The US solar sector could benefit from wide-reaching new policy support from President Joe Biden’s US$1.75 trillion Build Back Better (BBB) budget reconciliation package, currently being negotiated on by Senate Democrats.

Approved by the House by a near party-line vote of 220-213 on 19 November, the act would allocate US$555 billion for investments in clean energy and combatting climate change, including US$320 billion for a raft of clean energy tax credits.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

With policy support earmarked for areas spanning domestic PV manufacturing, energy storage deployment and the electric transmission grid, the framework represents the largest single investment in the US’s clean energy economy in history, according to the White House.

“The bill is transformative. I think there’s a great deal of enthusiasm and excitement to see this move into law,” says Gregory Wetstone, CEO of the American Council on Renewable Energy (ACORE).

While the US has had policies that promoted and incentivised renewable power for one, two or three years, for the most part, Wetstone says, the package would change that through long-term incentives to “provide our sector with the kind of certainty that business wants and needs”.

Among the solar deployment incentives included are an extension and expansion of the investment tax credit (ITC), which is currently at 26% and set to phase down as of 2023. The act would extend the ITC for plants that start construction by 2026 and are put into service by 2034. It would also increase the credit to 30%, provided prevailing wage and apprenticeship requirements are met.

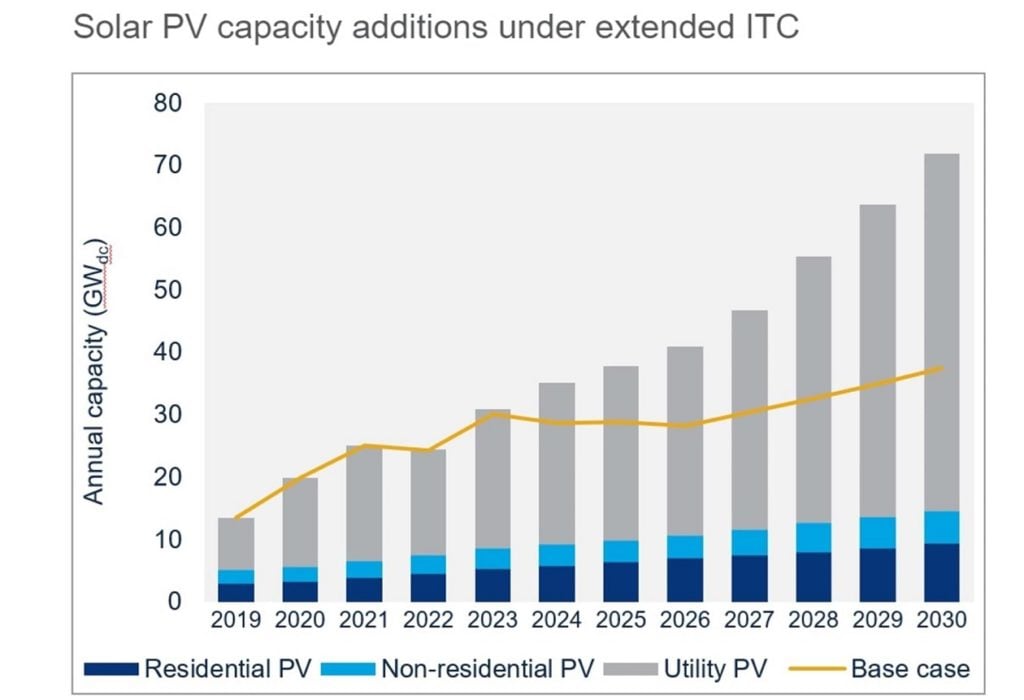

If the proposed ITC changes are included in the final act, solar PV deployment could increase by 44% by 2030, with utility-scale solar experiencing the biggest uplift, according to research firm Wood Mackenzie, which said total installs may reach 432GWdc by the end of the decade.

While energy storage projects such as large-scale batteries currently need to be colocated with solar projects to qualify for the ITC, the legislation would allow grid-connected energy storage installations to benefit from the credit, provided they have a minimum nameplate capacity of 5kWh. The US Energy Storage Association has said the storage ITC “is the single-most transformative policy Congress can enact to accelerate storage deployments at the pace needed to decarbonise the nation’s power system”.

Alongside the ITC changes, BBB would revive the production tax credit (PTC) for solar projects. Reinstated for PV plants beginning construction before January 2027, the PTC would provide a base credit of 0.5¢/kWh and a bonus credit of 2.5¢/kWh if prevailing wage and apprenticeship requirements are met.

Thanks to the generous support for solar included in the package, research and consultancy firm BloombergNEF sees the technology’s levelised cost of electricity (LCOE) declining by almost half by 2030 compared with business as usual, while standalone storage would see its LCOE decline 15%.

PV manufacturing tax credits

BBB will also target incentives to grow domestic solar supply chains. Announcing the package back in October, the White House said the framework will “ensure clean energy technology – from wind turbine blades to solar panels to electric cars – will be built in the United States with American-made steel and other materials”.

Included in the act is an advanced manufacturing production credit for domestic producers of components including solar modules, cells, wafers and solar-grade polysilicon. Broadly in line with proposals put forward by Senator Jon Ossoff earlier this year, these credits would increase if assembly takes place at a unionised US facility and phase down from 2027, before being removed after 2029.

Among the additional renewables support included in BBB is a new technology-neutral credit for clean energy production, with facilities eligible for credits provided their greenhouse gas emissions rate is not greater than zero and they begin construction after December 2026.

The act would also establish new ITC tax benefits that would allow solar and wind projects that provide benefits for low-income communities to be allocated a portion of 1.8GW of annual capacity given a 10% credit.

Proposed policies have enjoyed widespread support from across the US solar sector. Jesse Grossman, CEO of independent power producer (IPP) Soltage, says the country’s development and IPP community is very glad to see the BBB plan in its current form increasing and extending the ITC, providing tax credits to standalone storage and allowing for components of interconnection to be tax basis items for certain sized projects. “Also positive is the inclusion of diversity and equity components to enhance the tax credit and the option of direct pay,” he said.

One policy that has not made the cut is the US$150 billion Clean Electricity Performance Program, which would have rewarded energy producers that switch to renewables – a policy opposed by Senator Joe Manchin, who threatened to vote against BBB unless it was removed.

All eyes are now on the Senate, where Democrat leaders look to unite the party’s caucus behind the bill and get all 50 of its Senators on board to get it passed and then sent to Biden’s desk.

Speaking during a webinar hosted by investment bank ROTH Capital Partners earlier this week, Rhone Resch, CEO of consulting firm Advanced Energy Advisors, said he thinks there is a 50% chance that the Senate will vote on the bill before Christmas, but in terms of it getting enacted before Christmas, “it won’t happen”.

Nonetheless, Resch believes that the solar and renewables provisions are going to remain in the bill: “I think the code as written right now in the bill is going to stick based on everything that I’m hearing, which is great for solar. It really is a once-in-a-generation type of bill for us.”

Wetstone says that although the BBB package is “not perfect”, modelling from ACORE suggests that policies included could help get the US closer to its climate targets.

The bill, he says, is “really without precedent in this country, in terms of a full-throated commitment to the clean energy transition that we know we are going to need and that the American people want”.