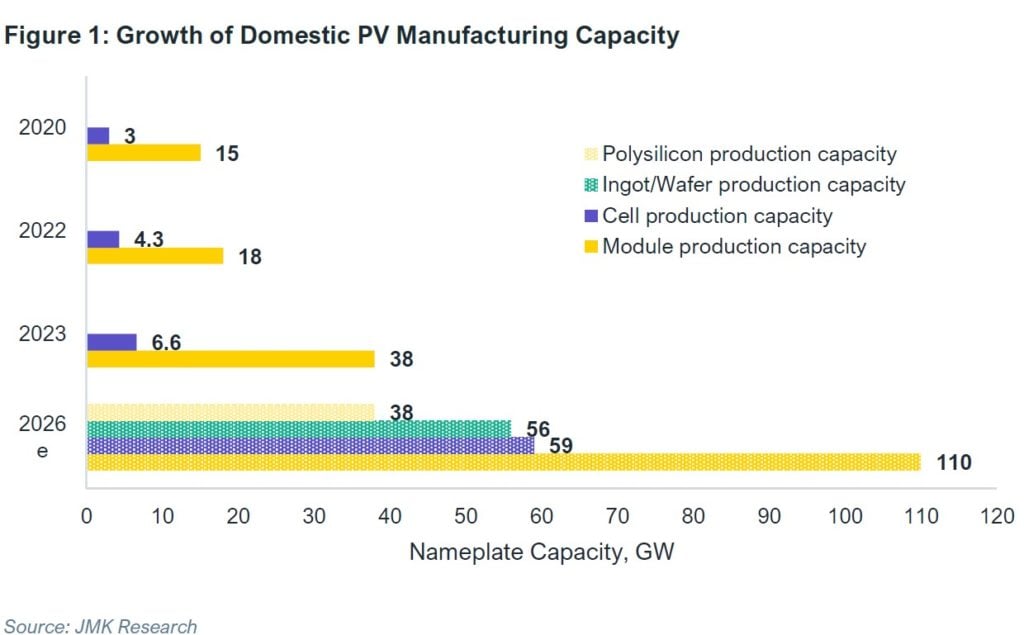

India’s accelerated pace with its domestic solar manufacturing capacity is set to reach 110GW of solar PV modules per year by 2026.

According to a joint report from the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics, India would become the second-largest PV manufacturing country behind China and be self-sufficient in terms of domestic demand.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Once India reaches a capacity sufficient for the domestic market in the coming two to three years, the country will require to focus on expanding further its reach to other markets as an alternative to the current dominant supply chain of China which exceeds 80% of all stages of PV module manufacturing, from polysilicon to modules.

Last March the country had an annual module manufacturing capacity of 18GW and more than doubled its nameplate in the span of a year to reach 38GW in March 2023.

With the launch of the production-linked incentive (PLI) scheme in 2020, the Indian government invested in domestic solar PV manufacturing that would reduce the country’s reliance on exporting modules and other components from China. The second round awarded 40GW of manufacturing capacity for three different tiers of production going from polysilicon to modules to only cells and modules.

“The future of the Indian PV manufacturing sector is bright. The favourable policy environment created by the Indian government is helping the PV manufacturing industry to grow rapidly, which is evident in the frequent announcements of expansions or new investments in the sector,” said the report’s co-author Vibhuti Garg, South Asia director at IEEFA.

Overall, the PLI will add 51.6GW of module capacity and at least 27.4GW of integrated “polysilicon-to-module” annual capacity in India in the coming three to four years, according to the report.

Another application for the boost of domestic manufacturing in India was the implementation of a basic customs duty (BCD) in April 2022 – which imposed a 40% tax on imported solar modules and a 25% tax on solar cells – that reduced the import of foreign, mainly Chinese, modules.

Moreover, another key aspect of the country’s boost for domestic solar PV manufacturing came with the introduction of the Approved List of Module Manufacturers (ALMM) in 2019 which was used to work as a “barrier” against China’s dominance in the supply value chain of solar PV.

The latest update of the ALMM, on 27 February 2023, had listed more than 70 domestic manufacturers with a combined capacity exceeding 22GW, according to Prabhakar Sharma, consultant at JMK Research.

All existing and proposed manufacturing lines are currently for mono-passivation emitter rear contact cells (PERC), according to the report, with the mono-PERC line plants able to shift to newer technologies such as heterojunction or tunnel oxide passivated contact (TOPCon).

However, the government recently relaxed the ALMM list in a move to allow developers to keep building projects and add capacity while plants are being built or increased as projects were facing module supply shortages that is set to continue impacting in 2023.

“Besides the augmentation of infrastructure in all stages of PV manufacturing, from polysilicon to modules, it will also lead to the simultaneous development of a market for PV ancillary components, such as glass, ethylene vinyl acetate (EVA) and backsheets,” added the report’s co-author Jyoti Gulia, founder of JMK Research.

One of the major hurdles highlighted by the report is the country’s continued reliance on Chinese imports for upstream components of PV modules such as polysilicon or ingots and wafers. A solution would be to increase the PLI scheme to include higher capacity for these upstream components, PV equipment machinery and ancillary components.

If there are more than 70 manufacturers in terms of module production, the list reduces to 8 or more with cell production, with a nameplate capacity of 6.6GW but is expected to exceed 50GW in three years due to high demand, according to the report.

Furthermore, solar manufacturer Adani Solar is the only company with a production capacity for ingots or wafers as it aims to expand to a 2GW annual capacity of monocrystalline silicon ingots by the end of this year.